Qantas is believed to have spent the past two weeks preparing for its $1.9bn equity raising, as speculation started swirling in the market that the COVID-19 pandemic could force the airline to slash up to a third of its workforce.

The number of staff cuts turned out to be 20 per cent, or 6000 workers.

The raising is the largest this year behind the $3.5bn raised by NAB and involves a $1.4bn share placement and a $500m Share Purchase Plan for retail investors, with shares sold at $3.65 each, a 12.9 per cent discount to their last close of $4.19.

Working on the deal are Macquarie Capital and JPMorgan.

Now the thinking is that Sydney Airport and Air New Zealand could not be too far away with a cash call of their own.

The news comes after DataRoom flagged on April 22 that an equity raising was on the cards for Qantas.

In March, Qantas had said a capital raising was not on the agenda, but many believed a move was inevitable, as its fuel hedging contracts put it on the back foot. However, Qantas maintains that the raise and the state of its contracts are unrelated.

It is understood that investment banks were officially appointed on Sunday. Luminis Partners, the financial adviser, has worked for Qantas since 2004.

Unlike other major equity raisings linked to COVID-19, in this instance, investors were not wall crosses for the deal in the days before it occurred.

The thinking is that Air New Zealand could raise around $NZ500m, with firms including Jarden, Forsyth Barr, UBS all involved, while KPMG has already been appointed to assist the carrier across the Tasman.

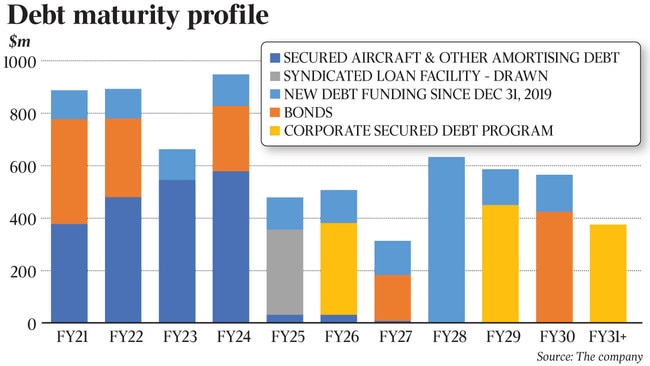

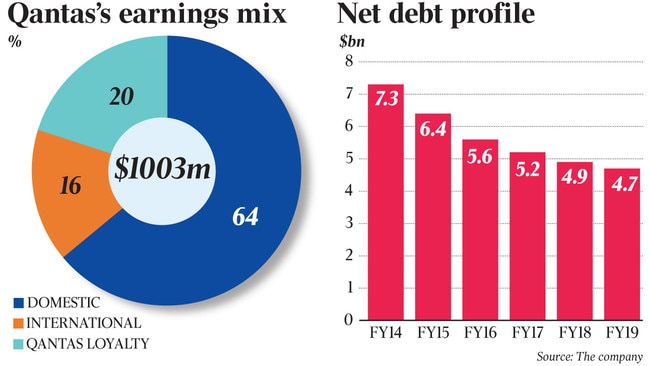

The raising by Qantas to strengthen its balance sheet takes the airline’s net debt to $4.7bn against a market value of $6.25bn. It has $3.6bn in cash.

Qantas chief executive Alan Joyce is prevented from taking part in the placement under ASX rules, but he will participate in the share purchase plan and has agreed to stay on to run the airline until 2023. He currently holds an interest in the airline of about 0.17 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout