Crown revenue tumbles after high-roller exodus

Crown Resorts is targeting cashed-up Chinese gamblers at its $2.2bn Sydney casino despite high-rollers tightening their belts.

Crown Resorts is pressing ahead with targeting cashed-up Chinese gamblers at its $2.2bn Sydney casino currently under construction at Barangaroo despite high-rollers tightening their belts ahead of an inquiry into the James Packer-backed group and concerns over the deadly coronavirus epidemic in the region.

Crown’s high-roller revenue tumbled 34.2 per cent to $13.1bn in the six months to December 30 as the company battled a series of negative headlines around the NSW Independent Liquor and Gaming Authority’s inquiry, which resumes next week and will examine whether the gambling giant can keep its Sydney licence.

The high-roller exodus has continued into the second half of the financial year after the federal government banned travel from China to limit the spread of the coronavirus, slowing the flow of Crown’s cashed-up north Asian customers.

Crown chief executive Ken Barton said it was difficult to say when the high-roller market, which accounts for about 13 per cent of the company’s revenue, would rebound.

But he said it wouldn’t affect how the company configured its Crown Sydney resort, which has been designed to cater for the local and international VIP market and is set to open in 12 months, in time for Chinese New Year.

“I don’t think we would make a long-term decision about the configuration of the property based on a six-month time frame,” Mr Barton said.

“It’s hazardous to look at what we’ve seen in the last six months … and say does that signal a mental shift in VIP.

“It (the market) has shown an ability to adapt. It’s shown an ability to grow when regulatory settings are left in neutral, and Australia historically has been able to get a reasonable market share of the overall VIP market.”

Fears over the virus, which has killed more than 1700 people and infected tens of thousands more, have also spilled over to Crown’s main gaming floor, which delivered flat revenue at $872.9m in the six months to December.

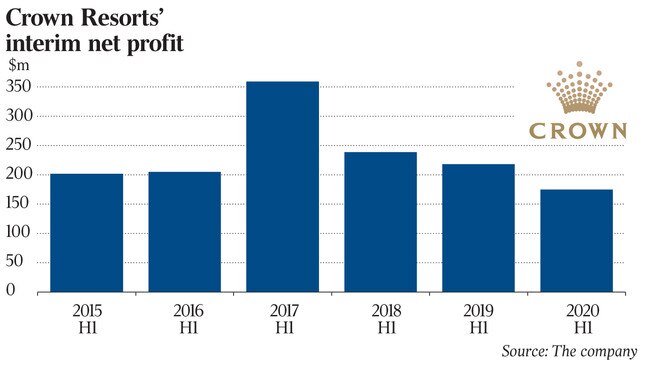

Overall, normalised net profit, which removes variance in win rates, sank 11 per cent to $172.7m.

Still, investors looked through the short-term hit to earnings with Crown shares ending down 4c at $11.76.

Mr Barton said people were avoiding crowded areas, fearing they would catch the virus, prompting him to install hand sanitizers around gaming floors as well as scaling back shifts for employees.

“There is no proficuous time for something like that. But obviously from our perspective (the coronavirus) coming in when it did right at the pointy end of Chinese New Year … has been unfortunate from a business perspective.”

He said before the coronavirus outbreak, the VIP market in Macau had shown some signs of recovery, with turnover rising 11 per cent in January. But for the past 16 days, Macau’s entire casino operations have shut down to limit the spread of the coronavirus, costing billions of dollars in lost income.

The virus triggered Melco — backed by Macau billionaire Lawrence Ho — to walk away from acquiring a further 10 per cent slice in Crown on top of his 9.9 per cent stake.

Mr Ho cited a desire to focus on Melco’s core markets rather than proceed with the deal, which involved Melco acquiring $880m of Crown shares from Mr Packer. The NSW inquiry was also set to examine the buyout for probity issues.

Mr Barton declined to comment on whether Crown has had any discussions with Melco about its intentions for its remaining 9.9 per cent stake, which it bought from Mr Packer for $880m last May.

Mr Barton did say that Crown remained reliant on junkets to drive high-roller revenue, despite allegations of money laundering, which the NSW inquiry will examine at its first hearing, scheduled for Monday.

He said the company had stepped up its due diligence on junket operators and continued to improve its business.

“As a reflection of what’s happening more broadly in the VIP market around the region, junkets have become a more significant part of the business. They have become a big part of the Macau business and in our own operation we … were predominantly a premium direct business now we are predominantly a premium junket business because they have done a very effective job in becoming an intermediary between the casinos and players.”

Crown chair Helen Coonan, a former federal communications minister, welcomed the opportunity to participate in the NSW inquiry.

“Another important point is some of the allegations the inquiry’s looking at are really pretty old,” Ms Coonan said.

“We have been at pains to point out and to do a lot of due diligence around continuous self improvement because we are all about looking at ‘that was then whatever that was’ and … we are focused on the future with significantly improved scrutiny and due diligence around all our business operations. Sometimes I think these inquiries can be beneficial because in effect you can come out the end of it and be the better for it.

“We certainly are very encouraged by the notion that the whole regulatory setting can be examined in this inquiry.”

Ratings agency S&P Global Ratings said a strong balance sheet and good cash generation should underpin Crown’s resilience through “a period of significant volatility and development activity”.

“We anticipate weaker earnings for the year ending June 30, 2020, due to lower inbound Chinese tourism and weak global VIP activity from the new coronavirus outbreak. We believe this is a one-off event and should subside with VIP growth recovering,” S&P Global Ratings said.

“We view Crown’s Australian casinos as largely long-term investments that are well positioned to capitalise on the likely favourable economic and demographic trends within the Asia-Pacific region. In addition, the completion of Crown Sydney over the next two years is likely to benefit the group’s scale and operational diversity in Australia,” S&P said.

Crown will pay an interim dividend of 30c a share on April 3.

Correction: An earlier version of this article incorrectly cited Moody’s. The correct citation is S&P Global ratings.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout