An initial public offering is believed to be not the only divestment option now up for consideration by Chemist Warehouse, with suggestions in the market that the $5bn pharmacy giant is in talks with at least one suitor.

The company had earlier hired Rothschild to prepare the business for a listing late this year or next year, but now the thinking is that a sale is more likely than a float in a year in which the group’s retail sales have been booming and proving defensive against the COVID-19 pandemic.

Offering a lift to earnings has been higher-than-normal sales of toilet paper and other essentials, along with personal protective equipment such as face masks.

Chemist Warehouse generates about $250m of annual earnings before interest, tax, depreciation and amortisation, according to estimates from analysts.

Some believe a logical suitor for the business is Wesfarmers, which now has some of the most experienced private equity operatives within its executive ranks.

Wesfarmers is cashed up, having sold $2bn worth of shares in the Coles Group supermarkets business in February and March.

The Perth-based conglomerate is known to have been scouring the market for opportunities and many believe Chemist Warehouse remains a good fit within its retail division, which includes Bunnings, Target, Kmart and Officeworks.

Wesfarmers may be keen on trying to acquire the business at a time when other foreign suitors may struggle to embark on such an acquisition, given that the travel restrictions make on-the-ground due diligence a near impossible feat.

But at the same time, most Australian corporations are focused on ensuring that they can identify risks within their own operations and may not want the distraction of corporate activity. Still, global buyout funds are known to have been working hard to find acquisition opportunities.

Chemist Warehouse is also a highly entrepreneurial operation and might not operate well bound by the restrictions of a corporate environment.

Wesfarmers is also known to be keen to target companies with exposure to new technology as it positions itself for future growth.

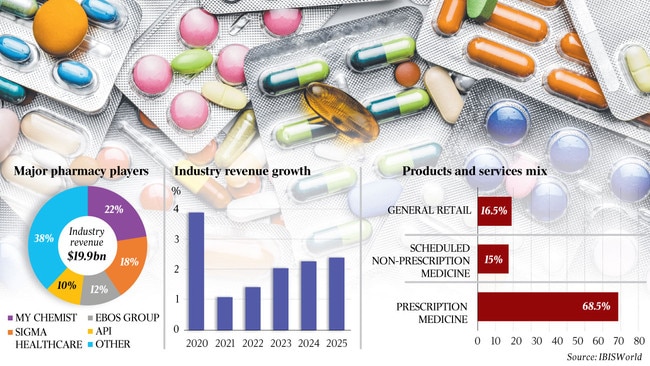

Chemist Warehouse is the country’s largest pharmaceutical retailer and is known in the past to have generated about $4bn in sales annually. It hired Rothschild after holding a beauty parade to appoint an adviser more than a year ago.

Macquarie Capital held investor education sessions about the business in 2017.

The Melbourne-based pharmacy chain is owned by My Chemist Retail Group and was founded by the Gance and Verrocchi families. It controls more than 300 pharmacies and has a complex ownership model that has enabled the business to work around the restrictive ownership rules.

A bid to avoid capital gains tax was said to be behind Chemist Warehouse’s move to wait until the fourth quarter of the year to embark on its IPO.

The company has undergone a restructure in preparation to be a listed company, but to prevent a major capital gains tax payment, it had to hold the business for more than 12 months.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout