Bidders for Blackstone’s $3.5bn Milestone Logistics Group are expected to find out if they have made the shortlist in the contest by early next week.

First-round bids were received by midday on Wednesday and the second round of the competition is due to finish around early April.

DataRoom understands that one of the strongest offers was from Singapore-based private equity firm GLP,said to be no higher than $4.5bn.

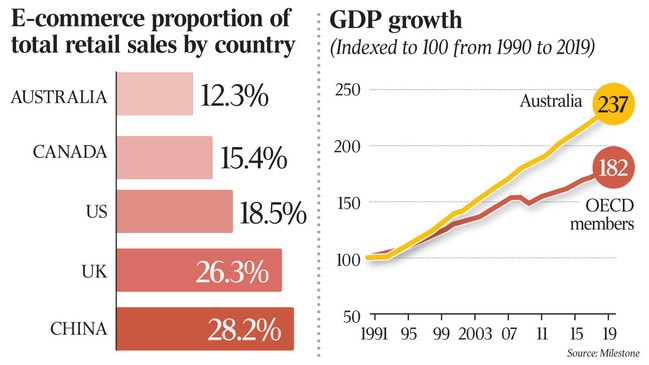

With about $US100bn of assets under management globally, the group was previously known as Global Logistics Properties and has tenants such as Amazon and JD.com.

After being listed, it was sold to a Chinese consortium in 2017.

The company is already known to Blackstone, having bought its network of US warehouses in 2019 for $US18.7bn.

Meanwhile, Australian real estate investor Charter Hall was understood to be off the pace, but the GPT Group was said to have put its best foot forward for the portfolio.

In total, there are believed to be about 10 parties that lobbed a first round offer. They are thought to include Australia’s ISPT and Singapore-based real estate investor Mapletree, along with Dexus Property Group, Logos property group, which is advised by Moelis, Warburg Pincus-backed ESR and Centuria, which is advised by Highbury Partnership.

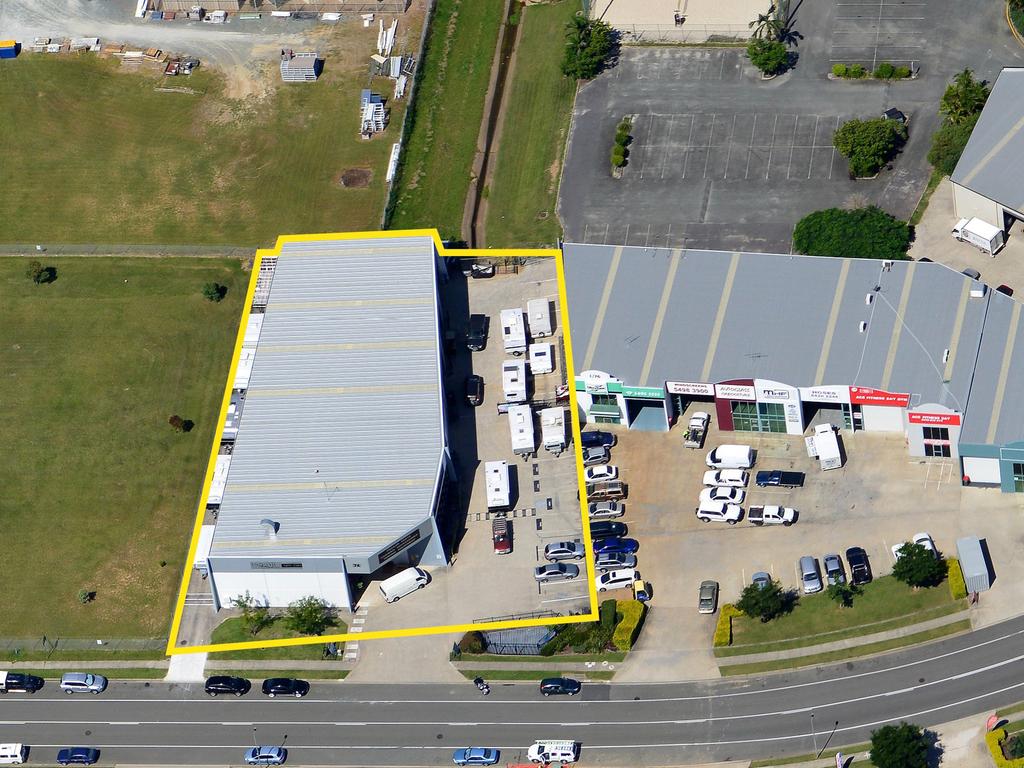

Logos is bidding for the Milestone portfolio after Qube announced on Thursday it had agreed to a deal with Logos to sell all of the real estate at its Sydney-based Moorebank Logistics Park for about $1.65bn.The Milestone portfolio of 45 industrial properties is understood to be worth about $3.5bn. It is being sold as part of a dual-track process, with Morgan Stanley and JPMorgan advising on the float and JLL and Eastdil Secured advising on sale plans.

Many in the industry are expecting knockout prices for trade buyers, which could mean that the portfolio sells for more than $4bn.

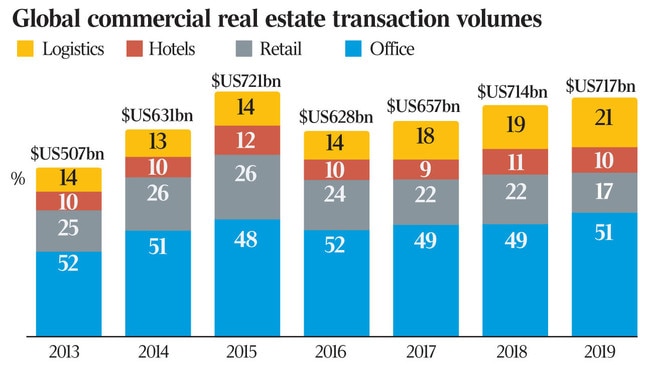

It comes as the sector remains in favour amid the global pandemic, with booming online shopping and low interest rates.

However, Blackstone is believed to be keen to retain a stake in the business, which could suggest an IPO is its preference. The marketing plans for the IPO will get under way in earnest next month, with Blackstone believed to be keen to sell down between $1.2bn and $1.5bn of the business.

Run by former AMP Capital real estate head Chris Judd and chaired by former Australian Morgan Stanley boss Steve Harker, Milestone Logistics has more than 90 tenants, including Woolworths, Lineage Logistics, Toll and WesTrac.

Elsewhere, Afterpay is expected to upsize its convertible bond raising to $1.5bn on the back of strong demand, say sources.

The buy now, pay later service provider announced on Thursday that it was raising at least $1.25bn by way of unsecured, zero coupon convertible notes due in 2026.

Working on the raise are Citi, Goldman Sachs and JPMorgan, while Highbury Partnership is also advising.

Proceeds are being used to increase its interest in the US-based Afterpay business to about 93 per cent from around 80 per cent.