Australia’s largest online book retailer, Booktopia, was understood to be on the brink of pricing its initial public offering through a cornerstone process on Thursday, with the company shaping up for a market value of between $310m and $315m.

The IPO is expected to be about $40m.

Pricing will equate to five to six times forecast gross profit for the 2021 financial year of $56m. It is understood that the price of the float will be finalised by Friday after a management roadshow this week.

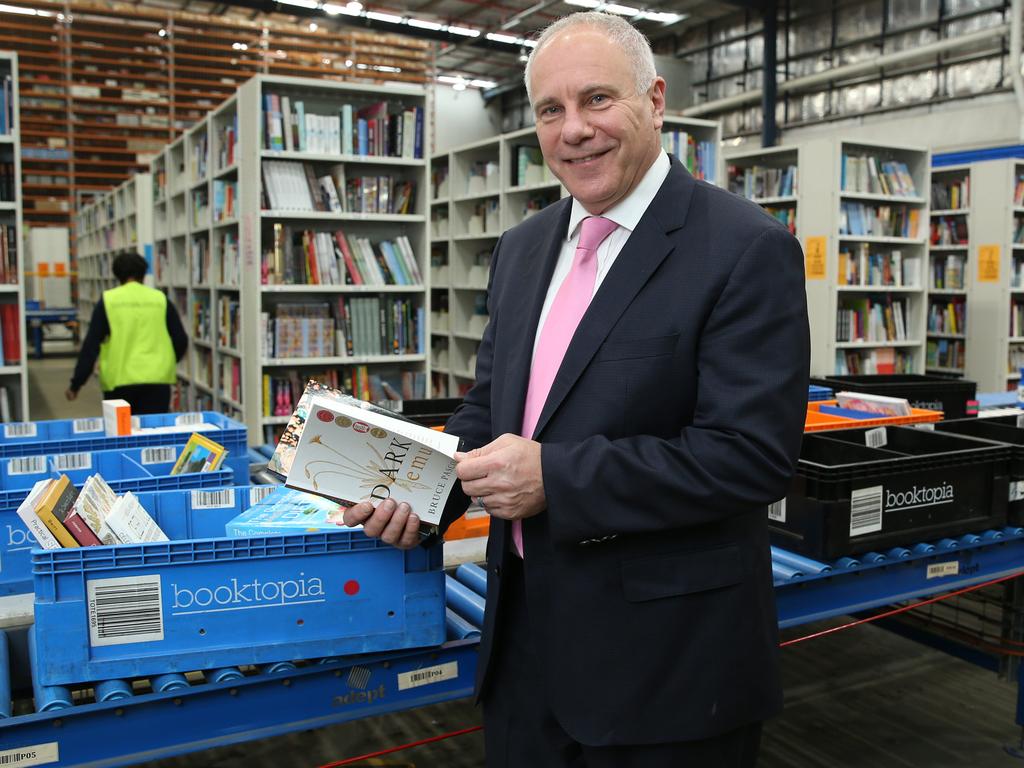

Chief executive and co-founder Tony Nash is expected to retain his stake and senior management and shareholders will stay on after the float.

For the 2021 financial year, the company’s revenue is expected to be about $200m.

Its prospectus is due out in November ahead of listing in December.

Booktopia is capitalising on the strong sentiment surrounding online retailers amid COVID-19. It made efforts to list in 2016, seeking to raise $40m to float with a $100m market value, but those plans were shelved.

Shaw and Partners and Morgans are working on the listing this time.

Sources said the online book retailer was modestly priced compared to IPO prospect Adore Beauty, which sells cosmetics online.

Adore Beauty gained a valuation of $635.3m, equating to 3.9 times its annual revenue, with a raft of well-known Australian institutional investors buying shares in the offer.

The largest investor is understood to be a US fund.

Meanwhile, Fantastic Furniture is currently conducting site visits for its planned IPO, with some saying the next two weeks will prove critical as to whether it can get a deal locked in by the end of the year.

The affordable furniture sector is booming amid the health crisis, with rival AMart Furniture apparently generating $100m of annual earnings before interest, tax, depreciation and amortisation. That business, owned by Quadrant Private Equity, is up for sale through Jefferies Australia.

Youfoodz is also popular with investors, as it carries out a management roadshow for its IPO. Advised by Bell Potter and Morgans, the fresh delivered meals provider plans to raise about $60m and hopes for a market value of about $200m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout