Coronavirus: One-third of Australian businesses seeking JobKeeper help

Startling new figures reveal the breadth of the damage to national industry wrought so far by social-isolation measures.

One-third of all Australian businesses have applied for JobKeeper assistance, with small and medium-sized firms accounting for nine in 10 of those applications, Treasury data says.

The figures reveal the breadth of the damage to national industry wrought so far by the coronavirus pandemic and associated social-isolation measures implemented to slow its spread.

By Friday morning, there had been 788,635 applications for the JobKeeper program, as measured by ABN registrations. There were just shy of 2.4 million businesses as at June 30, 2019, according to the Australian Bureau of Statistics.

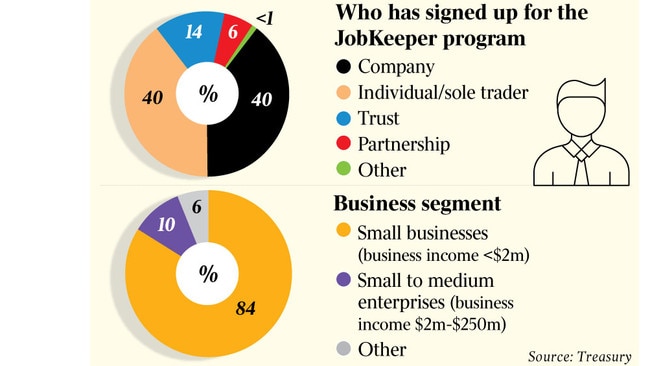

Treasury numbers seen by The Weekend Australian show 40 per cent of the applications for JobKeeper have been by sole traders, with companies comprising another 40 per cent. Of the balance, 14 per cent are classified as trusts and 6 per cent are partnerships.

The data shows how small businesses dominate the applications for assistance, just as they dominate Australia’s corporate landscape, and justify the government’s focus on supporting corporate minnows that employ more than 40 per cent of the country’s workforce.

“Micro” businesses with annual income of below $2m account for 84 per cent of the applications, those with income of between $2m and $250m a further 10 per cent. and individuals with non-business income make up 4 per cent.

Larger businesses with annual incomes above $250m are yet to show in the numbers, although companies such as Qantas have flagged they will access the program.

Applications by state roughly follow the geographic spread of businesses, with 35 per cent from NSW, 27 per cent from Victoria and 19 per cent from Queensland.

The proportion of businesses applying for JobKeeper can be expected to continue to rise. About 66 per cent of local businesses have reported that their turnover or cashflow had reduced as a result of COVID-19, according to a survey conducted by the ABS between March 30 and April 4.

That same survey showed a temporary reduction in staff work hours was reported by a quarter of small businesses (with 19 or less employees), 41 per cent of medium-sized businesses (20-199 employees) and 34 per cent of large businesses (more than 200 employees). Applications by sector were not included in the numbers, but the damage to individual industries such as hospitality, tourism and travel industries has been well documented.

Australian Tourism Export Council managing director Peter Shelley said the reality was it would take the export tourism industry “many years to get back to the heights we’ve come to expect”.

“There will be no rebound for the international market until COVID-19 is fully under control both here and globally,” he said.

“Domestic tourism will undoubtedly pick up as soon as Australia is safe, but our inbound market relies on many factors.

“While we know there is still a strong desire for global travel, it will take time to rebuild the system. There is a significant time between when a person makes a booking and when they actually travel, particularly to Australia, so while the intention may be there, it will be a while before we see people landing in Australia and enjoying our tourism destinations.”

Businesses that have suffered a fall of at least 30 per cent in monthly revenue will be eligible for the program, which will subsidise employees’ wages by $1500 a fortnight. The amounts are payable from the first week of May and will be backdated to March 1 and expire six months after.

Large companies with annual turnovers above $1bn need to show a 50 per cent decrease in March revenue.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout