CEOs say there is no need to fear ‘aggressive’ interest rate hikes

Bosses of some of Australia’s biggest companies say the economy is still strong despite consumers feeling hip-pocket pain from three rapid interest rate hikes, with more to come.

The bosses of some of Australia’s biggest companies are taking the Reserve Bank’s three rapid interest rate hikes in their stride, as they talk up the strength of the national economy after two pandemic-plagued years.

Commonwealth Bank’s Matt Comyn, Crown’s outgoing CEO Steve McCann and Harvey Norman’s Gerry Harvey are among those taking a “glass half-full” view, saying that consumer spending is still stronger now than two years ago.

Russia’s invasion of Ukraine and a prolonged pandemic-fuelled global supply-chain crunch have sent year-end forecasts of inflation hurtling towards 7 per cent, while sparking hip-pocket pain at the petrol pump and supermarket check-outs to household and other essential bills.

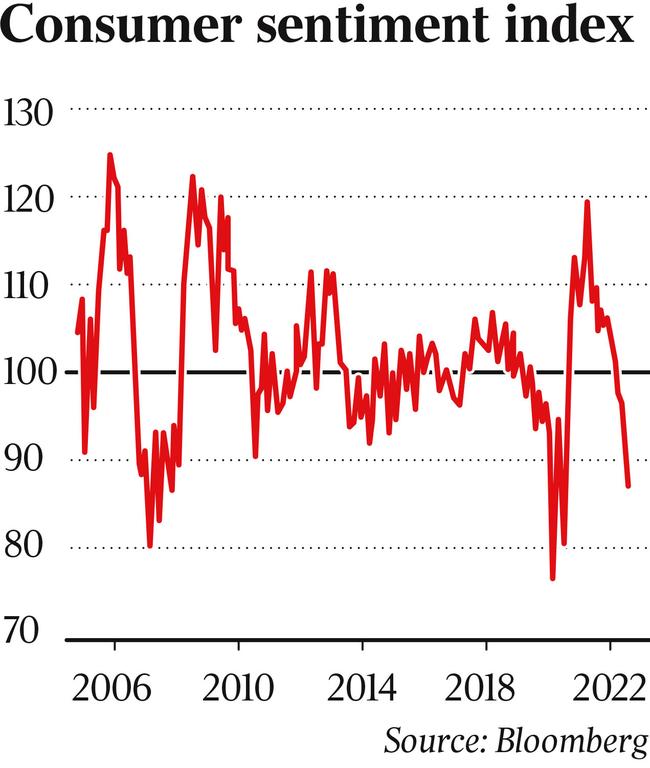

And the RBA’s aggressive rate increases – including two record back-to-back 50 basis point hikes in June and July, with expectations of more to come – coincide with a global risk of 1970s-style “stagflation” and recession, according to some economists.

But Mr McCann believes the return to rising interest rates – and dwindling disposable income – will not derail a recovery in the local hospitality and entertainment sectors.

Crown Resorts – which was sold to US private equity giant Blackstone for $8.9bn last month – is finally enjoying a rebound in trade after it was forced to close its restaurants and significant parts of its sprawling flagship Southbank complex during Melbourne’s 262 days of lockdown.

Mr McCann said pent-up demand to venture out again and interest rates still low compared to historical levels meant the RBA’s tightening was unlikely to have a “dramatic impact”.

“Remember that we’re coming off all-time lows in interest rates so the cost of money today is still materially below what it has been in the longer term,” Mr McCann said.

“There are different drivers that are creating the inflationary environment that we’re in and it’s not a surprise given the amount of money that’s coming into the systems around the world, and … there’s a wealth effect that’s driving part of this.

“So the interest rate rises are to manage the economy, slow down that inflationary growth, but I don’t think it’s going to have a dramatic impact on the amount of money that the tourist sector has to spend. Remember people have been through a lockdown for a couple of years so there are a lot of people very keen to get out.”

Matt Comyn, chief executive of Commonwealth Bank, said it was understandable people were anxious, but rising interest rates were a sign the economy was “performing well”.

He said there had been a “small number of problems” from customers as a result of the rapid increase rate increases. This in contrast to the start of the pandemic when CBA deferred 13 per cent of repayments across its $477bn home loan book.

“That maybe underestimates the concern that some people would understandably be feeling because we are going to go through a rapid series of interest rate hikes, probably somewhere in the order of 2.25 or 2.5 per cent to the cash rate by Christmas — that’s a pretty big shift, certainly from where we were a few months ago,” Mr Comyn told the podcast Making Money Easy.

“It’s definitely a period of adjustment. Fortunately, the Australian economy is in good shape.

Many CBA customers had a ‘natural buffer’ with $250bn-$260bn in aggregate savings nationally, and three-quarters of loans approximately two years ahead on repayments, on average.

But Barry Gill, Head of Investments at UBS Asset Management, said investors were grappling to forecast the durability of global inflationary pressures and whether central bankers “in their zeal accidentally tip the global economy into recession”.

Fellow UBS economist George Tharenou said in Australia market pricing of 3.5 per cent cash rate “would likely crash housing, and see the economy nearing a recession”.

However, veteran retailer Gerry Harvey said he struggled to see how Australia could be tipped into a recession, or two consecutive quarters of negative economic growth.

“I find it difficult to understand how we could go into a recession because we have got over full employment, you can’t get anyone to work for you and wages are going up. I’ve never heard of a recession where there’s full employment and wage increases and you can’t get people to work for you,” Mr Harvey said.

“So to have a recession, we’ve now got to go into unknown territory.”

On his own company, Mr Harvey said: “Realistically, if we got a sales figure that was 5 or 10 per cent less than last year, it’s still way up on 2019, which means we still have a very good result.

“But if you get the media out there and they look at results of companies that have got turnovers down 5 or 10 per cent on last year, they say this is a disaster, but it really isn‘t because it’s up 15 or 20 per cent on 2019.”

According to the Bureau of Statistics, Australia has about 500,000 job vacancies that businesses are scrambling to fill. Business Council of Australia chief executive Jennifer Westacott last month said this: “Puts a handbrake on businesses who want to expand and innovate, boost their productivity and pay sustained higher wages.

“And, it means customers face long waits when travelling, they can’t get reservations at their favourite restaurants and cafes, or they can’t access the services they want.

“To lock in our recovery and to make sure Australians get the services they expect, we must boost levels labour force participation, attract migrants and deliver a skills system that lets Australians re-skill and upskill quickly.”

Paul Huggins – a director of investment group Hamilton Chase, which oversees about $6bn in funds – said Australian is facing a “productivity crisis rather than an inflation crisis”.

“America and most of the western world has that, particularly in Australia where productivity is nowhere near what it should be. Output is not there, and it’s not there economically or in the workforce. Nobody pushes themselves to 70, 80 or 90 per cent of output,” Mr Huggins said.

“Efficiency and productivity is a big issue so inflation and the cost of living will ease up. I think it will take 12 to 18 months to two years for the bottleneck to ease.”

And if Australia’s lurches into a recession in the meantime, Mr Huggins said it could present a “great opportunity to expand”.

“If I was buying a home, I’m 1 per cent worse off than what I was a year ago. But gee, perhaps I’m buying 10-15 per cent below the market, so what’s that worth?

“It’s a 10 x ratio. I’m paying 1 per cent more but maybe 10 per cent off capital, and the stamp duty saving. People get all panicky but this inflationary aspect now is healthy, resuming its natural position.”

Mr Huggins forecast the end of job hopping to blockbuster pay rises as it becomes more affordable to introduce automation and other technology systems to increase productivity.

“The view I as an employer would be if you don’t want to come to work … I’m spending half that money on technology to do it 50 times faster and I don’t have to manage the individual. … I wonder how much longer employees will [threaten to leave for a higher wage elsewhere] … before the employer says ‘you can go’.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout