The contest to buy a stake in Commonwealth Bank’s $3.3bn Colonial First State wealth manager is understood to have been a two-horse race between US-based private equity funds Blackstone and Kohlberg Kravis Roberts.

KKR won the contest, say sources, with CBA announcing on Wednesday that the US-based buyout fund had purchased a 55 per cent interest in the business for $1.7bn.

It is understood that KKR was closing in on the business just before the onset of COVID-19.

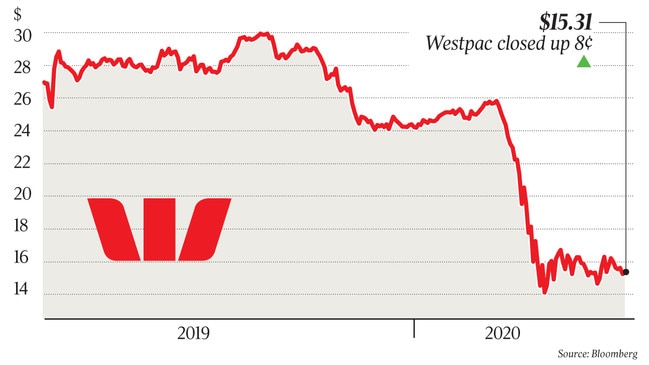

It now begs the question whether Blackstone will aggressively vie for other wealth assets up for sale by Australian banks, or whether the latest deal places KKR in a stronger position to consolidate the market further, buying NAB’s wealth manager MLC or wealth management assets expected to be on offer by Westpac.

Some believe that both buyout funds only wanted to acquire part of the business because $3.3bn was an amount too large to allocate to the Australian market alone.

It is understood that Affinity Equity Partners had also shown interest in CFS, as did other buyout funds some time ago.

KKR tapped Bank of America to advise on its acquisition of the $1.7bn stake of CFS, which has $130bn of assets under management and offers investment, superannuation and retirement products to individuals as well as to corporate and superannuation fund investors.

CBA was advised by UBS.

The transaction values the wealth business at $3.3bn and will see CBA receive cash proceeds of $1.7bn, with KKR obtaining 55 per cent of the business.

The price of the deal equates to 15.5 times the business’s net profit of $200m.

CBA and KKR said they intended to undertake “a significant investment program” that would strengthen CFS “as one of Australia’s leading retail superannuation and investments businesses”.

The deal is the first major M&A transaction in Australia since the onset of COVID-19 and comes after private equity firms were said to be circling bank-owned wealth assets up for sale.

The US-based KKR owns an interest in Australian financial advisory and accounting firm Findex, which was considered to be an initial public offering candidate when conditions were more buoyant.

KKR was said to be making efforts to sell its interest in that business about two years ago.

As reported by DataRoom in March, Findex has been keen to secure more funds to take on wealth managers Netwealth and Hub Financial.

Findex in 2015 bought the Australian and New Zealand business of accounting services business Crowe Horwath International and in 2014, acquired Centric Wealth, which was previously run by former Wallaby captain Phil Kearns.

It comes as other major Australian banks look to sell wealth assets, with NAB’s MLC on offer and wealth management assets owned by Westpac are expected to be placed on the block.

The latest transaction has also been announced after CBA in 2018 sold the bulk of Colonial First State Global Asset Management to Mitsubishi UFJ for $4.2bn.

It sold its insurance businesses CommInsure Life and Sovereign to AIA for $3.8bn in 2018, along with TymeDigital and Count Financial.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout