$90bn infrastructure blowout threat to Australia’s ‘big build’

Australia’s biggest infrastructure projects are facing collective blowouts of more than $90bn over the next decade, in a tidal wave of red ink that threatens government plans across the country.

Australia’s biggest infrastructure projects are facing collective blowouts of more than $90bn over the next decade, in a tidal wave of red ink that threatens the “big build” of governments across the country.

It comes as the Albanese government is expected to shortly finalise the outcome of the independent review of its $120bn infrastructure pipeline, announced at the start of May.

Governments across the country face a budgeting nightmare that may extend debts and stretch budgets as they try to make good on the infrastructure promises of their predecessors.

That $90bn blowout figure is an estimate based on The Australian’s analysis of publicly available information on some of the country’s biggest infrastructure projects, now worth more than $190bn – just a small portion of the massive state and federal government infrastructure packages on the horizon.

AMP Capital chief economist Shane Oliver said the spending blowout on infrastructure projects was “going to get worse before it gets better”, citing high labour costs, strong demand in the construction sector and an ongoing shortage of building materials.

Some, like the troubled Inland Rail project, are likely to be scaled back as government budgets are squeezed.

On Sunday, Infrastructure Minister Catherine King’s office could not provide an update about the infrastructure review, which was due at the beginning of August.

Analysis shows that Australia’s so-called megaprojects, collectively costed at about $100bn when announced over the past decade, are now likely to cost almost twice that if and when they are finally delivered.

Inland Rail is by far the biggest ticket item on the list, with its $31bn estimated completion the product of internal estimations by the Australian Rail Track Corporation, only revealed in April after the publication of Kerry Schott’s review of the troubled project.

NSW Premier Chris Minns faces a tough task to rein in spending on Sydney’s rail projects, after launching a review of the Sydney Metro West and Metro City and Southwest projects, amid claims they could come in late and as much as $17bn over budget.

Victorian Premier Dan Andrews has faced more scrutiny than most Australian political leaders about the state of his budget. Victoria’s “big build” – a key factor in Mr Andrews’s electoral success – includes major blowouts to the West Gate tunnel, to the Metro rail tunnel.

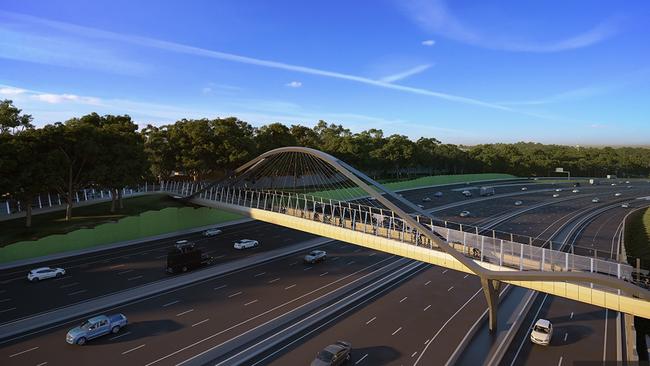

But perhaps the biggest is still to come, with the North East link road project currently tipped to come in at $16.5bn, more than $10bn above the initial $6bn cost estimate.

Dr Oliver also expected major projects to be curtailed or scrapped entirely, such as Victoria’s withdrawal from hosting the 2026 Commonwealth Games, to rein in cost overruns.

“Some of the upwards pressure on building materials is slowing but there are still price rises going through,” said Dr Oliver, highlighting such moves from James Hardie and Boral last week.

“The basic problem is there is a big pipeline of work to be completed in the construction and building industry, so the level of activity is still pretty high. Wages growth is also still accelerating.

“The demands from unions are still hefty. That’s been highlighted in the Fair Work Commission’s 8.5 per cent increase in the minimum wage and 5.75 per cent for award this year. That has a signalling effect that workers often try to go for more.”

But Dr Oliver said seeking higher pay increases in the construction sector could be a short-term gain for workers, particularly as the economy slows.

“The bottom line is we still have an unemployment rate at 3.5 per cent, so it’s an environment where workers can demand higher wages in many cases. But it could come at a cost down the track because some of these projects might end up getting cancelled.

“So you might be paid more now but then the problem swings around and becomes one of higher unemployment and tougher times in the construction sector. For now though the pressure is still on the upside.”

But Boral chief executive Vik Bansal said he was yet to see a single cancellation of an infrastructure project. His company is one of the biggest suppliers of concrete and asphalt.

“It might be slowing down, particularly for planning reasons. But I’ve not seen a single major project being cancelled. They’re all there. And our customers are telling us the (infrastructure) pipeline is full,” he said.

He expects a fundamental shift in the type of infrastructure projects that will get funding in the future.

“Our view on that is that we do believe the infrastructure will go on, but a fundamental change will happen. It will go from what I call high-profile engineering jobs to social infrastructure. Governments will have to spend a lot of money on housing, hospitals. And I think that’s the change I’m pretty confident is going to happen in the next 12 to 18 months”.

Transport and energy projects make up the bulk of the current spending on mega infrastructure projects.

One of the highest-profile projects is the Snowy Hydro 2.0 expansion, which was originally slated to cost only $2bn. Snowy is still to disclose the full extent of its blowouts at the project, but industry estimates tip the likely cost at around $10bn.

In Queensland, it was revealed earlier this year that the Cross River Rail project’s cost had blown out from $5.4bn to upwards of $6.3bn, and its opening delayed until 2026. Even South Australia faces an eye-watering blowout bill, with the most recent figures on Adelaide’s North South corridor road project suggesting a total cost of $15.4bn – $6.5bn more than its initial cost when announced.

Politicians and contractors have been quick to blame the impact of tight global supply chains and disruptions from the Covid-19 pandemic for the latest round of blowout confessions.

The fact that there are only a few tier-one contractors capable of bidding on the mega projects is another factor.

Pointing at the blowouts at Snowy 2.0, and the collapse of local engineering firm Clough, the chief executive of one mid-tier contractor said the move to government megaprojects – rather than smaller packages tendered separately – had allowed the international majors to “squeeze in both directions” – by forcing subcontractors to discount on their own bills, and holding governments to ransom over unfinished work.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout