Talk is once again mounting that Matthew Tripp is moving closer to lobbing a formal offer for Tabcorp.

There is further talk in the market about a proposed merger between Tabcorp and Betmakers mooted by Mr Tripp.

Mr Tripp owns a sizable stake in Betmakers, with about 92 million shares including his performance rights.

A merger deal could see his entire interest in the company worth about $192m based on Friday’s closing share price for Betmakers of $1.50.

Suggestions are that the former Sportsbet and EasyBet boss has been carrying out soft soundings to the market about a nil premium merger since The Australian broke the news in March.

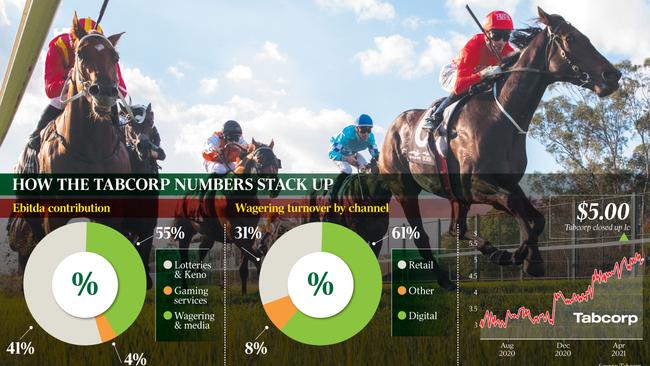

It comes after Ladbrokes owner Entain made a $3.5bn proposal to buy Tabcorp’s Wagering and Media unit for $3.5bn and Apollo Global Management put forward a $4bn offer for all of the company excluding the lucrative lotteries arm.

Tabcorp’s board is currently carrying out a strategic review with help from adviser UBS, and the outcome is expected to become known around the end of June.

One option on the table is a demerger of the Wagering and Media unit.

Parties are circling Tabcorp after discontent has been building amongst shareholders over the company’s performance since Tabcorp led an $11bn merger with Tatts in 2017.

Before the merger, the so-called ‘Pacific Consortium’ including Kohlberg Kravis Roberts, Macquarie Group, Aware Super and Morgan Stanley Infrastructure Partners made a $6bn bid for Tatts.

At that time, Ladbrokes was lined up to take the wagering arm.

Some believe another all of company takeover attempt makes sense, although the lotteries arm would be a big bite for any player and Macquarie is not thought to be currently working on a deal.

Mr Tripp is working with investment bank Goldman Sachs, say sources.

The Australian earlier reported a deal between Tabcorp’s wagering division and the $1.2bn data and technology Betmakers business could unlock $5bn in value for shareholders.

This year, Mr Tripp reached a strategic advisory and shareholding deal with Betmakers as part of a $75m raising.

Mr Tripp is understood to have made a bid for Tabcorp over the Christmas period after Steven Gregg had been appointed the company’s chairman.

However, it is understood that the offer was rebuffed.

Some Tabcorp shareholders have backed a spin-off of the wagering and media arm to be headed by Mr Tripp.

With respect to Tabcorp’s strategic review, chief executive David Attenborough, who was expected to retire, will stay on throughout the review and will not step down until it has a more certain future.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout