Global construction materials provider Knauf is yet to officially fire the starting gun for the sale of its plasterboard operations in Australia.

But it could be a European group that takes out the operations.

Apparently Knauf has been in talks with a party from the continent that may have an interest in its Australian assets, potentially a group already known to the global plasterboard heavyweight close to its German base.

Bank of America has been hired to sell Knauf’s plasterboard factories in Australia, but the sales process has not yet started.

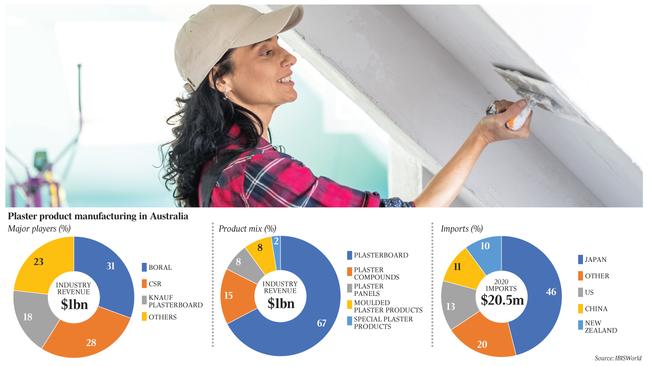

Boral had a plasterboard joint venture across Asia and Australia and New Zealand with USG, but Knauf bought out USG in a deal last year worth $US7bn ($9.7bn).

On offer are believed to be the assets that the family-controlled Knauf owned before it gained the USG plasterboard assets, along with its ceilings business, which is only a small part of the portfolio.

It is being forced to sell the assets it owned before the USG deal to appease the Australian Competition & Consumer Commission.

One reason for the holdup could be because Boral recently replaced its chief executive, Mike Kane, with Zlatko Todorcevski.

Mr Todorcevski is carrying out a strategic review of the country’s largest building materials provider that is due to conclude at the end of this month, and he may choose to recut another deal with Knauf.

It is understood the delay to the Bank of America process relates to further regulatory discussions, and under new management Boral could potentially propose to Knauf another way to please the competition watchdog, where it buys the Knauf operations and allows the European group to keep its other remaining USG operations here.

If that does not happen, the clock is then ticking for Knauf from a competition perspective, which makes it unlikely to be in a position where it can be too fussy about the price it achieves for the business.

The Knauf plasterboard portfolio is understood to have an asking price of about $400m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout