The eye-watering valuation for the initial public offering of online cosmetics retailer Adore Beauty may be good news for other online retailers hoping to float, like book retailer Booktopia that is carrying out investor meetings for its listing.

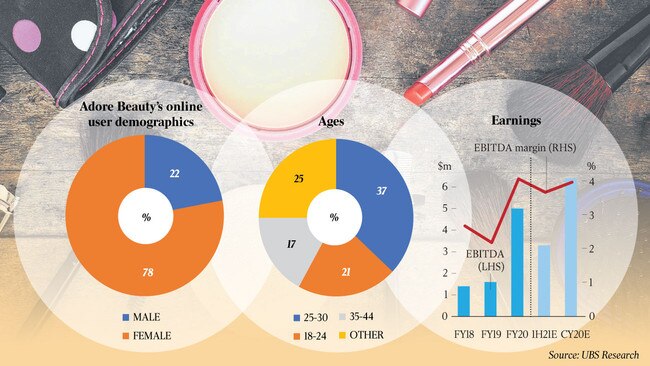

On Friday, Adore Beauty locked in a raise size of $269.5m for its IPO, with shares priced at $6.75 each, amounting to a price equating to 3.9 times its annual revenue and taking its market value to $635.3m — far higher than many expected.

The company, owned by founder Kate Morris and Quadrant Private Equity, will head to the boards on October 23 on a conditional basis through advisers Morgan Stanley and UBS.

Now it just has to prove that it can handle the transition to new management, with founders Ms Morris and husband James Height having less of a hands-on role as executive directors, with Tennealle O’Shannessy taking the reins as the chief executive.

While most doubt that Booktopia would achieve a 3.9 times revenue multiple, the strong valuation of Adore Beauty may help the company offer it a lift when it comes to its valuation prospects.

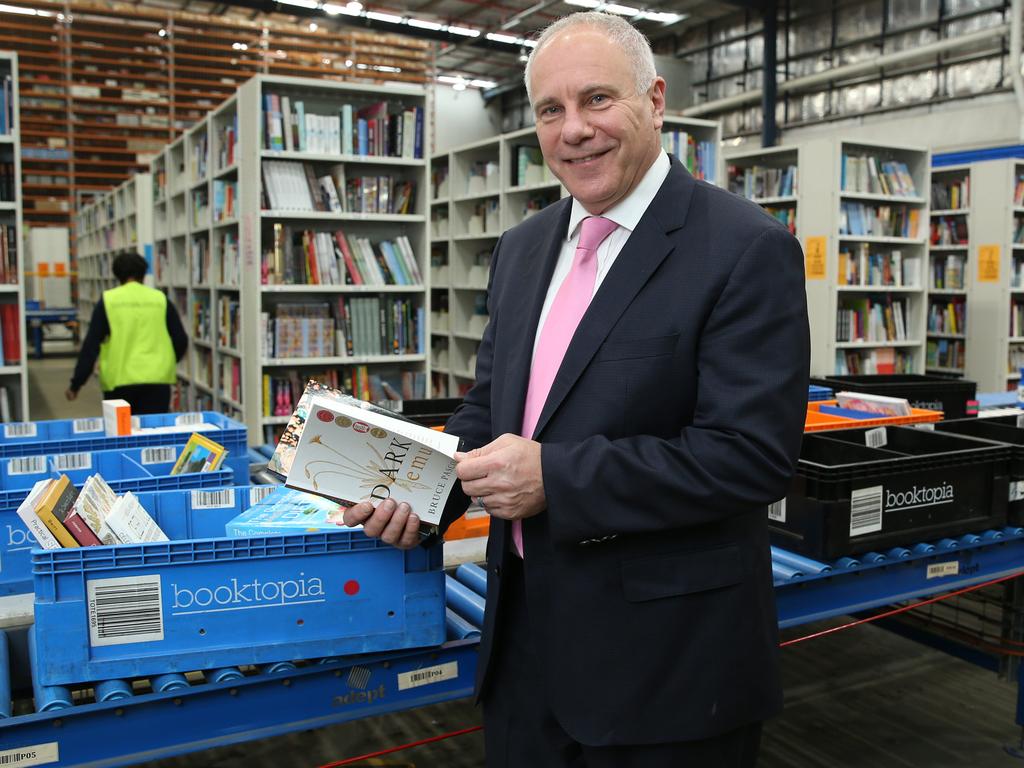

Booktopia is Australia’s largest online retailer and has an IPO scheduled for December through Shaw and Partners and Morgans.

Groups such as Booktopia and Adore Beauty have experienced soaring sales amid COVID-19, with the Booktopia sales staging a 28 per cent gain, topping $165m for the first time.

It made efforts to list in 2016, seeking to raise $40m to float with a $100m market value, but those plans were later shelved.

The pricing equated to 0.8 times forecast sales on an enterprise value basis.

At that time, the company was forecasting $104.5m in revenue for financial year 2017 and earnings before interest, tax, depreciation and amortisation of $2.1m.

Booktopia’s management team, once listed, will include Wayne Baskin, who is deputy chief executive and will be an executive director, and Geoff Stalley, chief financial officer.

Marina Go and Fiona Pak-Poy will be non-executive directors. The company is run by co-founder Tony Nash. Another co-founder includes Simon Nash.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout