Tabcorp is understood to have opted to move forward with a strategic review to consider a demerger of its wagering and media unit, with an announcement on the transaction due as early as Friday.

The $10bn betting company is understood to have received at least three bids for the business from the start of the year.

The market expected Tabcorp to make an announcement on its plans for the division when it delivered its half-year results last month.

However, while delivering results, Tabcorp said its board would take time to consider relevant issues and strategic options that arise in respect of the proposals.

Shareholders have been lobbying Tabcorp to carry out a demerger of the business since last year, after expressing frustration over the company’s performance since it led an $11bn demerger with Tatts in 2017.

The hope was that Tabcorp’s management could boost the performance of the Tatts wagering unit, but the turnaround and integration of the business has taken longer than most had anticipated.

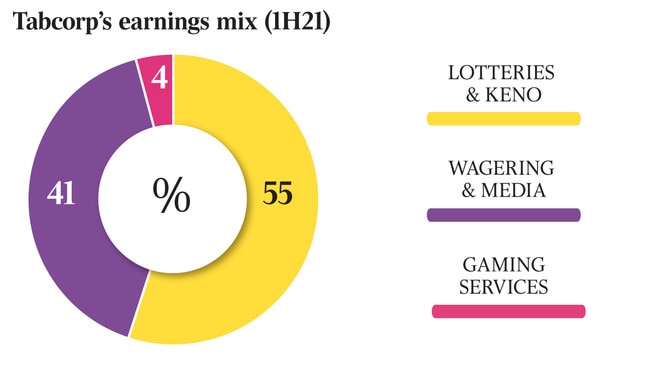

Some fund managers take the view that lotteries — considered the jewel in the crown — should be split from wagering, but the dilemma is where to put the Tabcorp gaming operations.

The parties that have made bids for parts of Tabcorp include British-based betting company Entain, which owns Ladbrokes, Apollo Global Management and digital betting pioneer Matthew Tripp alongside a private equity firm, thought to be Blackstone.

Apollo, advised by Gilbert + Tobin and Jefferies, put forward a cash bid for all components of Tabcorp except its lotteries division that was understood to be worth between $3bn and $3.5bn.

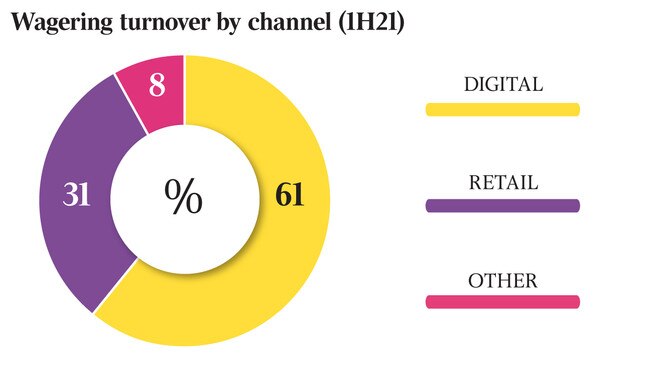

Entain, advised by Morgan Stanley and Macquarie Capital, offered $3bn cash for the Tabcorp wagering and media division, while keeping the door open for a potential alternative partial scrip offer.

The understanding is that the Tabcorp board has aspirations to achieve a price of at least $3.5bn for the wagering and media unit.

Tabcorp, advised by UBS, handed down a $185m net profit last month for the six months to December, down 7 per cent, as it wrestled with lockdowns amid the global pandemic.

Entain chief financial officer Rob Wood in London said in the past week that an acquisition of Tabcorp’s wagering and media unit would be highly compelling.

Entain was confident of navigating regulatory hurdles for an acquisition, a turnaround of the business and achieving strong revenue and cost synergies, Mr Wood said.

But he said the highest hurdle was gaining approval from the Tabcorp board.

While Entain is seen as having solid credentials to run the Tabcorp unit, a plan to buy the wagering arm may face opposition from the Australian Competition & Consumer Commission.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout