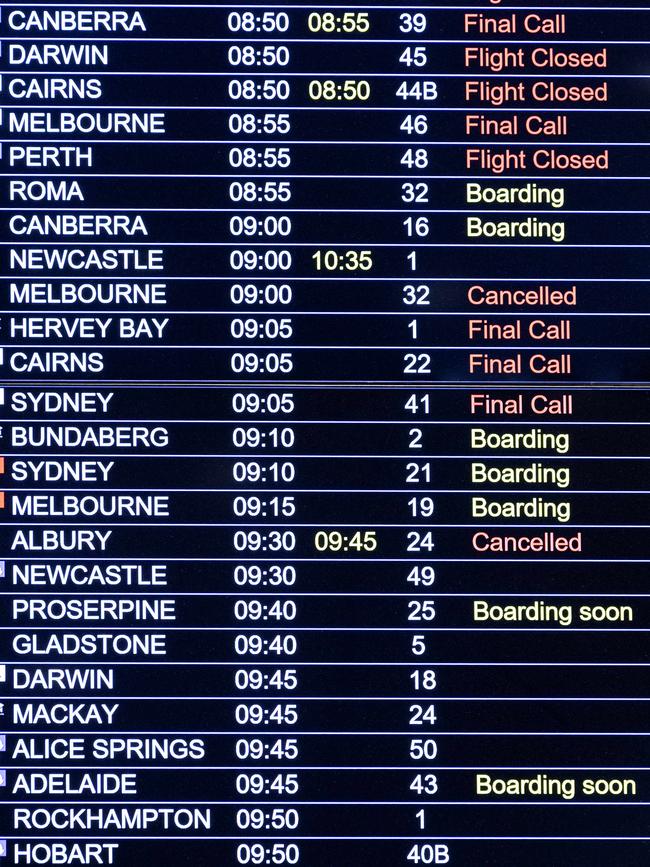

For customers paying top dollar to have a quick escape, the airport experience has been as brutal as trying to catch a Tokyo train during rush hour.

But Qantas’ board, in signing off the annual accounts, should be asking its management team led by long term chief executive Alan Joyce about how they marked themselves in planning for the post-Covid recovery.

Richard Goyder’s Qantas board should also be probing how the customer experience during the June half is consistent with one of the material business risks of the group – that the ongoing success of Qantas depends on satisfaction and loyalty.

For more than a year the board has warned Qantas’ management of the potential risks that a drop in customer satisfaction due to cancellations could have on the airline’s reputation.

During June, as the headlines about chaos and cancellations were at peak, it was just bizarre that the airline’s most profitable arm Qantas Loyalty was sending out offers and embarking on a promotional blitz to Frequent Flyer members. It was not a message consistent with the real strains the airline was clearly feeling.

The airline expects to have flown 350,000 people over this weekend as Victoria and Queensland holidays end and has added bigger aircraft to take the load. Its baggage contractor Swissport has offered shift bonus payments amid a chronic shortage of labour. NSW holidays end this weekend.

‘Cancelled’

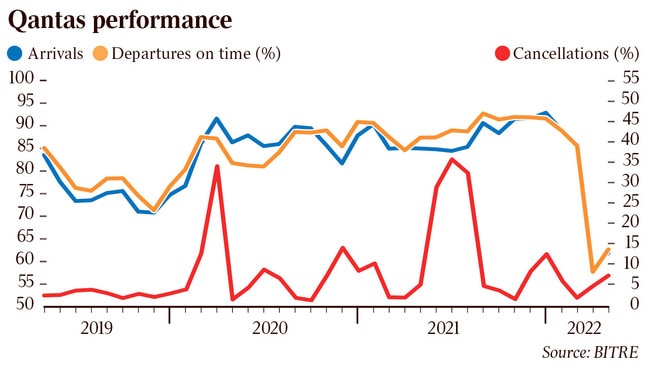

But in less than two weeks Qantas will be sweating on some of the most important non-financial figures of its short post-Covid recovery. The data compiled by Canberra’s Bureau of Infrastructure and Transport Research Economics will have a big impact on future business and the airline’s reputation.

In the past two months Virgin has overtaken Qantas on reliability for arrivals and certainty that a scheduled plane will take off.

In May Qantas’ averaged an on-time arrival rate across its entire network of 60.7 per cent and a cancellation rate of 7.1 per cent. Virgin, with about two-thirds the volume of flights, had an on-time arrival rate of 65.7 per cent and a cancellation rate of 5 per cent.

While the finger is usually pointed at the school holiday rush, a worrying trend emerges by drilling deeper into the numbers. The two busiest sectors for Qantas are the ones that bring in the biggest buckets of cash for the airline – Melbourne-Sydney and Sydney-Brisbane – and these are among the most chaotic.

Performance in these sectors deteriorated sharply in May, a month where everyone was back at school or work. Some 20 per cent of scheduled Qantas flights between Melbourne and Sydney during the month were cancelled. For the real world that’s a one-in-five chance your plane won’t take off. A little more than one-in-two (56 per cent) arrived at their destination on time. Virgin performed a little better with an on time arrival of 63 per cent and cancellation rate of 12 per cent. These passengers aren’t holiday makers, they are repeat commuters.

Cancellations for Brisbane-Sydney in May were under 10 per cent for Qantas while Virgin had a more reliable on time arrival rate at 65 per cent. Elsewhere, one-in-ten Qantas flights between Sydney and Canberra were cancelled in May. Some 9 per cent of Jetstar flights between Perth and Sydney were cancelled. On the same route Virgin arrived on time for only 53 per cent of scheduled flights.

A month earlier which includes the Easter holiday period Qantas’ on time arrival rate on Melbourne-Sydney was just 47 per cent with Virgin not much better at 54 per cent. Cancellation rates for that route were 16 per cent for Qantas in April and just 6.4 per cent for Virgin.

In an update last month Qantas said it has recruited more than 1000 operational staff, which it expects to help particularly around ground handling and cutting call centre waits. The airline said it “sincerely thanks” customers for their patience and understanding for ongoing delays.

There is a lot riding on the promises that things will get better.

Not alone

The Australian Airlines are not alone in their restart headaches. Carriers around the world are struggling to return to a “business as usual” footing particularly through the high demand European summer.

Germany’s Lufthansa Group, which is one of Europe’s biggest airlines, last week apologised to customers and chief executive Carsten Spohr wanted to be “completely honest”, by warning the crush in the industry will get worse before it gets better. Lufthansa employs more than 100,000 across its group of brands that include Austrian and Swiss.

“The ramp-up of the complex air transport system from almost zero to now almost 90 per cent is clearly not proceeding with the reliability, the robustness and the punctuality that we would like to offer you again,” said Spohr in an open letter to customers. To drive the point home across management, the letter was also signed off by the airline’s five most senior executives.

Another layer is complexity in Europe is the war in Ukraine which is causing bottlenecks as flights move further east.

“Too many employees and resources are still unavailable, not only at our infrastructure partners, but in some of our own areas too. Almost every company in our industry is currently recruiting new personnel, with several thousand planned in Europe alone,” Spohr wrote. However he said the increased staffing will only have “the desired stabilising effect” by the December quarter. Spohr said his airline “was doing its utmost” to regain its record on punctuality and reliability.

Lufthansa is just one of dozens of significant global airline brands being challenged on the recovery. Qantas and Virgin are also fishing in this global market for workplace talent, particularly ground specialists needed to ensure a plane can take off. Sydney Airport, owned by a string of industry super funds including UniSuper and AusSuper, now has a live jobs vacancy board in its domestic terminal.

For the first time in years, airline and airport employees now hold the cards when it comes to industrial relations.

Wages hike

This has partly prompted Qantas to offer a $5000 one-off bonus as a carrot for 19,000 non-management staff to sign on to a 2 per cent wage increase. This is on top of the offer of 1000 shares for employees that stay until August next year. The upfront cash, at a cost of $87m, plus shares might just be enough to win over the bulk of the airline’s employees for now.

Qantas on Friday said Covid was still impacting the airline with cases increasing in recent weeks, particularly in NSW.

“Additional crew on standby is helping minimise the impact this is having on flights,” Qantas said.

Outgoing Crown chief executive Steve McCann recently said the casino operator made the tough call to withdraw some services when staff shortages were acute through the Covid recovery. This meant closing restaurants on some weeknights and not booking hotel towers to 100 per cent capacity. McCann was not speaking about Qantas, rather he was discussing Crown’s own recovery experience.

Qantas is trimming capacity across its but this is financial over service driven. Cuts are in response to high fuel prices after the airline rolled over to a new fuel hedging contract from the start of July. Current capacity is being trimmed a total of 15 per cent by September and by 10 per cent from October to March next year.

On the ground is a lot different to in the air, but the concept is the same. Provide the service you promise and the customer will come back.

johnstone@theaustralian.com.au

As the winter school holidays start running down on the nation’s east coast, it’s a chance for Qantas, Virgin and the nation’s airport operators to take stock of what has been a highly unsatisfactory few months for the aviation industry.