Australian business urged to use Hong Kong as gateway to mainland China

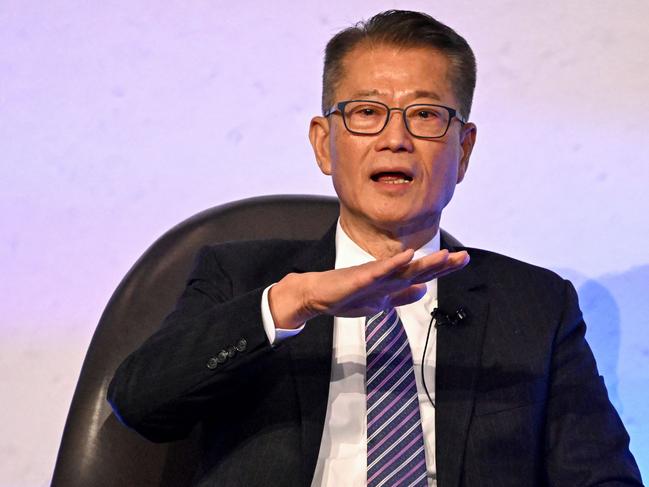

Hong Kong’s financial secretary, Paul Chan, has urged Australian companies doing business in China to consider listing on the Hong Kong Stock Exchange.

Hong Kong’s financial secretary, Paul Chan, has urged Australian companies doing business in China to consider listing on the Hong Kong Stock Exchange.

Mr Chan said Australian companies should also see Hong Kong as a gateway to selling into the China market, and encouraged Australian tech and start-ups to also consider the city as a place to develop their business.

Speaking at a business lunch in Sydney on the developments in Hong Kong as a financial centre, Mr Chan said Hong Kong did not compare itself with Singapore as a place to do business, but “benchmarked” itself against New York as one of the world’s major financial capitals.

He said listing in Hong Kong would provide Australian companies with access to investment capital from mainland China.

Mr Chan said Hong Kong was the location of 13 of the world’s top 20 banks as well as most of the world’s major fund managers and asset houses, and was an ideal place for Australian companies to raise money to help finance their business operations in China.

“Institutional investors in Hong Kong will better understand the purpose of your fund raising and where the money will go.”

Mr Chan said there were increasingly sophisticated channels for capital flows between China and Hong Kong.

The Hong Kong Stock Exchange had 2700 listed companies compared with Singapore’s 600.

Its stock exchange had a much larger market capitalisation than that in Singapore, while daily turnover was more than 10 times that of the Singapore exchange.

“It is a different ball game,” he said. “We don’t benchmark ourselves against Singapore, we benchmark ourselves against New York.”

Mr Chan has spent a week in Australia speaking to business groups as part of the Hong Kong government’s program of pitching itself to the world after its years of closure due to Covid.

Answering a question from the floor at the lunch in Sydney, Mr Chan acknowledged there were “geopolitical issues” which had made investors more wary of Hong Kong in recent years, a reference to increasing control over the city by Chinese authorities.

Concern about falling foul of legislation in Hong Kong and sensitivity about any criticism of China has seen many expats leave the city, and companies and family offices look to Singapore as their Asian financial centre.

Mr Chan admitted there were times when “geopolitics works against us (Hong Kong)”. But business people around the world were able to distinguish business from politics.

“All politicians have their domestic politics to care about, but business people think differently. They think about the business opportunities and the longer-term economic prospects.”

Mr Chan said Hong Kong’s proximity to mainland China was a major asset, with China contributing a third of Asia’s economic growth.

“There are tremendous opportunities in Hong Kong,” he said.

“The value proposition is about business and lifestyle and business opportunities with the mainland.”

Mr Chan’s meetings this week included speaking with Reserve Bank governor, Michele Bullock.

He met representatives of fintech industry organisation, FinTech Australia, as well as several Australian fintech companies including those involved in payment services, digital assets, green fintech, and regulatory technology.

Mr Chan said Hong Kong also offered Australian businesses proximity to the Greater Bay area which took in Hong Kong and southern China which had a population of 87 million people with a per capita GDP of almost $US40,000 ($59,000).

He argued that Hong Kong also had a better lifestyle than Singapore and also had “freedom of speech”.

Hong Kong had more than 4500 start-ups, with 20 per cent of them with founders from outside of Hong Kong.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout