Woolies to spend $780m on hi-tech warehouses

Woolworths will embark on the single biggest investment in its infrastructure: $780m on two automated distribution centres.

Woolworths will embark on the single biggest investment in its supermarket infrastructure, spending $780m on two automated distribution centres kitted out with armies of robots and hi-tech facilities, but will need to convince shareholders that the investment will pay off.

The pitch to investors that the state-of-the-art distribution centres will generate valuable gains in efficiency and productivity began on Tuesday, when it unveiled its ambitious building plan, but it was overshadowed by a trading update that stated profit for 2020 would be hit by almost $600m in new costs.

Although there was a boost to Woolworths supermarket tills since March from panic shopping in the face of the coronavirus pandemic, the retailer will face a bloated underpaid wages bill and the transformation costs for its liquor and hotels arm.

The hotels business has also suffered as much as $200m in lost earnings due to shutdowns caused by the health crisis.

When Woolworths reports its full-year results in August, the result will be awash in one-off pre-tax items totalling $591m, of which $176m will flow from redundancies and costs linked to shutting down distribution centres as it shifts to its two automated sites in 2023. The planned demerger of its liquor and hotels business Endeavour Group will account for $230m and remediation for underpaid staff $185m.

It will result in Woolworths reporting earnings before interest and tax on continuing operations for the 2020 fiscal year of $3.2bn-$3.25bn, against a consensus forecast of about $3.32bn.

But Woolworths is confident the investment in the construction of two automated distribution centres at Moorebank Logistics Park in Sydney will help underwrite future growth, as it matches a similar move by rival Coles, which last year said it would spend up to $1bn on robotic warehouses.

It will come with a cost of jobs. Woolworths said 1350 jobs would be made redundant by 2025 as the new distribution centres were set up, with the closure of the three distribution centres to be replaced by the two automated ones. However, it will also add 600 jobs at the two new distribution centres.

Construction is expected to be completed by the end of 2023, with initial benefits expected to be realised in the 2025 financial year.

Woolworths chief executive Brad Banducci said he was comfortable with the return on investment the company would get from the distribution centres, but would not put a figure on it.

Previously, analysts have criticised Woolworths for spending about double the amount on capital expenditure than Coles but not extracting returns for shareholders commensurate with this spend.

Once established, the automated facilities at Moorebank will replace the grocery operations at Woolworths’ Sydney Regional Distribution Centre (in the western suburb of Minchinbury), Sydney National Distribution Centre (Yennora) and Melbourne National Distribution Centre (Mulgrave).

Woolworths is expected to invest $700m-$780m in technology and fit-out of the two distribution centres over the next four years and has signed an initial lease term of 20 years with Qube.

“Moorebank will transform the way we serve our NSW grocery customers,” Mr Banducci said. “The new facilities will advance our localised ranging efforts, with the ability to hold over 30 per cent more products than existing facilities.

“Automation will allow the creation of aisle-specific pallets by store and, in doing so, reduce the time to restock shelves and result in better on-shelf availability for customers.”

Woolworths chairman Gordon Cairns also heralded the investment for its ability to inject new efficiencies into the retailer’s supply chain.

“The planned sites, which are subject to NSW government planning approval, will materially increase our capacity for growth, improve efficiency, advance localised ranging efforts and deliver better and safer experiences for Woolworths stores, team and customers,’’ Mr Cairns said.

The investment comes as Woolworths also confirmed on Tuesday that record sales growth experienced in April and May had continued into the fourth quarter.

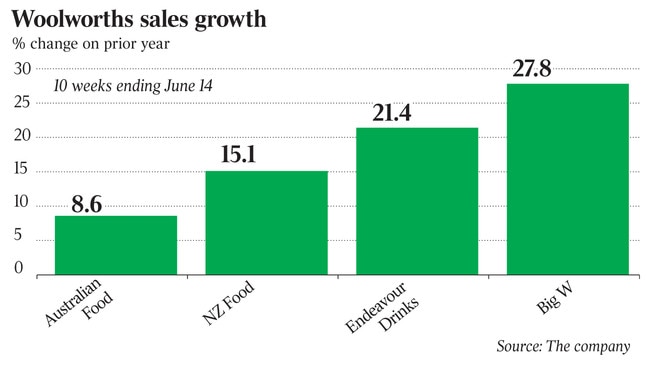

Australian supermarket sales were up 6.4 per cent in the first half, up 11.3 per cent in the third quarter and up 8.6 per cent for the fourth quarter to date.

New Zealand supermarket sales were up 13.7 per cent in the third quarter and 15.1 per cent for the fourth quarter.

Big W sales were up 27.8 per cent in the fourth quarter to date, against sales growth of 9.5 per cent in the third quarter.

Endeavour saw sales growth of 21.4 per cent in the fourth quarter to date, growing from a sales rise of 9.5 per cent in the third quarter. “Trading has remained strong in the fourth quarter to date, with the exception of hotels where venues were closed until the end of May and have just begun to enter different stages of reopening,’’ Mr Banducci said.

Unsurprisingly, the nationwide shutdown of pubs and hotels would crunch profitability for Woolworths’ hotels arm, with its hotels EBIT expected to be $160m-$170m, down from $355m in 2019.