Crypto, China risks abate despite sharemarket ructions over prospect of higher interest rates

Overnight Wall Street spent most of the session in positive territory, before dipping on the Federal Reserve’s rates call.

But at the same time, the immediate prospect of bitcoin leading a new asset class has been diminished by the sudden $US1 trillion ($1.4 trillion) losses suffered in recent weeks. Nevertheless the big New York institutions have a lot riding on bitcoin so, as I forecast last week, once the young margin traders had been sold out by their lenders and suffered painful losses, the institutions moved back into the market. They began pushing up bitcoin and other crypto currencies — exactly what they did last May when an earlier crop of young margin traders were sold up.

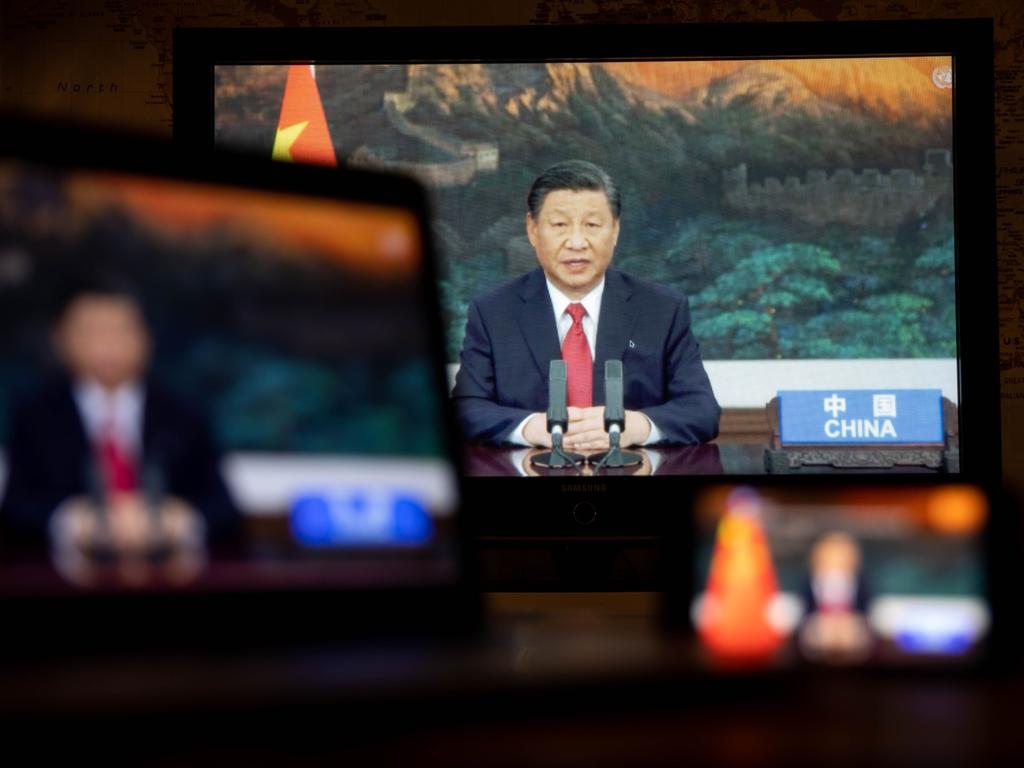

When China’s President Xi Jinping decided to make housing more affordable for the masses he encouraged the regulators to institute the so-called “three red lines” borrowing restrictions.

The “three red lines” defined strict thresholds on borrowing. They required a liability-to-asset ratio of less than 70 per cent; a net debt-to-equity ratio of less than 100 per cent and a cash to short-term debt ratio of one. These restrictions were not draconian for prudent developers, but for the high risk taking Chinese developers, they represented a benchmark way below current borrowing levels. And worse still they were backdated to 2020, leaving the developers in a precarious situation.

The first of the Chinese property developers to be unable to make those requirements was Evergrande. But then a series of other developers emerged also facing a crisis.

And once markets got wind of this looming disaster, money dried up and the process of takeovers and mergers, which is often used to enable those with liquidity issues to get out of trouble, was blocked.

No one would attempt a rescue takeover because inevitably it meant breaching the “three red lines”

The Chinese government faced huge property collapses which threatened to impact world markets because much of the debt paper had been issued in the US.

More serious for Xi Jinping, many middle class Chinese who had bought apartments “off the plan” would be left with half completed buildings. Some of the developments, where apartments had been pre-sold, had not even started and the developers could not raise the money to complete or start the buildings.

The potential social ramifications of this disaster suddenly hit the Chinese Communist party. And world capital markets feared a blow to add to the inflation-interest rate pressures.

When the Chinese economy hits difficulties they have a simple rescue formula — change policies as required and then harness the power of the state owned enterprises.

The South China Morning Post reports that the central government will now give cash-strapped property firms breathing space.

The regulators are excluding debt raised by a developer to acquire distressed assets of another home builder when calculating their compliance with the “three red lines”

That widening of the “three red lines” has encouraged more asset buying activity in the sector, so enabling state-backed companies to bail out those Chinese developers who were pushed to the edge of ruin by the borrowing restrictions.

Accordingly Agile Group, one of China’s top 20 home sellers, said it will sell its 26.7 per cent stake in a Guangzhou property joint venture for $US300m to a unit of state owned China Overseas Land & Investment.

Agile is facing a growing pile of debts including $US1.1bn in offshore notes due this year.

Shimao Group has sold land in Shanghai to a company owned by the Shanghai municipal government.

Meanwhile Liang Senlin, the chairman of China Cinda (HK) Holdings, a unit of one of the country’s biggest state asset managers, has joined Evergrande’s board as a non-executive director to help develop strategies overcome the mess.

There will be more announcements but China will now overcome the crisis. But longer term the days of the highly geared developers are over. The world wishes the inflation/higher interest rate crisis was as easy to overcome.

This week’s buying rally on global sharemarkets was quickly squashed as the market suddenly realised that official US interest rate rises start in March and will continue during 2022. But two danger points — cryptocurrencies and the Chinese property mess — have been taken off the crisis table.