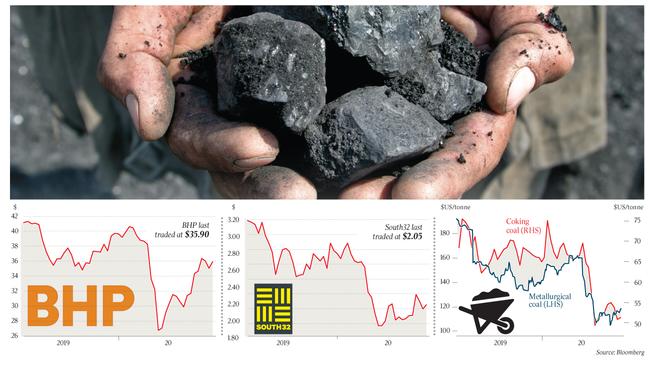

Dealmaking activity in the coal and nickel mining arenas is thought to be gathering pace, with Peabody Energy, BHP and possibly South32 all ramping up asset sale plans.

It is understood that Peabody Energy is now well into the first round of its sales process for its north Goonyella underground coal mine in Queensland that was first placed up for sale through Credit Suisse around March, as reported at the time by DataRoom.

It is now understood that first-round bids are due next month after the process was temporarily paused amid disruptions linked to COVID-19.

Peabody is understood to have attracted strong interest for the mine in the early stages of the process, with groups including New Hope and Whitehaven Coal likely to have at least taken an information memorandum.

The North Goonyella underground mine is 160km west of Mackay in Queensland and its coking coal is exported through the Dalrymple Bay Coal Terminal south of Mackay.

Production stopped at the mine in 2018 due to a fire at what is the company’s highest-quality mine.

The year before, it produced 2.9 million tonnes of coking coal, but Peabody has signalled no meaningful volumes for three or more years, with development coal to be produced in the second half of the year.

There have been suggestions it could fetch about $300m, but much of this depends on the view surrounding how hard it is to extract the coal following the 2018 fire.

Any buyer will have to pay a considerable amount for capital investments.

That asset is for sale as BHP has long been known to have JPMorgan and Macquarie Capital working on a potential sale of the $US2bn ($2.9bn) Mount Arthur coal mine in NSW and the 33 per cent interest it holds in the Cerrejon Colombian mine.

Macquarie Capital and JPMorgan were hired in the past two years for a potential sale, as earlier revealed by this column.

It will be interesting to see if private equity lines up for some of the assets, with interest in the space said to be brewing with buyout funds.

Last year, BHP was understood to be hesitant to sell its coal assets to private equity, but in the current tougher economic environment it may have changed its position.

While coal mines remain out of favour with investors who are wary about their impact on the environment, and also lenders who are hesitant to offer finance, they still generate a lot of cash, hence the appeal to some private equity funds.

Meanwhile, the spotlight remains on South32 — not just as a potential takeover target for Andrew Forrest’s Fortescue Metals, as suggested by Citi analysts in the past week, but for its plans surrounding its Cerro Matoso nickel mine in northern Colombia.

Some say a sale of that mine — thought to be worth more than $1bn — would not come as a major surprise.

While nickel is in favour by investors due to the use of the commodity to make batteries, the nickel at Cerro Matoso is of a different variety, used more for stainless steel.

Challenges for South32 include the fact that the mine is far away from its Australian base and that it has not been a strong performer in the portfolio.

BHP, meanwhile, is understood to have put highly anticipated plans for a sale of its Nickel West mine in Western Australia off the agenda and is investing more into nickel deposits.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout