US-based private equity firm Apollo Global Management is believed to be in talks with construction company CIMIC about a potential acquisition of its subsidiary Thiess, which some estimate could be worth more than $3bn.

Investment bank JPMorgan is working on a sale of the world’s largest mining services provider at a time when the industry is consolidating and many large companies are looking to sell their mining services operations.

Other companies that could also be examining the business are Blackstone and South American competitor Sigdo Koppers.

Run by billionaire co-founder Leon Black, Apollo as of June had $US77bn of assets under management and is known to CIMIC. Already, CIMIC has sold the private equity firm half of its services assets, which is a joint venture called Ventia.

At the time, it also offloaded its former subsidiary John Holland.

Thiess offers underground mining capabilities across Australia, Botswana, Canada, Chile, Indonesia and Mongolia and across many commodities.

It is understood to generate about $500m in annual earnings before interest and tax.

CIMIC is believed to have been eager to sell Thiess for some time and the thinking is that it would have put the business up for sale earlier this year if it was able to sell at the right price.

Many of the companies in the mining services space need capital spending after limited cash injections over the past four years when limit commodity price growth suppressed activity among many clients.

Mining services providers sometimes struggle to gain the attention of buyout funds, given the slim margins in the industry and the fact many resources companies are bringing their service capabilities in house.

However, Thiess is considered the industry’s best in breed, and with the commodity cycle picking up, it could prove to be a lucrative investment for Apollo.

Private equity firms are also cashed up amid a low interest rate environment.

A large cheque from a sale of Thiess could be helpful for CIMIC at a time when upcoming tunnel projects would likely acquire more than $400m of capital spending each, with working capital now needed upfront on alliance projects. CIMIC counts tunnelling projects among its current activities.

In the pipeline for CIMIC is the Sydney Metro project, Parramatta Rail, the second Sydney Harbour Crossing and the Cross River Rail project in Brisbane.

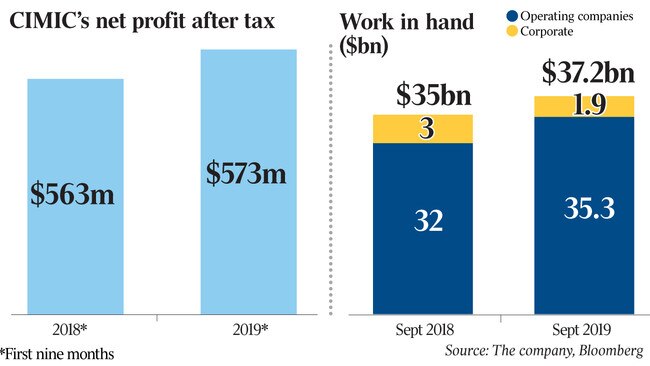

CIMIC’s cash position sits at $820m, according to its most recent accounts. Last year it was at $1.4bn.

The move to sell Thiess comes amid speculation that a privatisation of the remaining 27-odd per cent of the business could be on the agenda for CIMIC’s Spanish owners.

CIMIC, which was previously called Leighton Holdings, was subject in 2014 to a $1.2bn proportional takeover by Hochtief, which is controlled by Spain’s ACS.

With Lendlease soon to bow out as a competitor in the services and engineering space in Australia, the thinking is that it may mean perhaps it no longer has the same sense of importance to be listed.

In balancing that, some say with a weaker balance sheet, remaining listed would be an advantage in that it would help the company secure additional equity.

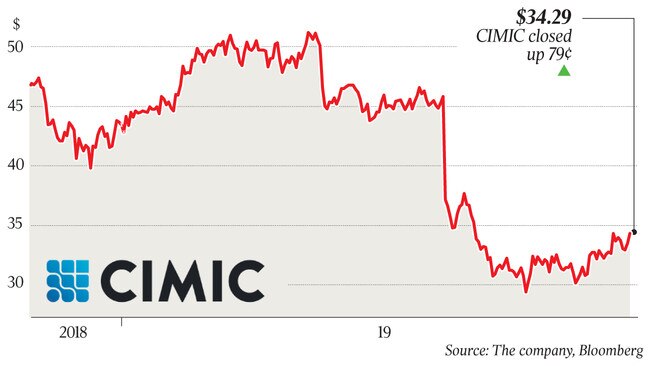

A decision to privatise the company, of which it owns 73 per cent, now makes sense, according to some, given CIMIC’s share price has fallen in the past year from $50, when its market value was $16.2bn, to about $34, with its market value now about $10.1bn.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout