Company insolvencies across Australia soared by 58 per cent in May

Company insolvencies across Australia soared by 58 per cent as mounting debt and tough economic conditions took their toll. SEE THE LIST

Company insolvencies have soared across Australia as mounting debt and deteriorating economic conditions start to bite.

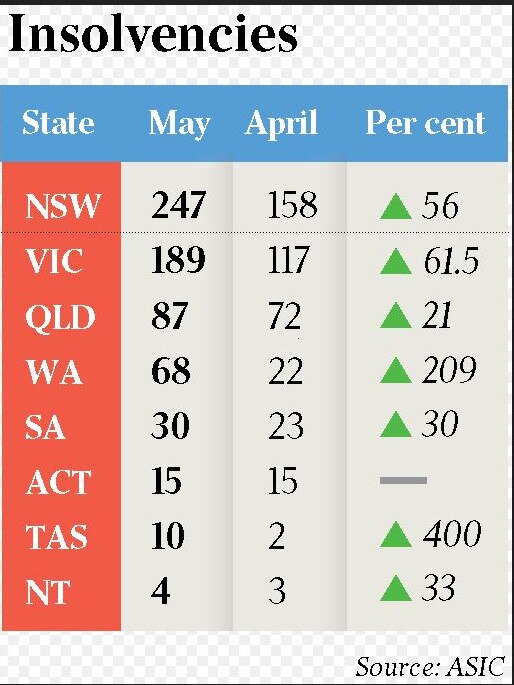

According to the Australian Securities and Investments Commission, there were 650 administrations and liquidations in May – up 58 per cent on April which recorded 412.

Insolvencies were 50 per cent higher compared with May 2022 which had 433.

Most of the company collapses where in NSW and Victoria which had 247 and 189 insolvencies, up 56 per cent and 61.5 per cent respectively on April.

Some of the major collapses were NSW-based Apricity Finance Group, which went into liquidation after months of turmoil, and the Australasian arm of weight-loss giant Jenny Craig which appointed voluntary administrators after being caught up in the collapse of its US parent company.

In Queensland award-winning developer Property Solutions Holdings – which was behind some of Brisbane’s major developments – and a string of related companies went into liquidation owing millions.

In Western Australia, the Slatter Group, which has been in business for 20 years, appointed liquidators to wind up the company.

Revive Financial head of restructuring Jarvis Archer said company insolvencies had continued their 2023 trend at or above pre-pandemic levels.

“It certainly feels busy, and the sense of urgency, even desperation, for company directors is high,” Mr Archer said.

He said liquidations remained high with an increased uptake of small business restructuring engagements for companies with less than $1m in liabilities.

“These suit small businesses that have recovered from the pandemic and are doing okay but need to reduce their ATO and other debts to survive,” Mr Archer said.

“The eligibility criteria for a small business restructure mean that their affairs will be in order, as ATO returns need to be lodged and all super paid.”

Mr Archer said what was unknown was how many businesses had fallen outside the tax system.

“We’re certainly seeing more companies with significant superannuation and ATO debts,” he said.

“A number of accountants have mentioned they’re helping clients with up to three years of outstanding Business Activity Statements and income tax returns.”

The ATO had continued ramping up debt recovery efforts since early 2022, and in 2023 has returned to full recovery mode – with its activity being described as “aggressive”.

While the construction sector had the lion’s share of insolvencies there was still strong activity in the accommodation and food services, and retail sectors.

WCT Advisory partner Andrew Weatherley said insolvencies in the hospitality/retail sectors in 2022-23 were well above the previous 12 months, in line with a decrease in consumer and overall confidence.

“The withdrawal of government and other support available through Covid and the continued challenging economic environment whereby a shortage or increase in costs for inputs have had a great impact,” he said.

Mr Weatherley there has been an increase in businesses from the food service sector winding up because of a lack of cash flow and the ATO “has certainly become more active”.

He that said in line with tough conditions, there had been a substantial increase in the use of the small business restructure process (SBR).

Mr Weatherley said there were only 70 SBR appointments in 2021-22, whereas in this current financial year up to May 14 there have been 350.

“Some increase in that number can be explained by the general increase of total insolvency appointments but we are finding it is often an approach worth exploring and more companies are meeting the requirements, particularly around payment of super debts and filing tax lodgements,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout