Tabcorp’s decision to launch a strategic review of its business is expected to trigger private equity interest for its more lucrative lotteries arm, say sources.

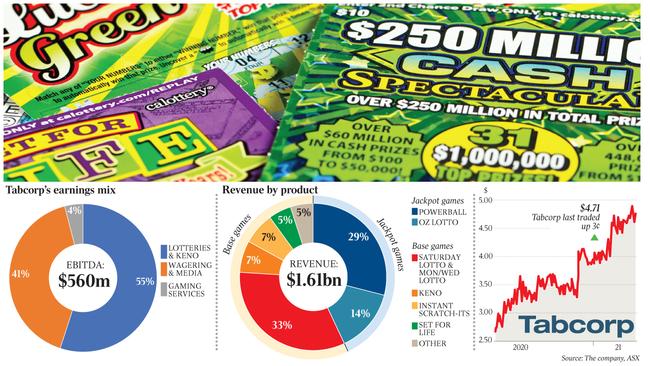

The lotteries division contributed 55 per cent of Tabcorp’s earnings for the six months to December and saw its earnings increase more than 5 per cent during the global pandemic. The lotteries unit has always been seen as Tabcorp’s jewel in the crown.

Tatts Group’s lotteries arm was subject to a takeover bid by a consortium comprising Kohlberg Kravis Roberts, Macquarie Group, Morgan Stanley Infrastructure and First State in 2017 before all of Tatts was acquired by Tabcorp.

In recent months, suitors have only made approaches for the wagering and media division of Tabcorp based on the assumption that Tabcorp would never be a seller of lotteries. But with a strategic review underway, some believe that will change.

As expected, Tabcorp announced on March 29 that it would undertake a strategic review to assess and evaluate all structural and ownership options to maximise the value of its businesses to shareholders.

The company added that these options could include a potential sale of the wagering and media business or a demerger. It comes after Tabcorp received several approaches for its wagering and media business that valued the unit at about $3bn, a valuation Tabcorp said was inadequate.

Among the parties to have made offers for wagering and media are Apollo Global Management, Labrokes owner Entain and a consortium headed by former Sportsbet and BetEasy boss Matthew Tripp.

Sources say Mr Tripp has been in discussions with private equity firms, with some suggesting that CVC Capital Partners is working on a tilt for the business.

The Australian reported earlier that Mr Tripp had discussed with the company a plan to run the Tabcorp wagering arm and merge the division with the ASX-listed Betmakers data and technology business.

Fox Corporation, headed by billionaire Lachlan Murdoch, is also thought to be around the hoop, but the move is to explore how Fox, which has the FOXBet brand, can leverage its media assets rather than involve itself with wagering.

The strategic review is expected to take at least ten weeks. Shareholders have been lobbying Tabcorp to carry out a demerger since last year after expressing frustration over the company’s performance since it led an $11bn merger with Tatts in 2017.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout