Fears lockdowns will lead to an increase in credit card debt

Last year Australians used Covid stimulus to pay down credit card debt – but RBA data shows new lockdowns might force debt levels back up.

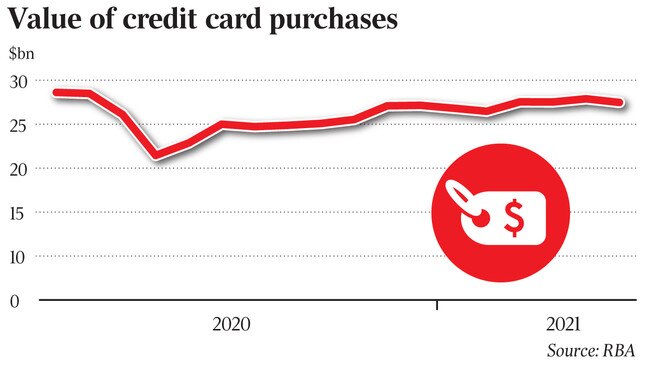

Australia’s credit card debt barely shifted in the six months to June, according to data from the central bank, raising fears consumer debt levels might explode in the coming months as the economic impacts of lockdowns flow through to hip pockets.

Reserve Bank of Australia data for personal credit card accounts released on Monday show in June, Australians had almost $20.01bn of credit card debt accruing interest – about the same as January – despite the number of credit card accounts falling to 2007 levels.

It stands in stark contrast to last year, where despite the economic havoc caused by the pandemic, unprecedented amounts of government stimulus and wage support helped Australians wipe a collective $7.38bn in debt off their balances in the year to January 2021.

However, other indicators show Australians were not stretched too financially in June: the number of purchases on credit cards dropped by more than 6 per cent from April while the value of cash advances fell more than 7 per cent to $30.9m.

But analysts warn the economic impacts of the extended greater Sydney lockdown, as well as snap lockdowns elsewhere, will result in a visible uptick of debt in next month’s data.

Canstar’s Group Executive for financial services Steve Mickenbecker said the outlook for July was “bleak.”

“Having paid down credit card debt from the early release of superannuation through 2020, Australian credit card holders are finding it tougher to stick to the diet in 2021,” he said.

“Looking forward, fewer opportunities to spend during lockdown will mean less physical use of the plastic, but more of us have, by necessity, discovered online shopping and will substitute spending.

“The longer the lockdown, the more unemployment will likely start to drive up credit card debt. The risk is that credit card debt piled on in desperation will be even harder to shift.”

RateCity.com.au research director Sally Tindall with “millions of Australians” appearing to be stuck in a “credit card rut,” consumers should examine ways to reduce their debt burden if they are in financial strife.

“Putting your bills on the credit card or taking out a payday loan could make a bad situation worse,” she said.

“There are support packages from the government, loan deferrals, rate reductions and fee waivers from the banks, crisis payments from Centrelink and hardship programs from essential service providers,” she said.

It comes as other early economic indicators show the lockdown is beginning to bite the NSW economy. Last week the Australian Bureau of Statistics recorded that one in five hospitality and arts and recreation workers in the state were stood down over the first half of July.

Meanwhile, the National Skill Commission’s internet Vacancy Index released on Monday showed the number of skilled job ads in NSW fell by more than 10 per cent in July, with the country at large seeing a 3 per cent decline.

But CommSec senior economist Ryan Felsman said the amount of jobs on offer is still relatively high.

“Encouragingly, job vacancies aren’t falling at the same rate yet as observed in last year’s nationwide lockdown,” he said.

“Overall ads are 38.3 per cent (or around 64,400 ads) higher than pre-Covid levels, with Australia’s closed international borders exacerbating skills shortages in some industries and occupations.”