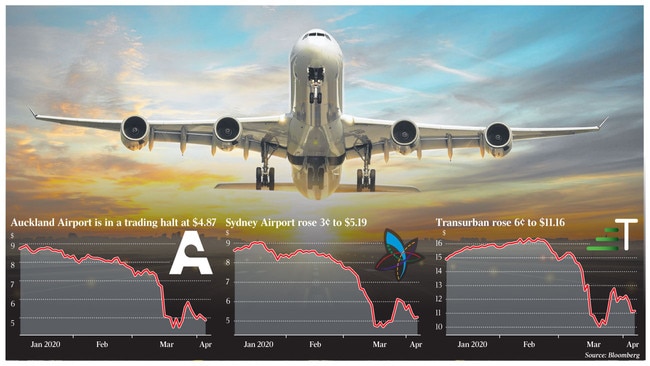

Sydney Airport and Transurban investors are now on watch for equity raisings in both companies after Auckland International Airport on Monday surprised some in the market by reaching out for at least an extra $NZ1.2bn ($1.17bn).

Citi, Jarden and Credit Suisse kicked off the equity raising that saw Auckland International Airport shares sold in a bookbuild to secure funds at between $NZ4.50 and $NZ4.66 a share. By the end of the day, the raise was covered at the top end of the range.

The market considers it a matter of when rather than if Sydney Airport and Transurban will tap the market.

The Auckland airport raise is not as steep as others — a discount of only 10.7 per cent to the last closing share price of $NZ5.04. This is because the airport has relatively low debt levels of about 25 per cent and has an A-minus credit rating, as it is government-backed.

Its main tenant is Air New Zealand, which is also supported by the government.

Some on Monday wondered whether it was an overreaction from Auckland International Airport, given that it now has enough funds to deal with COVID-19 disruptions until the end of next year.

But what would put the airport operator in a particularly disadvantaged position would be a situation in which it needed to again go cap in hand to investors, and the view is that the approach taken was a conservative one.

Auckland International Airport will be more severely restricted compared to Sydney Airport in the medium term.

Yet, market observers believe that a raise by Sydney Airport may not be too far away.

Sydney Airport has to have 51 per cent of its investors from Australia, which makes raising money freely more challenging, given it can’t call on Canadian pension funds or sovereign wealth funds to take large interests.

There are also rules that prevent airlines from tipping in funds.

It could embark on an entitlement offer, but not a placement, yet entitlement offers are harder to underwrite because they are more challenging for banks to price the risk.

Still, the raising on Monday was well supported because opportunities to secure exposure to good assets at a cheap price are hard to come by.

Toll-road operator Transurban, which this month tapped the bond market for €600m, could also raise equity, with declining traffic volumes due to COVID-19 disruptions.

But a raise could be more to do with building a war chest for overseas acquisitions rather than any balance sheet repair.

On its radar in the coronavirus aftermath could be toll-road assets in the US or the acquisition of the 50 per cent stake in the Sydney WestConnex toll-road network that it does not yet own.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout