China’s crushing wine tariffs destroyed our biggest market, and there’s more pain to come

Fears Chinese wine tariffs would destroy our biggest export market sadly turned out to be spot on, while recovery is hindered by the pandemic, chaos in shipping and labour shortages.

One year on from the wholesale destruction of Australia’s wine trade with China, experts warn “the worst is yet to come’’ as the global shipping crisis, labour shortages and continuing travel restrictions hinder industry attempts to recover.

There is also the issue of what to do with the $700m or so of orphaned wine still looking for a home after the Chinese borders slammed shut, with an excellent vintage earlier this year for once a double-edged sword, with wine vats brimming with unsold premium produce.

At this time last year, on November 28 to be exact, China slapped interim tariffs which ranged up to about 200 per cent on Australian bottled wine imports, amid two investigations into whether Australian companies were dumping wine into China, and whether our wine companies were being unfairly subsidised.

The dumping claims were dismissed as patently ridiculous by wine industry figures such as Mitchell Taylor, managing director of Taylors Wines, who made the point at the time that the revolution which had turned China into our most valuable wine market over the past decade or so was predicated on premium, high-priced product..

But the subtext, which had been signalled by earlier tariffs on barley imports and the suspension of beef imports from four major suppliers was clear - Australia had angered Beijing, and the Chinese Government wasn’t afraid to flex its economic muscles to demonstrate its displeasure.

There were warnings, from industry figures such as Australian Grape and Wine chief executive Tony Battaglene that the tariffs, if they continued beyond the initial review period, would effectively wipe out the wine trade with China. There were also faint hopes that the issue would be resolved.

It wasn’t, and Mr Battaglene’s prediction has sadly come true.

On March 26, 2021, China announced that as a result of its anti-dumping and countervailing duty investigations, it would apply duties of between 116.2 per cent and 218.4 per cent on Australian wine in containers of two litres or less, for five years.

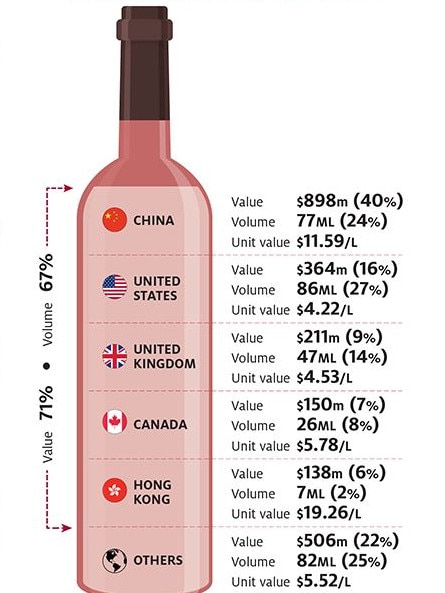

The tariffs have had their intended effect. New figures sourced from Wine Australia by News Corp Australia this week show that Australia’s wine exports to mainland China in the 12 months ended October 2020 were $1.26bn, but fell to just to just $82m in the year to October 2021. The volume of wine has dropped from 121 million litres to 10 million. A trickle in the context of the 640 million litres or so of wine which Australia exports each year.

And the number of companies exporting to China fell from 2198 to 399.

For all intents and purposes, Mr Battaglene now says, the China market is closed.

“We haven’t seen the worst of the pain for wine companies yet, because a lot of the wine that is going into China was frontloaded on, so we haven’t really seen the biggest impacts,’’ he said this week.

“The China market is closed, we’re going to have to be realistic about that. There are very small quantities going in, but essentially it’s closed for bottled wine and even bulk wine - the clearance rates are very slow, up to three months, and a lot of wine is being rejected.

“The worst is yet to come.’’

Mr Battaglene said there are estimates that about 40 per cent of the wine which would have been destined for China has found a new home, leaving a $700m hole in the Australian wine export figures.

The growth in wine exports to China over the two decades prior to the ban was truly astounding.

A briefing paper from the former Australian Wine and Brandy Corporation, prepared as a briefing paper arguing for a free-trade agreement with China in 2005, says at the time total Australian wine exports to China came in at $9.8m.

China’s entire wine imports at that time came in at 43.8 million litres - less than half of Australia’s 2020 share alone.

From those humble beginnings, China hit the number one spot for Australian wine exports in 2016, as marquee brands such as Penfolds swept in, creating a massive tailwind for the whole sector and inspiring knock offs such as “Benfolds” and others which owner Treasury Wine Estates has worked hard to cut out of the market.

The $1.2bn in wine which we exported in the year before the ports slammed closed accounted for more than our four next markets biggest markets - the US, UK, Canada and New Zealand - combined.

Virtually all of that revenue has now disappeared, and Mr Battaglene says the industry has resigned itself to the fact that China won’t be buying our wine for the next three to five years at least.

Efforts have been made to divert that wine, and the federal government came to the party with a $50m Export and Regional Wine Support package, but the pandemic, and a bumper vintage last year, has thrown a handful of spanners into the works.

Selling wine is fundamentally a relationship business, with winemakers wearing out shoe leather pitching their wines, often venue by venue, but almost always face-to-face, across the globe.

The pandemic has killed off the ability to do that until now, and the global shipping container crisis has also hit hard.

Winemakers have been struggling to source key inputs, including bottles and machinery, and the experts who can fix that machinery should it break down, while freight costs have increased as much as five-fold according to some estimates.

And, Mr Battaglene says, it should be kept in mind that wineries are also tourism businesses, with that income stream taking a huge hit, and now also facing staff shortages.

Mr Taylor, whose third generation Clare Valley company exports premium reds and whites globally, said exporters were finding it hard to find slots to get their product offshore, which was even more problematic at smaller ports such as Adelaide.

“At the moment our costs for ocean freight are going through the roof, they’re about three to four tomes the rate we were used to,’’ he said.

“A port like Adelaide, that has got a lot of ships that are starting to say ‘we’re not sure whether we can afford the time to pop in to Adelaide because it’s quite a small part of the whole shipping schedule.

“Even going to a market as close as New Zealand, which we used to take for granted as being one to two weeks on the boat, now also a port like that is being missed a lot so even getting our wines into New Zealand has been quite a challenge.

“Also on the supply side of getting our bottles in from overseas or getting our oak and our inputs for vintage, we’ve really had to pre-order and work about six months in advance.

For his own company and the industry more broadly, Mr Taylor said it had been a “very tough year’’.

“We’ve had to rethink our strategy completely. We’re still pivoting and trying to find new markets.’’

Taylors Wines previously had three people working full time on the China market, with staff having to either be let go or reallocated to other markets.

“The really tough thing about this is that we’re not trading bulk commodities where you can pivot into the global market,’’ he said.

“For us, we’ve found it very difficult with all the Covid disruption that’s occurring, to go from your very best export market, particularly with the high value and margins we were getting from China, to pivot into other markets it really takes a lot of energy, time and resources to get it right.’’

READ MORE:Australian wines set to be usurped by Chile, Italy and Spain | Penfolds releases ultra-rare g5 Grange blend

Mr Taylor said they were having some wins, but it was “very frustrating’’ that they couldn’t get on the ground in the markets where they wanted to expand.

And the impact at the grower level was starting to hit, Mr Taylor said.

“On the supply side, the price of red wine, all the fruit, everything is really dropping so we’re really looking at our inventory levels and making sure they balance.

“We’ve got to have difficult conversations with our growers, particularly some of the ones we didn’t have long term contracts with.

“The irony is that we had a big period of drought and were low in our stocks, particularly of red wine for the Chinese market. That whole trend has completely reversed with the record 2020 vintage that we had.

“It has been quite frustrating to see that impact.’’

And while the tariffs technically only apply to containers of two litres or less, the industry had deemed it too risky to cheekily move into larger packaging sizes to try to get around the duties.

Mr Taylor said there was some lobbying going on to increase the amount of wine which could be sold through duty free outlets to bolster the market locally, with the hope it would be increased from two bottles to six, however that would be a marginal gain in the scheme of things.

Taylors had been targeting North America and was relaunching in that market, and had been boosting its profile in Canada and looking at other Asian markets for growth.

South Australian Wine Industry Association chief executive Brian Smedley said some wine grape growers had become uncontracted due to the rapid shift particularly in the red wine sector.

“At this stage they are looking for other opportunities and there has probably been some as a result of the hail damage and other weather events ... but they are certainly minimal.

Mr Smedley said it was early in the season and the market could find more of an equilibrium due to weather events, but some growers were certainly apprehensive going into the next vintage.

On the pricing front, there was evidence of “softening” in the red market, while white grape prices had held up quite well, Mr Smedley said.

Mr Battaglene said he was pleased with the progress which the industry had made to date, with markets such as South Korea growing really well, but the gains being made were a long way from filling the gap left by China.

Wine and Grape Australia, using funding from the federal government, was looking at the market access issues which remained in other markets and what could be done about them, as well as what more can be done in other markets such as South Korea and Japan.

Proposals about what more could be done to boost the industry would be put to government in due course, Mr Battaglene said.

Mr Taylor said he’d like to see more government support for the sector,

“Something significant so that we can really get over into these vital markets and promote Australian wine,’’ he said.

“Australian wine has a value perception which is good, but mainly at the entry level, and we really need to market the high quality, the fine wine that we make in this country.

“Overseas they’re in the shadow of the other wine producing companies.’’

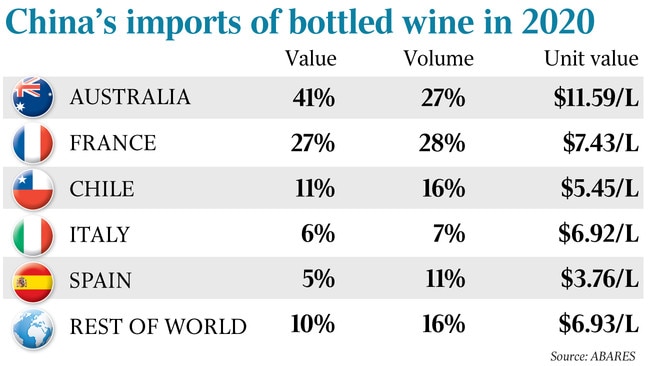

Meanwhile our competitors are moving in to fill the gap left by Australian wine being blocked out of the China market. While Australia was neck and neck with France as the biggest importer into China in 2020, Rabobank now predicts w will soon be overtaken by Chile, Spain and Italy, with Australia dropping back to fifth position by 2025, and even that seems optimistic.

The glass is very much half empty.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout