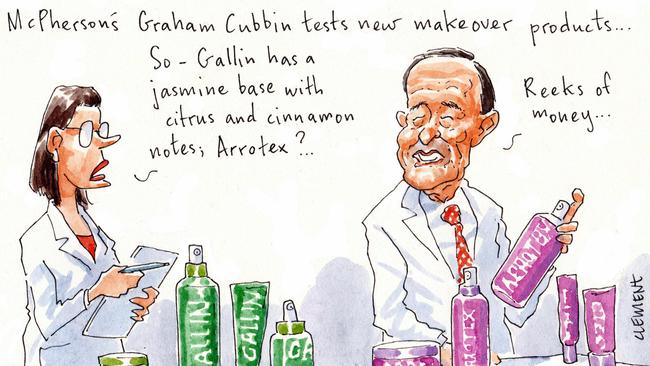

Raphael Geminder comes up against a big fish in fight for McPherson’s

If you think Melbourne billionaire Raphael Geminder has deep pockets, take a look at the international big gun that’s lined up in the fight for consumer goods and health group McPherson’s.

Welcome Arrotex Australia to the takeover battle for the 150-year-old McPherson’s, with the new player on the field a Melbourne-based outfit that’s ultimately jointly controlled by Canadian generic drugmaking giant Apotex and local millionaire Dennis Bastas.

Bastas, 54, who for perspective lives in a Toorak mansion that he bought for a bit under $17m almost a decade ago, runs Arrotex from its headquarters in inner-city Cremorne.

On Thursday Arrotex outbid Geminder’s $1.34-a-share offer via his private vehicle Gallin for the listed McPherson’s with a $1.60-a-share offer to take over the group via a scheme of arrangement.

Gallin’s offer had been rejected by the Graham Cubbin-chaired McPherson’s board, which on Thursday said it had agreed to grant Bastas, his numbers man and company director Andrew Burgess and the wider Arrotex team access to undertake due diligence towards moving the conditional offer forward.

The Arrotex bid values McPherson’s at $211m, while Geminder’s offer values the target at $177m, with the chairman of the listed Pact Group now under significant pressure to increase his bid to top that of Arrotex. Or walk away.

There’s plenty in the tank at Apotex, which is one of Canada’s biggest pharmaceutical companies. The group was founded by late Canadian businessman Barry Sherman, who with his wife Honey was found murdered in his home in 2017, the investigation of which remains ongoing.

At the time of his death, Sherman had an estimated worth of $US3.2bn with the battle for control of his empire between his children still unfolding.

Geminder, in the most recent edition of the The List, was estimated to be worth $1.18bn.

On the board of the local vehicle that ultimately owns Arrotex Australia is Apotex’s Canadian president and chief executive Jeffery Watson and businessman Alex Glasenberg.

Glasenberg is an Apotex executive who manages the Sherman family’s investments and is one of the trustees of the Sherman estate.

Unsurprisingly, Arrotex’s surprise offer was accompanied by a “highly confident” letter from its debt financier supporting the indicative proposal.

We expect it’s what Apotex might describe as a drop in a bucket.

McInnes’s rich exit

The breathtaking details of the monster $42m-plus potential package that retail billionaire Solly Lew is handing to new Premier recruit Richard Murray over the next six years got us wondering about what outgoing Premier Investments chief Mark McInnes walks away with when he exits later this year.

Melbourne-based McInnes, who turns 56 next week, started work as Lew’s chief lieutenant in 2011. Earlier this month he celebrating his 10 years at what is one of Australian’s most successful retail groups.

Premier Investments is now capitalised at $4.2bn.

McInnes, who was picked up by Premier after he resigned as boss of department store group David Jones amid a sexual harassment scandal, is walking away from a base pay of $2.75m a year at Premier, along with the potential for a short-term bonus of up $2.75m if earnings hurdles are met.

Indeed, the bonus can be even more if all-powerful Lew deems it appropriate.

So what will McInnes and his family live on?

After years of benefiting from Premier’s generous long-term incentive schemes, McInnes will exit with a holding of Premier stock comprising 982,100 ordinary shares, which he got for zero consideration in return for achieving performance hurdles. At Premier’s closing share price on Thursday of $26.27, those shares are worth about $26m.

Just by way of comparison, that’s more than the almost 11 per cent stake that Premier controls in ailing department store group Myer, which is now worth just $24.9m at Myer’s prevailing 31c share price.

With that sort of loot, it’s any wonder the departing Premier boss is looking to upgrade the $2.7m Sorrento holiday home he purchased with wife Lisa Kelly in 2014 after cashing in 400,000 Premier shares he held for $4m.

In February, McInnes, who with Kelly in 2017 spent $12.3m on a Toorak mansion, was an underbidder on the $22m sale of a cliff-top mansion in nearby Portsea.

Oh happy days.

Counting on refurb

We warned you earlier this week that the good men and women of the nation’s top accountancy body were up to something with their full-year accounts for 2020, but it seems there’s more that lurks beneath the group’s willingness to accept government handouts.

On a deeper dive into CPA Australia’s accounts, it has come to the attention of Margin Call that not only did the $7.4m in JobKeeper payments keep the lights on for the accountants, but that it did so while the not-for-profit outfit still had plenty of cash in the bank.

CPA logged more than $42m in cash and cash equivalents for the most recent year to December 31.

A lot of dosh for a not-for-profit group that’s run by members, but not quite as much as the $88.5m held at the end of the year before, attributable to the “purchase of investments during the year and higher deposits”, according to the report.

You see, as the organisation’s staff were encouraged to work from home during the pandemic, builders took up residence in CPA Australia’s Freshwater Place, Southbank headquarters in Melbourne, finessing a whole-of-office upgrade — the group called it an “exciting refurbishment”, including major structural works such as the installation of internal stairs.

How posh.

While details on the costs of the renos are scant, the group does note a $20.1m jump in the value of its property portfolio over the year to $31.1m, which it says relates to “property refurbishments carried out during 2020 and the addition of technology assets”.

JobKeeper and a new office to come back to. How nice.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout