Business expecting major virus hit, ABS reports

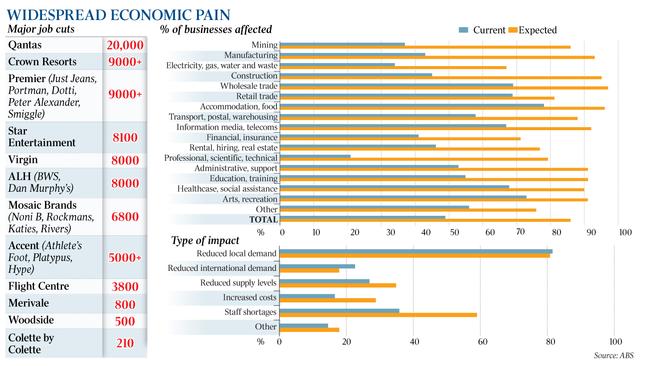

Ninety per cent of Australian businesses are expecting coronavirus impact, says a new ABS report that reveals where they’re already feeling the pain.

The coronavirus crisis will leave few firms unscathed in the coming few months, with a special ABS survey revealing nine in 10 businesses expect to feel the impact from the pandemic and measures taken to control its spread.

The Australian Bureau of Statistics questionnaire also showed the extent of the damage to corporate Australia even before the shutdown of non-essential services, with half of firms reporting they were already suffering the fallout from the virus.

The survey of 1230 companies across a range of industries was carried out between March 16 and 23.

ABS data showing that while the #coronavirus is not impacting every business currently, the sector unanimously expects it to in future - reflecting the methods that are needed to get control of infection numbers #ausbiz pic.twitter.com/jwRN6ViP8c

— Alex Joiner (@IFM_Economist) March 26, 2020

The ABS report showed the impact of the virus was, unsurprisingly, being most felt in the food and accommodation services sector, where 78 per cent of respondents said they were feeling an impact. Almost all of these firms – 96 per cent – flagged they expected to be affected in the coming months.

In contrast, businesses in professional, scientific and technical services (21 per cent), electricity, gas and water supply (34 per cent) and mining (37 per cent) sectors were the least likely to have been adversely affected by COVID-19 in the previous two weeks, the ABS said.

A drop in demand was the most common impact (82 per cent), and that was also the most common impact expected in coming months (81 per cent).

The survey revealed that the main issues for businesses to date were cashflow, the threat of closures, how to manage working from home, and planning costs. For coming months, firms are predominantly worried about closures and cash flow, as well the prospect of standing down workers.

Of those reporting they had been negatively affected by the health crisis, over a third told the ABS they had experienced staff shortages (36 per cent), and 59 per cent expected to experience staff shortages in coming months as illness, school closures and travel restrictions make it difficult for people to get to work.

Complaints of worker shortage “seemed at odds with the ongoing reports of significant job losses and stand downs,” ANZ senior economist Catherine Birch said.

“But we think it reflects the range of experiences across industries. For example, health is facing very different challenges compared with retail.”

This week the major banks announced branch closures as employees stay home to look after school-age children, while on Thursday Flight Centre was the latest big company to announce job losses, saying it would stand down 3800 workers in Australia.

The bleak business survey comes as experts now expect the economy to suffer its biggest quarterly contraction on record over the coming few months, in the order of 10 per cent, with the scale and the pace of the blow from the pandemic proving almost impossible to underestimate.

“Shutting down a large part of the economy should shift the economic dial more towards ‘depression’ rather than ‘recession,” CBA chief economist Michael Blythe said.

Output shrank by 10 per cent or more during the depression in the 1930s, while unemployment spiked towards 20 per cent. Winding dole queues this week harkened back to those distant times.

Mr Blythe said that while comparisons between the current problems and the Great Depression “are tempting, the differences are just as important”.

“The Great Depression was deepened and lengthened by some policy mistakes. The size and speed of the policy response this time offers encouragement, as does the range of measures being deployed. And no doubt the policy response will be ramped up further.”

Modelling by Westpac and JP Morgan suggests unemployment will hit double-digits in the coming months, from 5.1 per cent in February.

The statistics agency had attempted to survey 3000 firms, but received a response rate of only 41 per cent, significantly lower than usual, the ABS said. NAB economist Kaixin Owyong said this may reflect there have already been closures.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout