Unis sell assets as Covid bites

Signs are emerging of the financial pressure Australian universities are facing from the pandemic-inflicted travel restrictions on international students.

Signs are emerging of the financial pressure Australian universities are facing from the pandemic-inflicted travel restrictions on international students.

Sportsbet chief commercial officer Andrew Menz is understood to have departed the company.

Perpetual could be shaping up as one of the next companies subject to corporate activity in the financial services space.

Some institutional investors that had earlier been keen to buy shares in copper miner 29Metals are cooling on the opportunity.

An outcome in the competition for the Commonwealth Bank’s $1 billion general insurance business could be known within days.

Data Republic is understood to have attracted about 80 prospective buyers after it collapsed into the hands of administrator McGrathNicol.

Credit Suisse has replaced its ANZ co-head of investment banking, James Disney, with the recently recruited ex-Citi banker Dragi Ristevski.

When hyperactive fund manager Geoff Wilson chooses the ticker code WAR for his new strategic opportunities fund you know he means business.

Chemist Warehouse is set to tap ASX-listed cloud-based communications provider, Whispir, to fulfil Australia’s biggest e-prescription rollout.

Alumina’s franking credit balance is a perennial issue for shareholders.

Spanish conglomerate CIMIC Group is back yet again at the doors of shareholders in Devine, hoping to finally take full control.

Speculation is once again mounting that Matthew Tripp is moving closer to lobbing a formal offer for Tabcorp.

Investment banks testing market interest for an IPO of Property Exchange Australia are believed to be forging ahead for a potential listing next month.

The Australian Investment Council, says there was $27bn of funding fire power as of June last year in the private capital sector for future transactions.

Investment bankers are believed to be again testing interest in Challenger’s funds management operation Fidante Partners.

Analysts believe Silk Logistics is worth between $209 million and $251 million including debt as they release research ahead of a planned IPO in July.

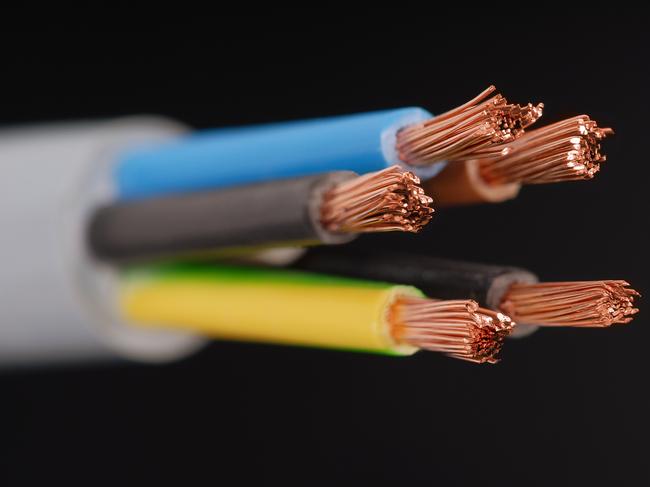

The drawcard for investors when it comes to buying shares in the upcoming float of 29Metals is the surging price of copper.

IOOF could be about to put some of the assets on the market it has inherited from the NAB as part of its $1.4 billion MLC acquisition.

There is that a private aged-care provider is soon to hit the block and some are pointing to the Melbourne-based Blue Cross owned by the Eccles family.

Investment bank UBS has hired Tim McKessar to lead its telecommunications, media and technology banking team.

Original URL: https://www.theaustralian.com.au/business/dataroom/page/191