Logos Property Group is understood to have hired Moelis as part of its efforts to buy Blackstone’s $3bn-odd industrial property company Milestone Logistics Group.

The move comes as the New York buyout fund runs a dual track process for the portfolio, with Morgan Stanley and JPMorgan working on plans for an initial public offering, slated to be between $1.2bn and $1.5bn.

Blackstone plans to retain about 45 per cent of the business, which owns a portfolio of 45 Australian assets worth about $3.5bn.

At the same time, JLL and Eastdil Secured are testing the appetite of portfolio buyers in a trade sale process that will see bids land some time at the end of March or early April.

The management roadshow for a potential float — first flagged by DataRoom last year — is expected to get under way after reporting season, following on from initial meetings with equity investors to test interest.

Logos, which is yet to finalise a deal to buy an interest in Qube’s $3bn-odd Moorebank Logistics Park, is believed to be vying for the business along with a long list of other contenders.

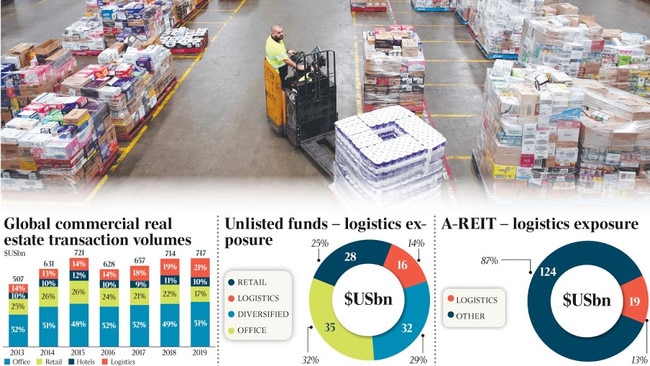

One source said that initially, there were 54 parties in the data room for Milestone Logistics at a time when warehouses remain in strong demand due to pandemic-fuelled online shopping and investors chase high-yielding opportunities amid low interest rates.

One of the other names that has emerged as an interested buyer is the Warburg Pincus-backed Asian investor ESR, based in Hong Kong.

Major Australian-listed commercial property investors such as GPT, Dexus, Charter Hall, Centuria, Mirvac, Stockland and potentially Goodman are also expected to be likely contenders, along with major local and global pension and sovereign wealth funds.

A challenge for international buyers could be opposition from the Foreign Investment Review Board, although some believe such a risk is low.

While many in the market believe that a float is the most likely exit option for Blackstone, which is keen to retain some exposure to the portfolio and will probably pay down debt, others believe that trade buyers will deliver knockout prices.

This is at a time of surging demand for industrial real estate and analysts believe that Blackstone will offload the portfolio for about $4bn on an enterprise value basis, making it out of reach for equity investors.

The equity value for the business — should it list — is expected to be between $2.7bn and $3.5bn.

Run by former AMP Capital real estate head Chris Judd and chaired by former Australian Morgan Stanley boss Steve Harker, Milestone Logistics has more than 90 tenants, including Woolworths, Lineage Logistics, Toll and WesTrac.

Centuria Industrial REIT trades on 17.5 times its net profit, but some say Milestone Logistics is a far superior portfolio.