Major energy investors are spoilt for choice when it comes to assets pouring onto the market, with a wide range of buyers set to line up for Partners Group’s $3bn CWP Renewables business in Australia, among others.

DataRoom revealed online on Friday that investment bank Macquarie Capital has been hired to explore a sale of the business for Partners, a Swiss private equity firm.

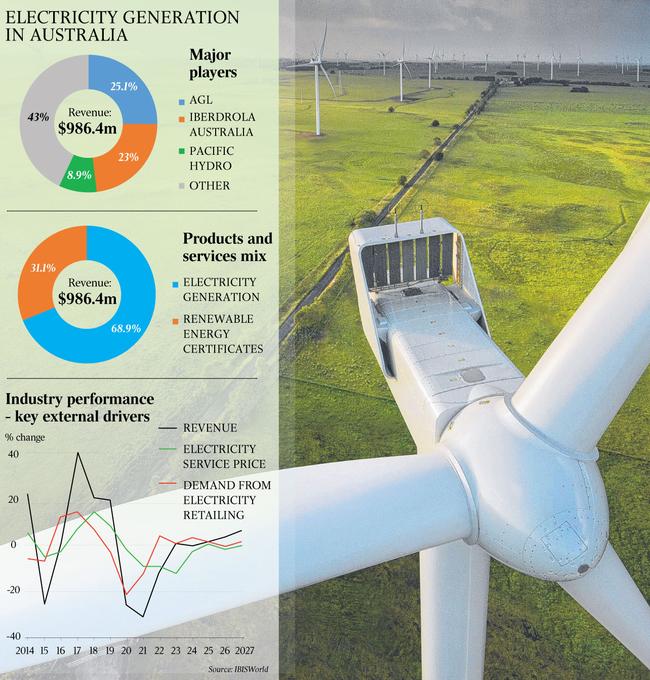

Meanwhile, some say it won’t be long until Pacific Hydro, which China State Power bought in 2015 for $3bn, also hits the market.

Others on offer include Alinta and Energy Australia, and suitors are putting their hands up to fund $500m towards the AGL Energy spin-off Accel Energy.

Buyers are expected to line up for AGL Energy after the coal-fired power generation part of the business, to be named Accel Energy, is demerged by June.

CWP Renewables is one of the largest renewable energy power producers in Australia.

In 2020, it merged with Grassroots Renewable Energy, which was established by Partners.

Sources believe that CWP Renewables is worth between $2bn and $3bn.

The company generates about 2000 megawatts of power through its Sapphire, Bango and Crudine Ridge Wind Farm assets in NSW, along with related solar and battery projects.

Australia-based CWP describes itself as a leading renewable energy developer, having already developed over 761MW of generation, valued at more than $1.7bn.

The company is ramping up projects ahead of the closure of the Liddell power station in NSW and other coal-fired generation assets, aiming to seize more energy market share.

Some question whether one of the buyers could be Australian listed gas pipeline owner APA, which has been looking to diversify away from gas.

It bid for the listed electricity owner Ausnet last year but was beaten by a Brookfield-led consortium with a $10bn offer.

Other traditional investors in the renewable energy space could line up, including Igneo Infrastructure Partners, Brookfield, Morrison & Co, Shell and Iberdrola.

APA may also be looking at assets owned by Alinta.

Chow Tai Fook is still believed to be assessing whether to break up Alinta and sell the business in parts or as a whole.

While the obvious part to offload is its Loy Yang B coal-fired power station, the challenge would be attracting a buyer at the right price at a time when the commodity is truly out of favour.

That could leave Plan B, involving a deal where Chow Tai Fook sells the remaining operation, obtaining Loy Yang B and running it down over time.

Other pieces of the business are its retail electricity operation, gas-related infrastructure, remote power in the Pilbara region and renewable energy assets.

The assets may appeal to the same sort of buyer as Brookfield, which recently bid for AGL Energy and planned to put its coal-fired power assets in another fund and wind them down.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout