RBA injects $2bn into state bond market

The Reserve Bank has injected $2bn into the state government bond market.

The Reserve Bank has injected $2bn into the state government bond market in a bid to help revive the ability of NSW, Victoria and other state treasuries to borrow and fund stimulus packages as traders in the semi-government bond market strain under continued selling pressure.

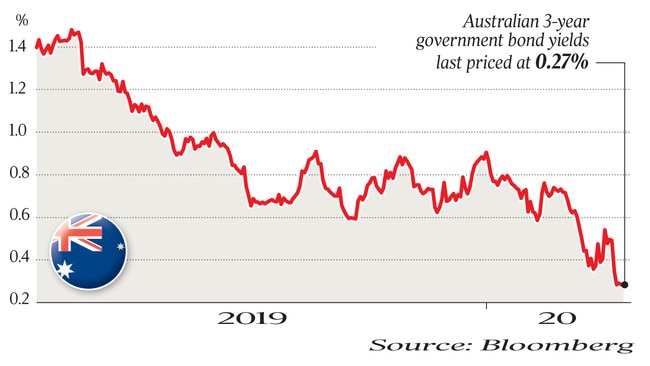

The unprecedented move into state-issued treasuries represents a further expansion of the central bank’s unconventional monetary policy program after buying $13bn worth of securities in the Australian government bond market since the launch of its interest rate easing plan on Friday.

Financial markets sources told The Australian participants in the bond market had balance sheets “clogged” full of state government bonds and were unable to sell into the market or buy any pent-up demand. “There is no capacity to absorb any selling pressure,” one source said.

Although Australia does not have US-style regulatory limits on how much risk and leverage bond dealers can take onto their books, local financial institutions often put in place their own internal risk frameworks that, in this instance, have precluded local traders from being able to buy and sell normally in the market at the moment.

In a further leg to the central bank’s intervention into the financial system, the RBA will also fling Australian banks and local financial institutions a $US10bn ($16.5bn) lifeline in US dollar-denominated funding in an auction set to take place on Thursday.

This multi-billion-dollar currency “swap line”, which was set up between the RBA and the US Federal Reserve late last week, will be offered to local banks on a loan term of 84 days, and will serve as a way to ensure local financial institutions have a steady flow of the vital currency.

In a bid to get the state government bond market functioning properly, the Reserve Bank has made a foray into the state government bond market, known as semi-government securities, just days after it immediately expanded its easing program beyond shorter-dated federal government bonds and into longer-term securities last week.

The RBA on Wednesday bought $530m worth of NSW treasury notes, $370m worth of Victorian notes, $310m of Queensland bonds and $590m worth of West Australian treasuries, all maturing between January 2026 and June 2030. The RBA also bought about $200m of treasuries issued by South Australia, the ACT, the Northern Territory and Tasmania.

Commonwealth Bank head of bond and interest rate strategy Martin Whetton said the move would “tighten” the difference between where state government and federal government bonds and swaps were trading.

By narrowing the prices at which buyers and sellers would engage in the bond market, Mr Whetton said the RBA’s action would “allow for these markets to function in such a way that issuance can recommence in the near future”.

The semi-government bond purchases take the total amount of bonds bought under the week-old RBA program to $15bn.

As the coronavirus crisis grips the federal and state governments, treasury corporations will have to tap markets for hundreds of billions of dollars in extra cash to fund stimulus programs.

Westpac chief economist Bill Evans said the government bond supply would balloon by $250bn, which would take the amount of outstanding government debt securities to an $820bn market — about 40 per cent of the size of the Australian economy.

“The stock of government securities on issue is set to jump, mirroring the cumulative budget deficit for the two years to 2020-21,” Mr Evans said, noting he expected the deficit to reach $90bn this year and $160bn the following year.

State governments, which were already loading up on debt amid ambitious infrastructure programs, have also unveiled their own multi-billion-dollar stimulus programs, which will need to be funded at a time when stamp duty revenue is crashing due to a looming slowdown in the housing market, GST revenue is sliding as consumption dives, and payroll tax is haemorrhaging as unemployment soars. Ahead of the coronavirus outbreak, global ratings agency Standard & Poor’s had questioned whether the states would be able to maintain their credit ratings if they were forced to borrow any more funds.

The RBA on Friday said it had opened the temporary currency swap deal with the US Federal Reserve to provide additional US dollar liquidity worth $US60bn to the local financial system to “lessen strains” in global US dollar funding markets.

The RBA plans on weekly auctions of up to $US10bn, but does not believe there is an urgent need for US dollar funding from the local banking sector, which is more likely to on-lend the financing.

The lifelines have been opened up amid a global rush on the greenback as the coronavirus crisis spirals out of control, as companies around the world race to draw down credit lines to stay afloat because business operations have been frozen by governments attempting to stall the spread of COVID-19.

At the same time, investors are liquidating their positions out of global equity and bond markets, further fuelling demand for the greenback and driving down rival currencies, such as the Australian dollar, which has crashed to an 11-year low.

The currency swap line allows the RBA to swap Australian dollars for US dollars, which will then be made available to local financial organisations when the central bank conducts its repurchase agreements, known as repos.

“Our banks don’t really need US dollar funding at the moment,” one financial markets source told The Australian. “They’ve got a lot. As the currency has come down they’ve got a lot of US dollars. If they get any out of the auction it would be to on-lend.”

On top of access to the swap line, the RBA has provided banks with a $90bn funding pool to lend to small business, and Scott Morrison has earmarked $15bn to be injected into the residential securitisation market. Along with Australia, the Federal Reserve has set up swaps that will operate for at least the next six months with eight other central banks.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout