CIMIC and Apollo Global Management are believed to be pressing ahead with plans for a float of their services business Ventia with price expectations of more than $3 billion.

It is understood that a beauty parade was held last week to select investment banks for the initial public offering which could happen towards the end of this year at the earliest.

Among the groups that pitched were Citi, JPMorgan, Credit Suisse, Morgan Stanley and Macquarie Capital.

Sources believe that Macquarie has already secured a role on the potential float by CIMIC, an Australian-listed construction and engineering firm, and private equity fund Apollo, but at least one other investment bank will also be on the ticket.

Macquarie Capital sold half of CIMIC’s stake in Ventia to Apollo in 2014 in a deal valuing the operation – then called Leighton Services – at about $1bn.

Both CIMIC and Apollo own about 47 per cent of the business and the remainder is held by management.

The hope is to secure between $3 billion and $3.5 billion for the business, and a selldown of about $1 billion is likely.

Services businesses have been out of favour but low interest rates and soaring commodity prices could see a shift in sentiment.

Ventia is a collection of services businesses previously owned by Leighton Holdings, now known as CIMIC.

It provides maintenance and management of critical public and private assets and infrastructure across the telecoms, transport, local government, water, power generation, electricity, gas, healthcare, education, resources and defence industries.

The float has been a long time coming, with both owners plotting an IPO as far back as 2018, as first revealed by DataRoom.

Apollo has been eager to stage an exit, but a sales process run in 2017 by Credit Suisse failed to eventuate in a deal.

CIMIC was believed to be in talks after that to buy back Apollo’s half of the business but the deal collapsed.

CIMIC was unhappy about having substantial debt consolidated on its balance sheet through an acquisition of Ventia.

Last year, there was talk that Apollo was weighing a potential deal where it bought Thiess in a joint venture.

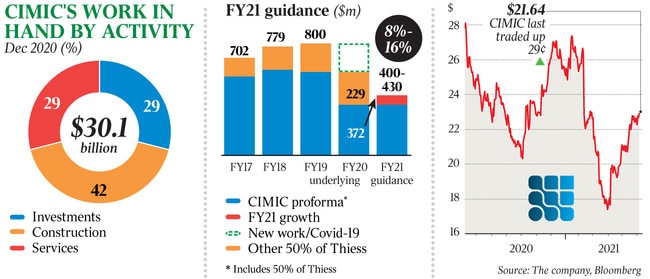

But CIMIC instead sold 50 per cent of Thiess to Elliott Advisors for about $2.2 billion cash in a deal valuing the entity at about $4.3 billion including debt.

Thiess is considered the industry’s best-in-breed. With the commodity cycle picking up, its challenge is that it services the out-of-favour coal mining sector.

However, CIMIC’s majority owner with about 73 per cent is Hochtief, which is controlled by Spain’s ACS, and the group remains under pressure to sell assets to pay down debt following the €6.5 billion acquisition of Abertis in 2018.

JPMorgan had been running a sales process for the world’s largest mining services provider. There has also been talk that Thiess has been targeting a listing, but first wants to make acquisitions to reduce the proportion of revenue generated from serving coal miners, a deterrent to institutional investors.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout