Australia’s exports to China hit new highs

New data shows the elevated price of resources continues to undermine China’s trade retaliation.

Exports to China hit a record in the first three months of the year as strong demand for iron ore continues to more than offset Beijing’s strikes on coal, wine, lobster, timber and barley.

The total value of goods exports from Australia rose 20.7 per cent to $US33.7bn ($44.36bn) in the first quarter of the year, according to data released by China’s customs agency.

Exports in March were $US13.2bn, the highest monthly total ever. China’s exports to Australia for the three months to the end of March were up 50.5 per cent at $US14.1bn.

The elevated prices of iron ore and liquefied natural gas — the two biggest exports to China — has undermined the campaign of economic punishment President Xi Jinping’s regime has waged on the Morrison government.

Australia’s ambassador in China, Graham Fletcher, last month said the lack of impact of the trade restrictions had contributed to the ongoing “stand-off” between Beijing and Canberra.

“The total impact on the economy, and on [Australian] government policy frankly, is not delivering the result that China wanted,” Mr Fletcher told the Australia China Business Council at a briefing.

Beijing’s trade strikes — which Mr Fletcher described as “deliberate coercion” — began with an 80 per cent tariff on Australian barley exports, imposed weeks after Foreign Minister Marise Payne last April called for an independent inquiry into the origins of the coronavirus without forewarning her Chinese counterparts.

The barley tariff was followed by the suspension of licences for six beef abattoirs, the imposition of a 200-plus per cent tariff on wine that priced the industry out of what had been its biggest market, the banning of timber after Chinese officials said they had detected pests in Australian cargo, and a blacklisting of lobsters and coal that has never been made official.

Australia had been the dominant supplier of coking coal to China, the world’s biggest steel maker.

Beijing’s ban on coal — which had been Australia’s third-biggest export to China, worth $14bn in 2019 — has increased the cost of the steelmaking ingredient for its local industry.

“It just shows the extent to which China is prepared to pay a price itself to make a political point,” Mr Fletcher said.

According to numbers by China’s customs, no Australian coal has entered China this year.

Despite reports that copper concentrate had also been blacklisted, China’s official numbers show the metal has continued to enter the world’s second-biggest economy. Industry in China has been concerned that copper from Chile — the world’s biggest producer — may be disrupted by a wave of coronavirus in the South American country.

The China Iron and Steel Association met on Tuesday to discuss the high costs of its resource inputs. Australia is China’s main supplier of iron ore, which continues to trade without interruption.

That meeting came a week after Mr Xi’s top economics adviser, Liu He, discussed the increase in the prices of bulk commodities with officials.

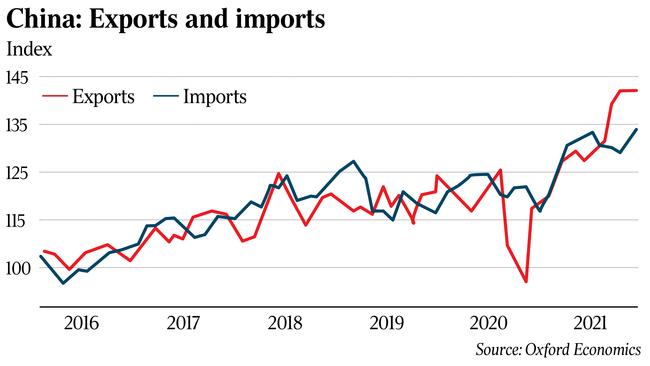

China’s total imports in March rose 38.1 per cent from a year earlier to $298.4bn, after rising 22.2 per cent in January and February.

China customs spokesman Li Kuiwen said rising commodity prices had helped push up China’s imports in the first quarter.

“Overall speaking, there are many positive factors but external challenges have not diminished,” he said.

Oxford Economics said demand for commodity imports was likely to decrease in coming months.

“Infrastructure and real estate investment should decelerate after the strong growth seen last year, amid a slower expansion of credit to these sectors, reflecting the authorities’ efforts to keep macro leverage generally stable,” the forecaster said.

The new trade numbers show the deep complementarity between resource-rich Australia and China, its biggest trading partner.

They come after new analysis by the Lowy Institute’s chief economist Roland Rajah found most Australian industries caught up in China’s trade campaign had been able to offset much of their lost income by finding new markets.

The lobster industry, which sold more than 90 per cent of its product to China, and the country’s most China-exposed winemakers have felt the most pain.

“Our friends had to bite the bullet,” China’s deputy head of mission at its Canberra embassy, Wang Xining, told a separate Australia China Business Council function in February.

State-controlled tabloid the Global Times this week said the Morrison government had “sent bilateral relations into a free fall” with “incessant provocations”.

“With Chinese buyers drifting away from Australia, shunning Australian products, we are surprised to see those Australian politicians come up with different gimmicky stunts — such as launching WTO complaints, seeking assistance from its allies to counter China, or vowing a diversification push to look for another market like China’s — but they always refuse to reflect on its past deeds that harmed China’s national interests or hurt Chinese people’s feelings,” it said.