Fresh from attempts to buy Healthscope and Navitas, BGH Capital is believed to have turned its attention to Commonwealth Bank and National Australia Bank.

Speculation is mounting BGH Capital is scrutinising NAB and CBA’s wealth management operations, which have been earmarked for sale or demerger.

The thinking is that NAB’s $4 billion MLC business is the most compelling target for BGH, although the remaining wealth management arm of CBA is also of interest. CBA last year sold Colonial First State Global Asset Management to Mistubishi UFJ for $4.13bn.

It comes at a time Australia’s largest banking institutions are moving to focus more on their core banking operations and divest supplementary operations such as wealth managers as they face more scrutiny and regulation after the finance industry royal commission.

Private firms such as Hellman & Friedman are already said to be circling banking operations.

BGH counts one of Australia’s top former financial services bankers, Robin Bishop, among its partners. That adds weight to talk BGH remains in the market for both operations. However, a sale of MLC could be some time away, given the additional work needed on the business to position it for divestment.

BGH Capital is poised to buy education provider Navitas for $2.1bn but is thought to have walked away from its other target, Healthscope. A $4.1bn bid was made last year but rejected.

On the smaller side, the group is also understood to have put its hat in the ring for New Zealand ice cream brand Tip Top.

Market analysts said it made sense BGH remained in pursuit of major opportunities after raising $2bn over a year ago. It is yet to make a large acquisition.

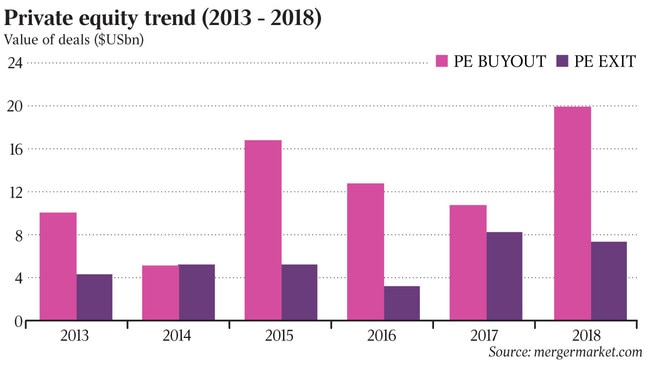

The Australian private equity industry is considered a fierce battleground of late, with some of the top industry players leaving well established firms to start competing operations.

BGH Capital comprises top executives from TPG Capital, including Ben Gray and Simon Harle, while former Carlyle Group Australian boss Simon Moore recently launched Colinton Capital. The management at reasonably new fund Adamantem Capital consists of former Pacific Equity Partners executives.

Many of the top names have gathered in Sydney’s Westin Hotel this week for the AVCJ Australia and New Zealand annual private equity and venture capital forum.

During a panel session yesterday some leaders in the industry discussed the growing prevelance of co-investment and the trend of sponsors co-investing with founders in smaller companies to enable a smooth transition towards a more institutional structure.

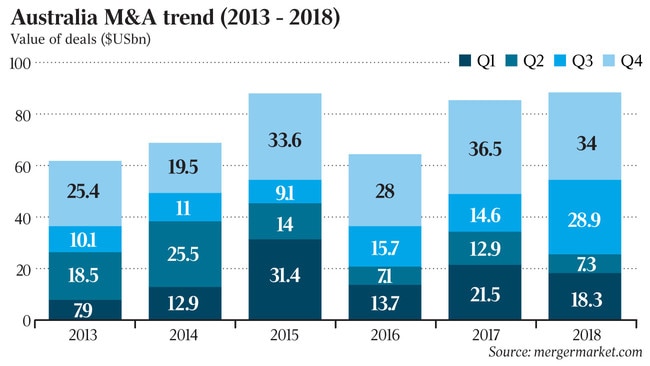

Last year Australia announced 583 mergers and acquisitions worth $US88.5bn, according to research from Mergermarket. That was less than the $US85.6bn the previous year. The value of domestic transactions almost doubled to $US50.9bn.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout