CommBank finds young Australians the hardest hit by cost of living crunch

While every other age group spends up, the cost of living crunch is hitting young adults the hardest – forcing cuts to travel, clothing and takeaway food.

The cost of living crunch is hitting Australians aged in their late 20s harder than any other cohort as rising interest rates and surging rents force many to readjust spending habits.

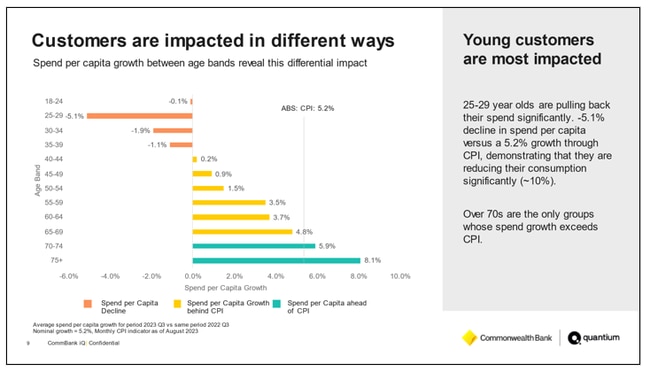

The CommBank iQ Cost of Living Insights Report found that Australians aged between 25 and 29 have cut total spending by 5.1 per cent – the only age group to decrease both discretionary and essential spending in the September quarter from a year ago.

This was in stark contrast to older Australians who are thriving under the cost of living crunch, with those aged over 70 the only cohort to have increased their spending at a pace greater than the rate of inflation, which was up 5.4 per cent in the most recent quarter.

The report, which uses payment data from seven million Commonwealth Bank, customers found young Australians had reduced spending by nearly 20 per cent and pulled back on clothing, retail and takeaway services such as UberEats and DoorDash by about 10 per cent.

Despite a pullback in discretionary purchases, those in their 20s continued to find room in their budget for entertainment experiences, which were up 13 per cent.

Wade Tubman, CommBank iQ’s head of innovation and analytics, told The Australian that intergenerational differences in spending habits were becoming more evident than earlier in the year, as was robust strength of spending in regional areas compared to the capital cities.

“Regions are generally worse off in typical financial situations, however this around they are actually fairing much better because of the housing situation,” he said.

“Those under 30 are feeling the brunt from the cost of housing with many having been impacted by higher rents or they are likely to be first home buyers.

“They are likely to not have a savings buffer, nor the ability to accumulate savings.”

Mr Tubman said many older Australians had befitted in the current interest rate environment with a sizeable percentage having no mortgage and a war chest of savings.

“Those in retirement are less likely to have a mortgage and have a lot of savings, which in the current interest rate environment is earning them a lot more interest and therefore more disposal income to spend,” he said.

CommBank found overall that Australians increased their spending on entertainment and travel by more than 8 per cent between July and September compared to a year ago. Entertainment was driven by major sporting events such as the FIFA Women’s World Cup, the Barbie and Oppenheimer films and the concerts.

Expenditure on insurance increased by 12 per cent, more than any other category, as higher costs of visiting a doctor and at pharmacies left less money to spend on discretionary categories such as household goods and clothing.

The Reserve Bank has made 13 increases to the official cash rate since May 2022 in a bid to take heat out of the economy – and therefore force Australians to spend less on goods – in an effort to get inflation to fall to its target band of 2-3 per cent. The data from CommBank showed that all age brackets above 55 had spending growth above the RBA’s target band, while those under 55 were feeling the pinch.

Those over 65 increased spending on travel by 17 per cent and spend 11 per cent more on eating out.

“Travel is an experience that people are willing to prioritise for, but even then we are seeing younger Australians even cut back on that now,” Mr Tubman said.

“While spending on travel remains high, it is not as strong as it once was and a downward trend is forming. It will be interesting to see over the coming months with recent RBA hikes and Christmas what happens to this category.”

Australians had also reduced giving to charities by 5 per cent and household good spending by 8.1 per cent. This coincided with poor first quarter results by Harvey Norman and The Good Guys.

South Australia, and Western Australia recorded the strongest spending growth per capita, while NSW, Victoria and Northern Territory had the weakest growth.

CommBank iQ is a joint venture between Commonwealth Bank and The Quantium Group.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout