$6bn coronavirus hit expected for tourism, mining and education

Coronavirus is expected to deliver a $6bn hit to Australia’s economic growth this year, according to the first independent modelling.

Coronavirus is expected to deliver a $6bn hit to Australia’s economic growth this year, according to the first independent modelling of the impact on tourism, education and mining.

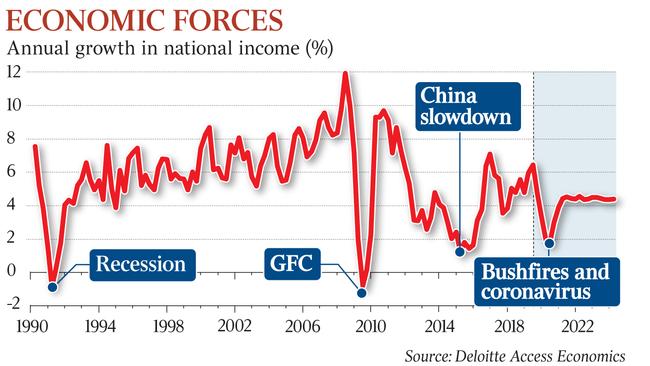

Analysis from Deloitte Access Economics reveals the economic impact of coronavirus would equate to a 0.3-point fall in growth if the outbreak were contained by July. Modelling to be released on Friday warns that the health crisis will likely gouge $1.8bn from the budget, leaving little wriggle room to deliver a surplus in May.

With business investment falling 5.8 per cent across 2019, and recording the worst quarterly result since September 2016, Treasury teams are running scenarios assessing wider impacts across the economy. Josh Frydenberg’s $5bn surplus has already been hit by an immediate cost of $500m for bushfire recovery.

The local sharemarket dived for a fifth day on Thursday, while the Australian dollar dropped to its lowest value since the global financial crisis and government bond yields hit record lows. The modelling undertaken by Deloitte Access Economics looked at two scenarios on the length of time that travel bans would remain in place.

It concluded a cost to the economy ranging from $5.5bn to $5.9bn in 2020. This eclipses the broader economic impacts of the bushfires, which are estimated to be under or close to $1bn.

“It is fast-moving but if you say that the most likely thing is that travel bans stop in mid-April and things have settled a bit by mid-2020, then the final outcomes would be that the loss to national income is between $5.5bn and $5.9bn,” said Deloitte Access Economics partner Chris Richardson.

“It’s a big figure but we are a bigger economy and (it) needs to be put in the context of a $2 trillion economy. The main thing is the human and health cost but the economic cost is not evenly borne … tourism, education and mining are where the pain and potential pain is.”

On Thursday, Citi lowered its end-of-year GDP forecast to 1.7 per cent in 2020, flagging a significant impact in first-quarter economic growth. Using scenario and modelling analysis, Citi lowered its first-quarter GDP forecast and estimated growth would contract by 0.1 per cent.

Mr Richardson defended the government’s move to manage expectations around the budget surplus but said Australia was better positioned than most other countries to absorb the impacts.

“The direct loss to the budget from coronavirus is $1.8bn … it is not too bad,” he said. “It says the sounding of potential retreat (by the government) was the right thing to do to manage expectations because it could get worse.”

Mr Richardson said while Australia’s economy was already weak, it wasn’t “spectacularly weak”.

The Deloitte Access Economics modelling was calculated on gross national income, which takes in the total income to the economy including from overseas sources, as opposed to gross domestic product.

Despite the slowdown fuelled by coronavirus and the bushfires, the economy is still estimated to be in a better position than during the global financial crisis in 2008-09 or the early 1990s recession.

The last comparable fall in national income of this level was the 2014-15 China slowdown.

Citi senior economist Josh Williamson said the Reserve Bank might be forced to cut interest rates below its historically low levels to deal with the impact of coronavirus. “A fiscal policy response would be the most effective way to negate the negative demand side behavioural shock, particularly if the shock lasts for longer than expected,” he said.

“While the virus alone won’t cause the RBA to cut rates, it does add to downside risks.”

.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout