China trade links mean coronavirus a $1bn risk

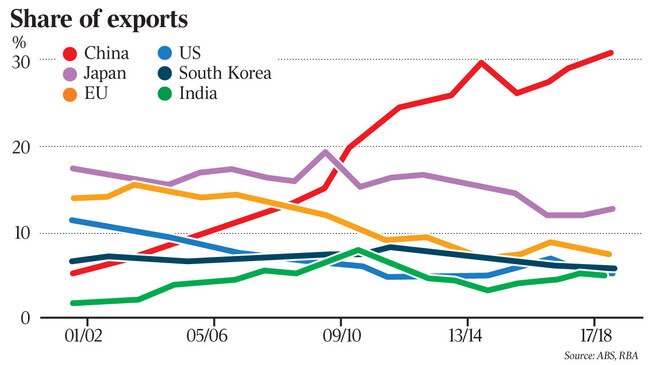

Australia faces a deeper economic hit from the coronavirus than from the 2003 SARS outbreak because of our growing dependence on China trade.

Australia faces a deeper economic hit from the coronavirus than from the 2003 SARS outbreak because of the nation’s growing dependence on trade with a Chinese economy that has grown substantially over the past 17 years.

Economists warn that potentially more than a billion dollars in tourism, higher education and commodity exports would be at risk from a general slump in the Chinese economy.

“China’s a lot bigger now, a lot more integrated, and we’re a lot more dependent on them too,” said economist Warwick McKibbin, whose 2003 analysis put the total cost of SARS for the Australian economy at 0.07 per cent of GDP.

“Anything could happen because of psychological factors, which are so hard to predict,” he added, conceding the damage could be much worse this time.

The warning came as the local benchmark ASX200 index sank 1.3 per cent, the biggest one-day fall in four months, as investors tried to quantify the likely economic damage from the virus that’s already killed more than 100 people. The slump followed an even sharper 1.6 per cent drop in New York on Monday — its worst one-day fall since October.

China has shut its financial markets until February 3.

Future Fund chairman Peter Costello singled out tourism as the sector likely to feel the most pain.

“In the short term, there’s obviously going to be an effect on tourism into Australia,” he said. “That will affect airlines, it will affect airports, and it will affect general consumption at a time when many tourist industries have also suffered because of the bushfires.”

But the impact will be felt across the economy. The world’s largest rock lobster exporter said it was hoping to resume trade to China after the coronavirus prompted a temporary halt in sales. Geraldton Fishermen’s Co-operative chief executive Matt Rutter said his organisation wanted to reduce the impact of the halt on workers, including Chinese workers and their families, who were associated with their export business.

“There is definitely going to be a lull for a period of time while the Chinese people have been instructed to avoid crowds and avoid big groups,” Mr Rutter said.

The resumption will be important for Rick Dipane, who has been fishing for 53 years. He said his family had been crayfishing for a century. Mr Dipane and his family fish out of Fremantle, Mandurah and Yanchep in Western Australia.

Professor McKibbin, an economics professor at ANU and a former Reserve Bank board member, put the global damage from SARS at $US40bn. “The impact on death rates and morbidity was quite small. Behavioural changes are 90 per cent of the damage — the demand effect on households, the cost effect on businesses who have to deal with disruption to their supply structures,” he explained.

Simon Baptist, chief economist at the Economist Intelligence Unit, estimated the virus would lop between 0.5 and 1 percentage point off China’s growth this year.

Brendan Rynne, chief economist at KPMG, expects damage to China’s economy of between 0.1 and 0.2 percentage points for 2020. The cost for Australia could be $700m this year and $1.4bn by 2024, he said. “But this is a moderate (and) not (a) “contagion” scenario,” he said.

The prospect of further drags on the economy from China follows an intense bushfire season also expected to shave business and household confidence, on top of billions in damages to property.

“The Australian domestic response has been pretty good, and the Chinese did respond incredibly quickly this time,” Professor McKibbin said.

An Ai Group survey of 252 chief executives taken late last year, before the bushfires intensified, found a greater share of CEOs were expecting deteriorating conditions. And for the first time since 2015 this was a greater share than those who expressed optimism for their bottom lines.

“Australia’s extraordinary bushfires have further weakened the outlook for 2020,” Ai Group CEO Innes Willox said.

Additional reporting: Paige Taylor

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout