New report identifies one age group feeling the cost of living pinch

The latest CommBank iQ report has identified one age group in particular feeling the crunch of rising inflation, interest rates, and rent.

Australians in their 30s, especially those renting, have been singled out as the group most acutely feeling the pressure from uncertain economic conditions locally and abroad.

The latest CommBank iQ Cost of Living Insights Report found growing inflation, interest rates, and rent are putting the squeeze on those aged between 30-34.

However, it’s also found people in this age bracket are being more thrifty when it comes to spending on essential items, in order to afford experiences.

The report, which uses payment data from 7 million Commonwealth Bank customers, found spending on travel and accommodation was up 39 per cent in the first three months of the year, compared to the January-March period in 2022.

“Putting our expenditure under the microscope shows we’re responding to the increased cost of living in diverse and sometimes unexpected ways,” said report author and CommBank iQ’s head of innovation and analytics Wade Tubman.

“What we’re seeing is a continued Covid rebound effect, with consumers catching up on the experiences that they missed out on during the pandemic.

“It seems counterintuitive that at a time of increased cost of living pressures, consumers are choosing to boost their discretionary spending.”

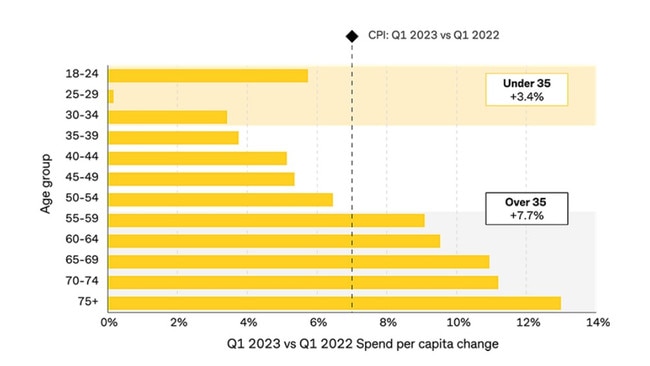

Meanwhile, Australians older than 35 are spending more, with the report showing their annual expenditure up 7.7 per cent — almost double the 3.4 per cent increase in spending by those under 35.

Those aged 25-29 show the largest reduction in expenditure, while 18-24 year olds have sustained their spending, given many are still living with parents.

“Our Cost of Living Pressure Indicator shows renters are experiencing more pressure than homeowners in general,” said Mr Tubman.

“Despite the increased financial burden on some mortgage holders, a little under half of all homeowners are mortgage-free and a third of those with a mortgage have savings buffers of two years or more.”

CommBank iQ is a joint venture between Commonwealth Bank of Australia and The Quantium Group Pty Ltd.

The spending data they collect and use in the report has been aggregated and de-identified.