Exports resilient despite China trade tactics; ratings agencies raise concerns with Treasury

Credit rating agencies raised concerns about the impact of Chinese trade sanctions directly with Treasury officials including Josh Frydenberg.

Credit rating agencies have raised concerns about the impact of Chinese trade sanctions directly with Treasury officials including Josh Frydenberg, who told them the Australian economy had the flexibility to withstand the shocks.

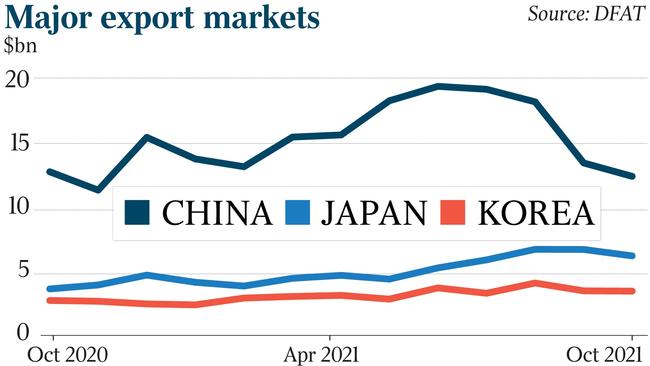

Documents prepared for two virtual meetings with Fitch and S&P after the May budget, but which have only emerged now after a freedom of information request, show the ongoing trade restrictions had a significant impact on specific firms and regions, but most goods targeted by the restrictions were successfully redirected to other export markets.

According to ministerial briefs prepared by the international economics and security division of Treasury, the effect on the overall Australian economy was “limited”.

That was also the view of Fitch, which released a report in April that said trade tensions with China had not had a material impact and were unlikely to affect Australia’s AAA credit rating.

“As Treasurer I and my department have maintained regular and constructive dialogue with the credit rating agencies, particularly after major fiscal announcements such as the budget,” the Treasurer told The Australian.

“In addition, as I outlined in a speech in September, Australian exporters have been remarkably resilient in being able to find new markets, and today the trade surplus is at a record high.

“Despite the major economic challenges facing Australia as a result of the pandemic, we remain one of only nine countries to maintain AAA credit rating from the three leading credit ratings agencies and our economic recovery is well under way,” Mr Frydenberg said

Australia’s two-way trade with China in 2019 was worth $251bn and its exports to China – 34.2 per cent of Australia’s total – were worth $169bn.

Imports from China were valued at $83bn or 19.5 per cent of Australia’s total.

In 2020 and early 2021 China imposed several disruptive and restrictive measures on Australian exports, including anti-dumping import duties on barley and wine, suspending some forestry log imports and beef imports from some establishments, increased customs testing of rock lobster imports and a reported ban on coal imports.

In May, China imposed anti-dumping and countervailing duties on barley imports of 80.5 per cent.

Six months earlier, it slapped anti-dumping tariffs on Australian wine of up to 212 per cent.

But the Australian government was “not aware of any evidence that Australian wine exporters have dumped their product in the Chinese market”, Treasury said.

Experts have warned of worse to come for Australia’s wine industry thanks to a global shipping crisis, labour shortages and continuing travel restrictions, as well as the question of what to do with the $700m or so of orphaned wine still looking for a home after the Chinese borders slammed shut.

Exports subject to China’s actions were a “fraction” of Australia’s total exports to China and less than 1.2 per cent of gross domestic product, Treasury said.

Estimates that stopping 95 per cent of Australia’s trade with China would cause a 6 per cent hit to the economy, due to reduced exports and investment, were “based on simplified, strong assumptions that are not realistic”.

Those estimates assumed an immediate stoppage of trade and unchanged monetary and fiscal policy, as well as that just a single good was produced and traded by each country.

“In reality, we produce a variety of high quality goods with potential to divert our trade and diversify our economy,” Treasury said.

“Australian consumers can find substitutes.

“Producers can export to alternative markets and mobilise capital and labour to produce other goods.”

Budget forecasts out to 2024-25 incorporated explicit industry-wide import restrictions by China on coal, barley and wine, but they didn’t have a material impact on the forecasts for real GDP.

“Australia’s economy is flexible and Australian businesses are globally competitive and adaptable,” Treasury said.

“Our resilience is built on a flexible, open and dynamic market economy that fosters openness, trade, investment and ideas. Our exports are highly regarded internationally.”

The government was working to maximise market access opportunities for businesses across a broad range of countries, including the Agriculture 2030 package, providing $87.7m to help farmers diversify and increase their exports, and the Enhanced Trade and Strategic Capability, which provides $198.2m over four years to support Australian exporters.

“Given global demand, most Australian exports can generally be diverted, though sometimes at a discount,” Treasury said.

As an example, it said Australia’s total coal export volumes fell just 7.8 per cent through the year to the March quarter, as Australian coal that otherwise would have gone to China found purchasers in other markets, though often at discounts.

Metallurgical coal export volumes to India rose 46.5 per cent through the year to the March quarter.

Volumes to Japan rose by 7.5 per cent, and by 34.5 per cent to South Korea.

Thermal coal export volumes to Japan were up through the year to the March quarter 2021 by 1.1 per cent.

They rose by 23.3 per cent to South Korea and by 231.0 per cent to India.

Beijing’s ban on Australian coal has worsened a rolling Chinese power crisis that has closed factories, left households in the dark and created chaos as traffic lights have been cut off.

“We continue to work to maximise market access opportunities for Australian businesses across a broad range of countries, including through our extensive FTA agenda,” Treasury said.

While noting that trade disruptions would have a negative impact, it said Australia’s economy was flexible, its businesses globally competitive and adaptable, its workforce highly skilled, and it produced high-quality products that were in demand globally.

Australia was a “reliable place to do business, a safe and welcoming destination, and an exporter of high quality, price-competitive goods and services that contribute to China’s economic growth”.

“Both Australia and China have benefited greatly from our trade relationship,” Treasury said.

“Without this, we both lose.”

Australia “sought assurances from China that trade will occur in a timely, transparent, non-discriminatory and predictable manner” and would “stand behind our exporters and champion an open, rules-based global system that has served us so well”, Treasury said.

China remained important to Australia’s economic future and the nation wished to “continue our mutually beneficial relationship with China on terms that meet the interests of both sides”.

Australia stood “ready to engage in ministerial dialogue” with China to resolve the various disruptions to trade, but was “proceeding with clear, national interest objectives in mind”.

To mitigate the damage from China’s trade action the government was “deepening Australia’s economic partnerships with a range of countries to ensure that Australian businesses are well-placed to reap the full benefits of a strong and growing region”.

“Since coming to office our two-way trade covered by free trade agreements has increased from 26 per cent to over 70 per cent, with the goal of reaching 90 per cent in coming years,” Treasury noted.

“We have secured agreements with Indonesia, Japan, Korea, China, and the 11 nation trans-Pacific Partnership.

“In November, Australia signed the Regional Comprehensive Economic Partnership Agreement between Australia and 14 other Indo-Pacific countries.”

Reforms to Australia’s foreign investment framework aimed to boost Australia’s status as an attractive destination for foreign investment and would “continue to work to maintain Australia’s reputation as an attractive destination for investment that is in our national interest”.

“We will always protect our national interests, first and foremost and will continue to stand up for our values and our long term security, prosperity, and sovereignty,” Treasury said.

“We will work constructively with other countries – to identify common interests and build mutual respect.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout