Dividends paid early to beat ALP franking changes

The guardians of some of the nation’s equities investments are adjusting their strategies in anticipation of a Shorten government

The guardians of some of the nation’s trillions of dollars in equities investments are adjusting their strategies in anticipation of a Shorten government, with the $360 million Mirrabooka fund yesterday paying a special dividend to shareholders six months early, ahead of Labor’s planned changes to franking credits.

Australia’s biggest companies, including industrial, mining and popular blue-chip stocks such as the four major banks and Telstra, sit on an estimated $45 billion in franking credits that could be released to shareholders before a future ALP government rips up the nation’s dividend imputation system.

Mirrabooka, a conservative stockmarket investor based in Melbourne, announced it would pay its traditional end-of-year special dividend now rather than after July 1 to safeguard its investors in the face of growing uncertainty around the use of franking credits for retirees and pensioners.

It is believed to be the first public company to reshape its dividend policy ahead of this year’s federal election, which the latest polls suggest Labor will win.

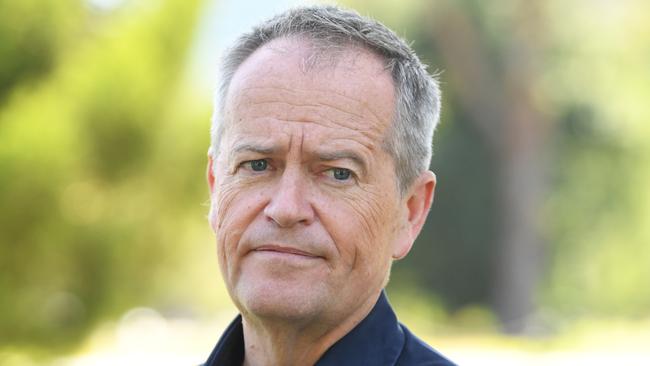

Last year, Bill Shorten unveiled his franking credits policy to claw back nearly $60bn over 10 years by abolishing cash refunds for excess dividend imputation credits.

The early dividend payment comes after a US investment bank predicted the valuation of shares in Australia’s biggest banks could be slashed by as much as 13 per cent if the ALP policy was implemented and cash refunds were ripped from investors.

JPMorgan equity strategist Jason Steed said yesterday there was an increasing likelihood that companies with large franking credit balances would look to accelerate special dividends and off-market buybacks. JPMorgan believes other stocks most likely to take measures to realise franking credits in the near term are Caltex, Harvey Norman, Metcash, Rio Tinto and Woolworths.

Issuing its interim results yesterday to kick off the reporting season for 2019, Mirrabooka chief executive Mark Freeman said because of the uncertainty created by Labor’s dividend imputation policy, the fund believed it should pay special dividends now rather than wait to July when a Shorten government might change the rules.

“The feedback so far is if they (ALP) change the policy, then it will take effect from July 1 this year so if they get that through as policy, then from July 1 you will no longer get a refund cheque — and so if you put out the special dividend this financial year, people will still be able to have that as part of their return and potentially (receive) a refundable credit,’’ Mr Freeman said.

He said Mirabooka thought Labor’s policy was “very grossly unfair for investors and trying to shift the playing field in favour of managed funds over self-managed superannuation”.

“We are feeling the potential pain of people if this rule comes in, and so let’s try to help them out now,’’ Mr Freeman said.

A spokesman for the opposition’s Treasury spokesman, Chris Bowen, declined to comment when asked about the Mirrabooka decision.

Federal Liberal MP Tim Wilson, who chairs the house economic committee’s inquiry into removing franking credits, said Mirrabooka’s decision did not come as a surprise.

“In the economics committee hearings, we’ve heard witness after witness saying they’re already restructuring their investment strategy so they won’t be hit by Shorten’s retirement tax,” Mr Wilson said.

“Some of the most disturbing evidence we have heard has come from financial advisers admitting they can help their clients around Shorten’s retirement tax, but those without financial advice or literacy won’t know they’re being slugged till it is too late.”

Mr Steed said any negative effects of the policy were most likely to be felt by the higher yielding sectors with franking, such as the banks and Telstra.

“You would certainly be minded as a board to consider whether or not using those franking credits in advance of a potential legislative change would be advantageous to your shareholders or to certain cohorts within your shareholder base,’’ Mr Steed said. “There are many companies that have access to franking that would arguably be … considering similar action.’’

Investment bank Citi warned in a report to its clients last week that potential changes to dividend imputation and the removal of cash refunds from investors was likely to have a significant impact on bank shareholders.

“We estimate that 10-20 per cent of shareholders receive cash refunds from bank dividends,” Citi said.

“Additionally, the value of franking credits continue to make up (about) 28 per cent of our major bank valuations, with any changes to dividend imputation policy likely to impact major bank (and other stocks more broadly) valuations as a consequence.

“Depending on the changes implemented, this could impact major bank valuations by up to 13 per cent.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout