Jemena suitor lines up acquisition of stake in $5bn gas business

One prospective buyer has dropped out but another is starting to look increasingly likely as it progresses towards an acquisition of Singapore Power’s 40 per cent stake in Jemena.

One prospective buyer has dropped out but another is starting to look increasingly likely as it progresses towards an acquisition of Singapore Power’s 40 per cent stake in Jemena.

The broadcaster has confirmed it is back in active talks with Paramount’s Network Ten about a sale of its regional television assets.

Paladin Energy’s $1.3bn acquisition of Fission Uranium is facing a delay with shareholders slow to register to vote on the deal.

A government-owned bank created out of Australia Post is understood to be back on the agenda.

Tabcorp is another company that will likely see a newly appointed chief executive move to tap the market following a disappointing result on Wednesday.

Dental care chain Pacific Smiles proved on Wednesday why the company was so sought after in a recent takeover battle, after more than doubling its underlying net profit to $8.5m.

Private equity owners of MPC Kinetic are trying to stage an exit, six years after considering a float.

Locally listed miner Yancoal may try to snap up the $US3bn Kestrel coal mine from its private equity owner, EMR Capital.

A sale of BGH Capital’s cybersecurity business, CyberCX, is possibly further off now as its most likely buyer, Telstra, has other priorities.

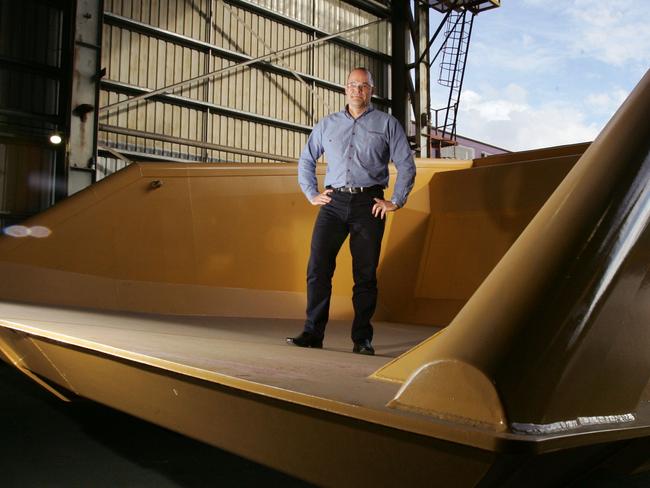

Perth-based Austin Engineering has made no secret of its appetite for acquisitions, clearly laying out plans in its full-year results.

Deal-makers are unsure who will acquire the commercial wine brands of Treasury Wine Estates after Pernod Ricard sold its Australian business to Bain Capital.

Speculation is mounting that Chris Ellison-backed Mineral Resources could be in talks with Japan’s Mitsui.

Investment bankers are getting busy on real estate sales for the troubled Elanor Investors.

A merger between IFM and ISPT has been a long time in the making.

After timing divestments nicely at the market’s peak two years ago, Pacific Equity Partners is keen for acquisitions.

A sale process could be triggered if Commonwealth Super sold its $2bn stake in the data centre operator.

The regional carrier may wind up as a break-up candidate, with its air ambulance service drawing interest.

First round offers are due soon for the SkyBus owner, with the British arm drawing particular interest.

Goldman Sachs has made a new hire, picking up one of Barrenjoey’s trading specialists.

Oaktree Capital Management is understood to be progressed on a deal to buy the Italian-backed accounting and financial firm AZ NGA for at least $600m.

Original URL: https://www.theaustralian.com.au/business/dataroom/page/25