Private equity has been back around the $7bn Woolworths spin off Endeavour Group as recently as just days ago, say sources, but the deal talks have gone cold amid volatile market conditions.

DataRoom understands the group on the scene was a private equity firm with executives on the ground in Australia.

It comes with talk of one of the industry’s best retail operatives being courted to run the business and separate speculation a party has been considering an acquisition of an Australian retail liquor business, which could suggest the buyout fund may have had a corporate carve out of Endeavour on its agenda.

However, it would be a complex transaction for Endeavour Group, where in Queensland bottle shops can only be operated with groups that have a commercial hotel liquor licence, meaning they need to be attached to a pub.

Endeavour’s share price has dived since February and is down 35 per cent since listing in 2021.

It is also without a chief executive following the announced departure of Steve Donohue in September, making it vulnerable to a takeover.

Chairman Ari Mervis stepped into the executive chair position but a search for a new chief executive is ongoing.

Sources have suggested former Walmart US boss Greg Foran has been approached by Endeavour Group’s key shareholder or other representatives about taking on an executive chairman position at the Dan Murphy’s liquor store and pub owner.

Mr Foran recently resigned as the Air New Zealand chief executive and finishes up later this year.

He was previously a top executive at Woolworths Australia before he moved to the US after missing out on the chief executive role and is known to have close ties to former Woolworths chief executive Roger Corbett.

While approached, say sources, it is unclear whether Mr Foran would be keen on the job.

It is understood he has also been courted for top retail chief executive roles in the United States.

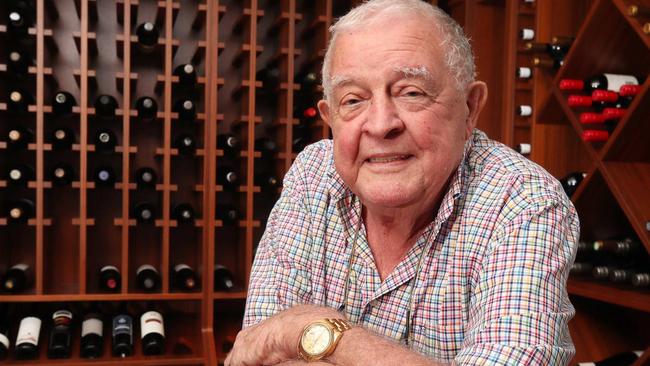

Mr Corbett is also close to billionaire publican Bruce Mathieson, who is known to be frustrated with the performance of Endeavour Group, including the length of time that was being taken to find a new chief executive.

Mr Mathieson also owns a 15 per cent stake in Endeavour Group after his private pub operations he jointly owned with Woolworths (an 85 per cent holder), ALH, were spun out of Woolworths and listed as a new business, Endeavour.

Some take the view he may see a solution around Endeavour as more urgent to recover losses and redeploy the money into Star.

The Endeavour share price is now about $3.98 with its market value at $7bn, half the price it was at when it was listed in 2021 and below its $8 peak.

It leaves Bruce Mathieson Group about $1bn less off, based on the price, and comes after the publican, whose son, Bruce Mathieson Junior served as a director, has previously agitated for boardroom change to improve performance.

However, his chosen lieutenant, Bill Wavish, was not voted on to the board.

Endeavour is also expected to face the consequences of more heavy regulation on gambling given most of the pubs in the hotel and liquor business generate profits from poker machines.

John Wylie and BGH Capital

The chatter coincides with the emergence of John Wylie on the scene at Endeavour, a former investment banker turned investor who has a way of turning up just as corporate activity starts to heat up around embattled companies, with Boral and Healius being two examples.

Meanwhile, another possible chief executive candidate is David Bortolussi, the chief executive of a2 Milk and held in high regard by its board.

When Endeavour was being demerged, The Carlyle Group, Apollo Global Management and Melbourne-based BGH Capital all showed interest.

The cashed up BGH is headed by TPG Capital executives Ben Gray and Simon Harle and ex-Macquarie Capital boss Robin Bishop.

It was understood to have revived its interest after that time, and some believe it could make sense that it was back around the hoop.

It looked at the KKR business Australian Venue Co when it was up for sale in 2023.

Endeavour’s retail liquor operations are a category killer, and a demerger of Endeavour’s pubs has previously been discussed.

Previously working for Endeavour has been Citi and Jarden, while the Mathieson family has used Luminis Partners.

Endeavour has Australia’s largest liquor store network under the Dan Murphy’s and BWS brands.

Overall, it has the largest portfolio of licensed hotels with a network of more than 1675 stores and 344 hotels.

For the six months to December, Endeavour booked a 15 per cent fall in net profit to $298m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout