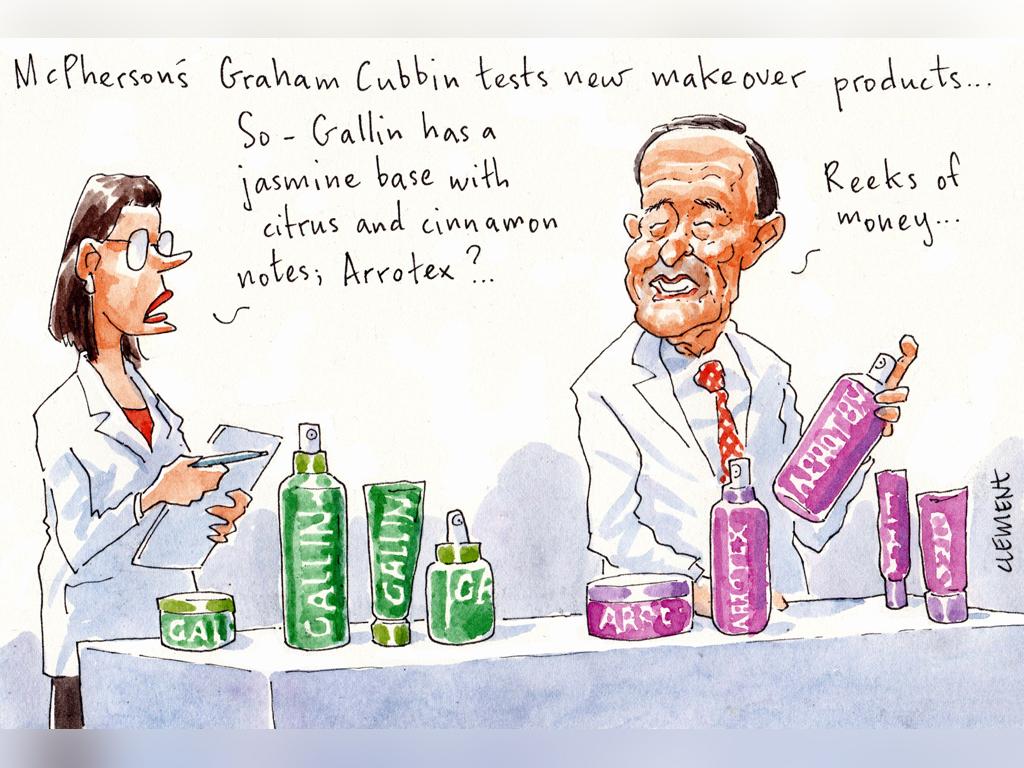

Geminder weighs up McPherson’s options as Arrotex bid lobs

Billionaire packaging mogul Raphael “Ruffy” Geminder is weighing up whether to continue his takeover bid for health and wellness company McPherson’s following the emergence of a higher offer from pharmaceutical player Arrotex Australia, or walk away and pocket a few million by selling the near 5 per cent stake in the company he has accrued.

On Thursday, Arrotex made an indicative offer of $1.60 per share for the 150-year-old company, a 19 per cent premium to the $1.34 a share bid from Mr Geminder’s unlisted Kin Group, rejected by the McPherson’s board as “utterly opportunistic”.

Days on from the offer and there has been nothing but uncharacteristic silence from Mr Geminder‘s deputy Nick Perkins, director of Gallin, the Kin subsidiary company through which the bid for McPherson’s is being made.

Mr Perkins had been enthusiastically urging shareholders to vote in favour of the $1.34 offer “without delay” while criticising the McPherson‘s board for ”disrespecting” shareholders by not releasing a trading update.

His recent lack of comment is all the more conspicuous for the fact that the McPherson‘s announcement coincided with a soft trading update that could easily be used to support his argument that McPherson’s “has lost its way and is in urgent need of reinvigoration” by an experienced businessman like Mr Geminder.

Sources say Mr Geminder’s team is quietly reviewing the trading update and considering whether it is worth entering a bidding war for McPherson’s by upping their own offer for the consumer products company.

The emerging view appears to be that Arrotex’s offer, which values McPherson’s at more than $200m, overvalues the company.

Having flushed out a superior bid, a more agreeable option could be simply to allow the Gallin offer to expire on May 10 and offload the accrued 4.95 per cent stake in McPherson’s for a quick profit.

Before making his offer in late March Mr Geminder amassed more than six million shares in the company, paying on average $1.28 per share.

The stock price has shot up since. If Mr Geminder sold around McPherson’s last closing price of $1.53, he’d make an easy $1.6m. If the Arrotex offer proceeded, he could make around $2m offloading his shares to them.

But that’s contingent on Arrotex emerging from its four-week due diligence process believing McPherson’s is worth $1.60 — something Mr Geminder’s people reportedly think is not a certainty.

On Friday Shaw and Partners analyst Jonathon Higgins cut McPherson’s from buy directly to sell on the “poor” trading update, despite the company trading below Arrotex’s offer price.

“The (Arrotex) bid is highly conditional with several conditions that are required to be met and there is no certainty the bid will be successful and go ahead,” Mr Higgins noted.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout