Companies urged to look offshore

The COVID-19 pandemic is making Australian companies increasingly wary of investing offshore, says Asialink Business.

The COVID-19 pandemic is making Australian companies increasingly wary of investing offshore, a report to be issued on Tuesday by Asialink Business has warned.

“A lot of boards are shaken by COVID,” Australia Post chief executive Christine Holgate says in the report. “There is a risk lens, rather than a growth lens.”

Ms Holgate, a former chief executive of Blackmores who is also chair of the Australia ASEAN Council, said COVID had increased fears about the risks of investing offshore.

“The cost of capital to launch overseas compared to funding the domestic business will be significantly greater due to the perceived risks,” she said.

She said travel and other COVID restrictions were also making overseas trade more difficult. “Practically, its very hard to get trade done,” she said.

The COVID pandemic had made boards more risk averse. “Risk maps are now key,” she said.

The report, which says major Australian companies that have expanded offshore have delivered higher total shareholder returns, warns of an increasing focus on the domestic market.

It says the lower growth outlook over the past three years was already making companies more wary of investing offshore before this year’s onset of the COVID-19 pandemic.

“Our consultations highlighted the overwhelming desire to focus domestically in the current environment rather than court risks offshore,” it says.

The low growth environment for corporates over the past few years has led to increasing short termism and aversion to risk by companies and their investors.

“A focus on quarterly, half yearly and annual performance continues to dominate the attention of senior leaders,” it says.

“Short termism continues to be on the rise. Risk aversion among investors also appears to be on the rise.”

The report, calling Winning in Asia, was produced for Asialink Business with the involvement of the Australian Institute of Company Directors, Chartered Accountants Australia and New Zealand, the Commonwealth Bank and the Boston Consulting Group with backing from the Sid and Fiona Myer Family Foundation.

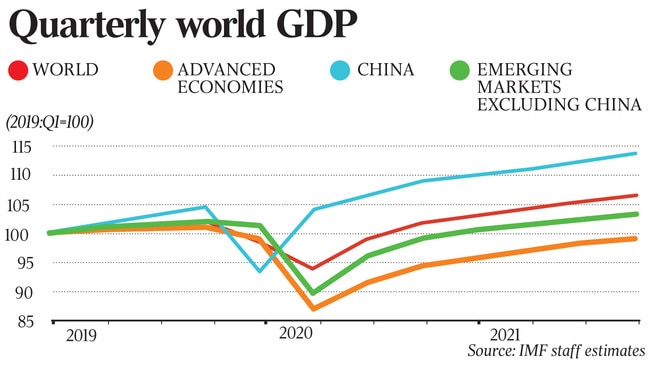

The report says the Australian economy has done relatively well during the COVID pandemic compared to other countries. But it warns that the ability to trade with and invest in Asia would be the key to future prosperity.

“Going forward, sustainable long term growth in the performance and returns of Australian businesses will be even more dependant on Asia markets,” it says.

“Winning in Asia’s highly competitive markets will be central to sustaining our per capita income levels, adding sustainable jobs to the workforce and growing our long term pool of national savings,” it says. “Our largest companies will be central to this.”

The report recommends companies need to be more proactive in expanding into Asia and look for ways to boost the capabilities of their leadership teams.

It also recommends companies learn from those that have successfully expanded into Asia using different business models including Lendlease, Macquarie Group, Goodman Group, Cochlear, IDP Education, accounting software company Xero, and Treasury Wine Estates.

It argues that successfully doing business in Asia needs more “boots on the ground” and more investment by companies in external affairs capabilities in the countries they are operating in.

The report says ASX 200 companies that are internationally focused create more value for shareholders. The average five-year total return for the 10 largest listed companies that had diversified international operations was 74 per cent higher than the 10 that were domestically focused.

But the report shows that a range of factors is making the big Australian companies more wary of expansion.

“Indonesia should be a country that Australian companies should focus on,” Nicola Wakefield Evans, a director of Macquarie, Lendlease and BUPA said in the report.

“It is one of our closest neighbours with a huge market and significant GDP growth over the last 10 years. “Yet boards and senior management remain wary of investing in Indonesia because of concerns about the legal system, bribery and corruption.”

Several executives said privately owned companies were often better at expanding into Asia than listed ones.

Peter Yates, deputy chair of AIA Australia, said private and family owned companies tended to be more successful in Asia as they were not subject to the short term demands for performance and could take a longer term view.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout