Last week’s first industry-wide delegation to China by corporate Australia since 2019 gave its 15 members an opportunity to have a peek behind the shop window.

Their four days on the mainland also functioned as a quick refresher of some of the perils facing China’s foreign business community.

Not that the leader of the Australian delegation – David Olsson, president of the Australia China Business Council – was naive about those.

“We want to find out where we fit into this more complex environment,” Olsson, a Hong Kong-based partner at law firm King & Wood Mallesons, told me days before setting off.

Things became even more “complex” during their trip.

On Wednesday, Beijing passed legislation that expanded its already sweeping anti-espionage laws.

On Thursday, the American consultancy Bain & Company confirmed that its Shanghai offices had been raided by Chinese officials.

On Friday, the US Chamber of Commerce voiced the concerns of many business people based in China: “Foreign investment will not feel welcomed in an environment where risk can’t be properly assessed and legal uncertainties are on the rise.”

Australian businesses in China have been concerned about decisions coming out of Beijing well before last week. A survey of 160 companies operating in China, released in December, offered a useful overview.

“Uncertainty, pessimism, and early signs of disengagement from China” were among the top-line findings in the Australian government-supported report.

Just over half of those surveyed (52 per cent) said the investment environment in China was deteriorating. Legal uncertainty and unclear regulatory frameworks were common concerns.

They weren’t directly asked about the nightmare scenario for any Australian business person in China: being arrested. But it’s a sad fact that having an Australian passport, or that of any other US ally, at this geopolitical moment adds to the risk of being in China.

Last month, a Japanese pharmaceutical executive was arrested in Beijing on vague espionage charges. His boss Naoki Okamura has since declared: “The era of sending expats is coming to a close.”

Not that his firm, Astellas, is going to spurn the Chinese market. “Instead of deciding to cut off China, we are preparing for such risks by preparing alternative options,” he told the Financial Times.

There’s more than just gloom in the Chinese economy. China’s huge consumer market remains a source of allure to companies around the world. It is one of the reasons Japanese corporate giant Kirin last week made a $1.9bn takeover offer for Australian vitamin company Blackmores.

The recent Shanghai car show was a reminder of how impressive the Chinese private sector can be. Expect to see a lot more EVs from China’s BYD, Nio and XPeng on roads in Australia and around the world in the coming years.

Olsson’s delegation – which included executives from Rio Tinto, Fortescue and HSBC – was particularly focused on opportunities for Australian businesses to profit from China’s green transition. It’s one of the mega-trends in the world economy. We need to be paying close attention to it.

For all the political drama, China remains by far Australia’s biggest customer.

Iron ore makes up close to two-thirds of our total exports to China. Add LNG, lithium, coal and gold and you have nearly 90 per cent of Australia’s exports to China.

That concentration is as comforting for Canberra as it is frustrating to Beijing. Over the last three years, the Chinese government has taught us that, even when furious, Beijing is reluctant to block strategic resources.

There are profitable pockets beyond extractive resources. One of the Australian corporates on the trip last week was from Cochlear, the listed Australian hearing aid business, which in 2020 opened a $50m manufacturing plant in Chengdu, China’s panda capital. The expansion of what is already the world’s biggest elderly population is likely to be good for business.

Those Australian agricultural products not black-listed by China continue to sell well. And there is chatter that Australian lobsters may again be sold in China – without first being smuggled through Taiwan – after Trade Minister Don Farrell’s much-delayed trip, perhaps only weeks away.

We’ll see. For all the headlines about improving trade ties with Australia, for now coal is the only one of the $20bn in black-listed products China has allowed back in.

There is so much going on in China right now as it reopens after its Covid isolation. Regrettably, there are nowhere near enough Australians on the ground making sense of it.

To make informed decisions, the Australia business community will need more than impressions of the occasional visiting delegation and the irregular postcards – entertaining but at times wildly inaccurate – from a sometimes Beijing-based former Australian ambassador.

China makes the situation so much worse by refusing to issue visas to most think tanks and academics and all Australian journalists. “Open for business” but closed to most everyone else doesn’t inspire confidence.

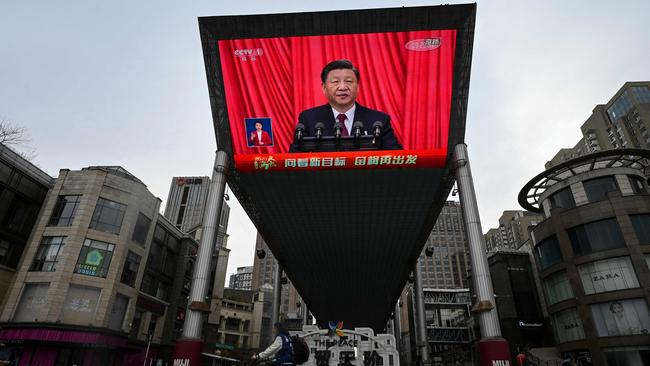

In recent months, China’s government has put up its “open for business” sign. Xi Jinping even sent his childhood friend Liu He to Davos to spread the word.