Crackdown on black economy could yield $6bn: KPMG

Cracking down on the black economy could save almost as much as Labor’s plan to wallop self-funded retirees, says KPMG.

Cracking down on the black economy could save almost as much as Labor’s plan to wallop self-funded retirees by removing full cash refunds for franking credits, based on new research published by KPMG today.

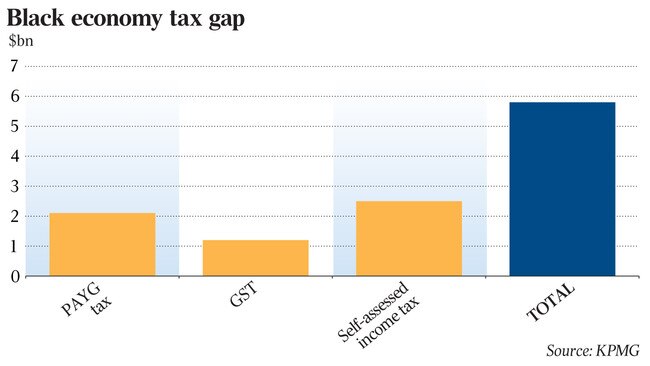

The report says the federal government could “conservatively” raise an extra $5.8 billion from the black economy — which includes legal and illegal activity — estimated at $32bn a year. Labor expects to raise about $5.9bn from its policy to increase tax on shareholders, announced last week.

“At a time when other revenue measures are struggling for bipartisan support, the proposed crackdown on the black economy is more likely to gain passage through the Senate, generating much-needed additional revenue for budget repair,” said Grant Wardell-Johnson, a KPMG partner at the Economics and Tax Centre.

An extra $2.1bn, $1.2bn and $2.5bn could be raised in income tax, GST, and business tax respectively, the report estimated.

KPMG recommended a suite of measures to bring all of the economy into the tax net, including banning cash transactions above $100,000, providing limited amnesties for business to disclose they’ve been avoiding tax (and for their employees to report them), and denying income tax deductions for wages paid in cash to employees.

“Adopting these measures would increase the fairness of the tax system and level the playing field between dishonest and honest businesses and individuals. It would also support community ethics and rebuild trust, as honest taxpayers witnessed the reduced incidence of others cheating the system at their expense,” Mr Wardell-Johnson said.

The Australian Taxation Office has suggested a revenue return of around $14 for each $1 spent on trying to recoup uncollected tax. KPMG estimates $100 million to $400m spent could raise an extra $700m to $2.8bn in tax.

“Other taxation revenue for the states and territories would be a further natural consequence,” the report said.

The Turnbull government is expected to respond to a report from a black economy taskforce, which delivered a final report last year, in the forthcoming May budget.

The taskforce said the black economy “provides unfair competition for honest businesses”.

“It leads to the exploitation of more vulnerable workers and increases the costs of providing government services because of people who don’t pay their share of tax,” it said.

Mr Wardell-Johnson said the black economy here was of similar size to that in Britain and Canada, although smaller than in Scandinavia, where cash is now used much less as a form of payment.

“Those countries rely more on tax withholding mechanisms than we do; for instance, they tend to calculate your capital gain for you,” he explained.

Reserve Bank data show cash in circulation has risen to the equivalent of about 5 per cent of GDP, the highest level in 50 years, while reported cash usage has declined dramatically.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout