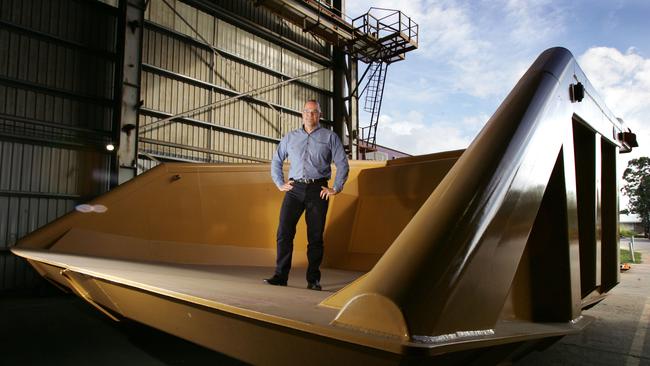

The Perth-based Austin Engineering has made no secret of its appetite for acquisitions, clearly laying out plans in its full-year results announcement on Tuesday.

The $360m listed company said in its presentation that it continues to assess potential strategic mergers and acquisition opportunities to improve its geographic capabilities, customer offerings, production capacity and product footprint, and continues to leverage its economies of scale.

The company said that the opportunities would be evaluated on their merits.

“There are currently no opportunities that Austin considers are sufficiently advanced to warrant disclosure at this time,” the company said in the statement.

Some questioned whether expansion opportunities in the US are on its agenda, but it is understood that Austin is also looking at opportunities in Australia as they arise.

It comes after a period of considerable consolidation among mining services companies.

Decmil was purchased by Macmahon Holdings, while Perenti purchased diamond drilling company DDH1 in the past 18 months.

Bids in for AirTrunk

Elsewhere, two bids went in on Tuesday for AirTrunk from suitors that were understood to be worth more than $20bn including debt.

The two bidders were Blackstone, backed by Canada Pension Plan Investment Board and advised by Deutsche Bank, Morgan Stanley and Citi, and Digital Bridge, leading a large consortium including Silver Lake, IFM and GIP, and advised by Barrenjoey and JPMorgan.

It is believed to be too close to call as to who will be the winner.

AirTrunk is owned by PSP, Macquarie Group and former Next DC executive Robin Khuda. It is one of the country’s most prized data centre companies at a time when they are in demand with the rise of artificial intelligence, with more than 1.4 gigawatts of announced data centre capacity across 11 sites and a pipeline for more.

It is considered the best-in-class hyperscale data centre platform for large cloud content and enterprise customers across the Asia-Pacific.

AirTrunk launched its first hyperscale data centre in western Sydney. The data centre company also has operations in Japan, Malaysia, Hong Kong and Singapore.