Coronavirus and markets sink Australian consumer confidence

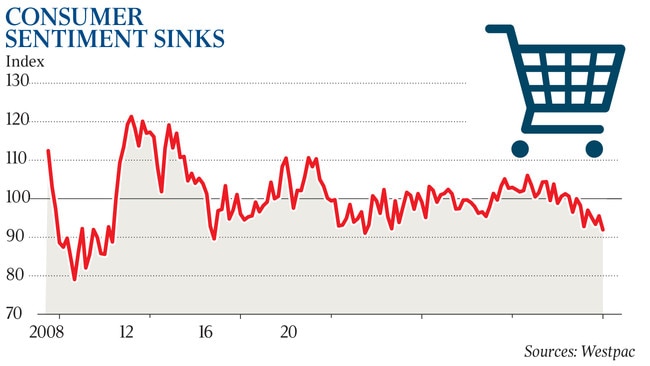

Consumer confidence crashed to its lowest in five years in early March under the weight of the coronavirus emergency.

Consumer confidence has crashed to its lowest level in five years under the weight of the coronavirus emergency and sharemarket collapse, as CEOs of the country’s biggest banks assured Josh Frydenberg they were willing to help support the economy and struggling customers.

The Westpac-MI consumer sentiment index fell 3.8 per cent to 91.9 points in March, driven by a “spectacular” plunge in households’ confidence in the economy over the next 12 months. The closely watched gauge is now at its second weakest level since the GFC, when the index fell as low as 79. Since the financial crisis, the measure was only lower in late 2014, when the fall-out from the end of the mining boom drove a national income recession and in the wake of Joe Hockey’s tough May budget.

The dire confidence figures came as the ASX officially entered into a bear market, and as NAB and Citi said they now expected a deeper economic contraction over the first three months of the year.

Global ratings agency Standard & Poor’s said it believed Australia could “weather a temporary economic shock” and that our coveted AAA debt rating was “not under immediate threat”, despite predicting Australia will suffer its first recession since 1991 over the first half of 2020.

Following Wednesday morning’s meeting with the Treasurer, Australian Banking Association chief executive Anna Bligh said banks stood “ready to assist, and if anyone is in need of assistance, they shouldn’t wait to come forward”.

The lenders assured Mr Frydenberg they were healthy enough to meet the challenges of the coronavirus, and that they were seeing positive signs out of China that the worst of the impact was behind it.

Reserve Bank deputy governor Guy Debelle at a business summit on Wednesday said Australia’s banks were “well capitalised”, in a “strong liquidity position” and will be “resilient to a period of market disruption”.

All of the ABA’s members committed to helping virus-affected business and personal borrowers on a case-by-case basis, including by waiving fees and charges, allowing repayment “holidays”, offering interest-free periods and debt consolidation.

Mr Frydenberg said the government recognised “the important measures that banks have already put in place to support their customers during the drought, floods, bushfires and now the coronavirus”.

NAB chief executive Ross McEwan said the bank was doing its bit “to support our customers and the broader economy”.

“We will work closely with the government on measures to support customers, particularly SMEs, through this,” he said. “NAB kept lending through the GFC and we are determined to do the same now.”

CBA chief executive Matt Comyn said he recognised “the important role we play to support our customers, our people, our suppliers and the economy”.

“We are assessing the impact on our operations on a daily basis,” Mr Comyn said.

The Australian sharemarket began tanking on February 20, as it became apparent that a China-focused epidemic had gone global. The S&P/ASX 200 index slumped a further 3.6 per cent on Wednesday, extending the losses from last month’s peak to over 20 per cent.

Bank share prices have been under particular pressure in recent sessions as investors factored in the squeeze on profit margins from lenders’ decisions to pass on the recent Reserve Bank cut in full.

Crestone Wealth Management chief investment officer Scott Haslem said there was some historical evidence that chaos in financial markets can have real economic effects.

“We know that the most likely immediate impact of market corrections is to undermine consumer and business confidence,” Mr Haslem, a former chief economist at UBS, said.

On Tuesday NAB’s key gauge of businesses for February showed corporate Australia was its gloomiest since 2013.

Scott Morrison on Wednesday confirmed his government would announce a much-anticipated package of fiscal support measures to help cushion the economic impact of the global epidemic, which he stressed was “connected to the life cycle of the virus”, and therefore must be considered a temporary phenomenon.

The Prime Minister said the government’s package had been designed so “there is a clear fiscal exit strategy”. The measures will be “timely but targeted” and “proportionate”, he said.

Westpac chief economist Bill Evans, who this week predicted a recession in the first half of 2020, said the details of the consumer sentiment survey showed Australians “are rightly concerned about the near term outlook for the economy but are less perturbed about their finances or the longer term outlook for the economy”.

“That is consistent with the notion that virus-related disruptions will be large but temporary,” he said.

NAB on Wednesday downgraded its GDP growth forecast for the first quarter of the year, and now expects the economy to contract by 0.3 per cent, against a prior prediction of a 0.1 per cent fall. The economy will grow by 0.3 per cent in the June quarter, the bank’s economists said.

Citi, too, issued a more pessimistic update to its growth estimates, saying the economy will shrink by 0.25 per cent over the first three months of 2020, versus an earlier forecast of a 0.1 per cent fall. The economy will stagnate in the June quarter, Citi said, after previously expecting growth of 0.4 per cent.

NAB chief economist Alan Oster said the duration of the disruption from the coronavirus will determine whether Australia avoids a technical recession over the first half of the year.

“Our judgment is the risk has to be that the virus will be a problem for longer and hence there are downside risks,” Mr Oster said.

While gloom grows around the prospects for the economy in the coming months, the Australian Bureau of Statistics reported the pace of new home loan growth accelerated further in January.

Seasonally adjusted data from the ABS showed the value of new mortgage commitments, excluding refinancing, jumped 4.6 per cent in the month to be up 23.3 per cent from a year earlier.

Westpac’s survey revealed softening sentiment around housing, with the “time to buy a dwelling” sub-index falling 0.3 per cent to 111.8. Mr Evans said while consumers’ confidence around buying a property appeared “resilient” against the broader falls in sentiment, “it is unusual for the index to fall following an interest rate cut”.

Consumer expectations for house prices fell sharply, the consumer survey also showed.

The “house price expectations” index fell 6.6 per cent in March, the biggest monthly decline since February last year.

“That said, at 141.7, the index is still well above the long run average of 125 and up 66 per cent on a year ago,” Mr Evans said.

“Most consumers still expect prices to rise over the next year but the result is consistent with some slowing in momentum.”

additional reporting: Richard Gluyas

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout