‘Normal’ won’t be back: Woolworths

Woolworths to spend up to $275m in the business to keep customers and staff safe.

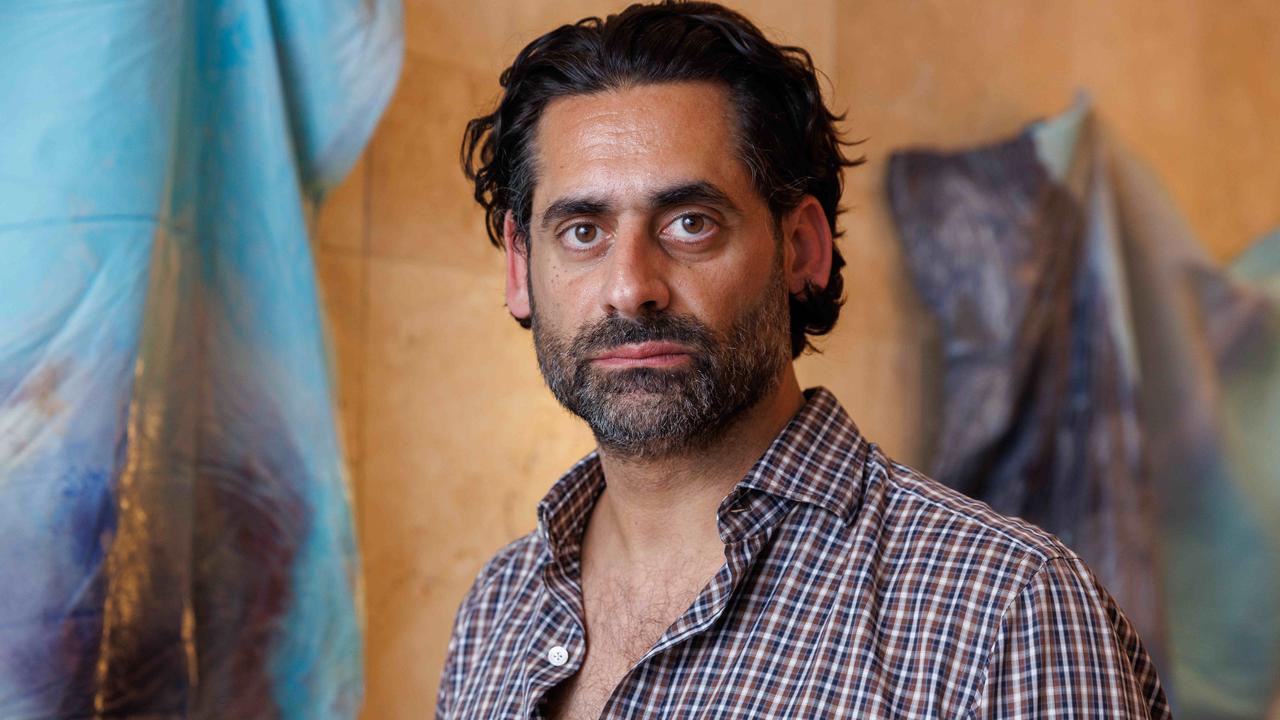

Woolworths chief executive Brad Banducci says he is willing to compromise short-term profits in favour of refashioning the supermarket in the “new normal” world of the coronavirus crisis.

He said shareholders and his board understood the need to invest up to $275m in the business to keep customers and staff safe.

This would come on top of almost $35m a month in losses being racked up by Woolworths’ shuttered hotels arm and a much more challenging economic setting for 2020 as businesses come out of hibernation and unemployment could pass levels not seen since the last recession.

The boss of the nation's biggest retailer ominously signalled that normality might never return, even when the coronavirus pandemic has passed, and that Woolworths was choosing now to invest heavily in store operations, accelerating its online shopping and strengthening its supply chain.

“I don’t think normal conditions will come back. We have entered a new normal, and I think our shareholders and certainly our board understands the costs we have invested in, which can be unwound, or are temporary, to keep customers and team members safe,” Mr Banducci told The Australian.

The Woolworths boss also said says front line supermarket staff were in line for a bonus payment at the end of the financial year given their efforts in steering customers through the COVID-19 crisis.

“Our team have played a critical role during these unprecedented times,” he said.

Woolworths on Thursday unveiled its third-quarter sales. Comparable store sales at its flagship Australian supermarkets rocketed up 10.3 per cent, but were below analysts’ expectations and beaten by rival Coles, with investors and analysts more concerned about the leap in costs driven by the coronavirus crisis.

Mr Banducci revealed that Woolworths was expecting incremental costs in the range of $220m to $275m in the fourth quarter, generated by everything from security guards at stores, perspex walls to protect staff and a range of sanitation initiatives, which analysts fear will dent profits unless sales remain at booming levels.

But Mr Banducci was adamant that these costs were necessary and would serve the company for the best in the long term, even if they constrained short-term profits.

“In the short term we have to compromise profit in order to do that. We feel comfortable it’s the right thing to do and in time you will get the benefits of doing that.”

The market was ruffled by the cost blowout and Woolworths undershooting third-quarter sales forecasts, with the retailer’s shares falling 28c to close at $35.75 against strong gains by the broader index.

‘I don’t think normal conditions will come back. We have entered a new normal’

Much of the investment would pay off, Mr Banducci argued.

Accelerating its investment in e-commerce so that all new stores were fully online-equipped made sense, with the current health crisis underlining the importance of technology as Woolworths’ online sales for the third quarter rose 34 per cent to $817m.

“No new store will open — there will be one exception to the rule obviously, so don’t hold me to that — but no new Woolworths store will open that is not fully e-commerce enabled.’’

Woolworths also went harder and deeper than Coles in applying buying limits during the panic-buying seen at supermarkets in March and April, which hamstrung its sales trajectory compared to Coles. On Wednesday, Coles reported same-store sales growth of 13.1 per cent.

Total supermarket sales for the quarter rose 11.3 per cent to $11.2bn, but it was a choppy month, with total sales growth of 3 per cent for the first seven weeks of the quarter, but this quickly shot up to 40 per cent growth in the week ending March 22 as shoppers stripped the shelves of toilet paper, rice, pasta, hand sanitiser and other essentials.

Woolworths said the volumes were mostly driven by people checking out with larger volumes of groceries, with local supermarkets enjoying stronger trade towards the end of the quarter as people isolated at home shopped locally rather than heading out to larger malls.

Woolworths also said on Thursday morning that New Zealand supermarket comparable sales were up 14.8 per cent.

Its long-struggling Big W chain reported a 9.9 per cent lift in comparable store sales to $866m but there was an adverse change in product mix being sold, as home essentials, leisure and toys performed well while apparel sales declined in March. The category mix changes resulted in higher average selling prices but are lower margin categories.

Woolworths hotels and drinks business, housed within its newly created Endeavour arm, suffered as a result of its pubs and hotels being shut since March. Its hotels arm is now churning out losses of between $30m and $35m a month.

Endeavour Drinks, which runs the liquor stores Dan Murphys and BWS, saw total sales rise 9.5 per cent in the third quarter to $2.3bn with like for like sales up 8.9 per cent. January and February sales were subdued.