TV shake-up: Why Kerry Stokes’ Seven Network is betting on prime time again

With Seven Network winning its bid for long-time regional partner Prime Media, this is how it will affect TV viewers.

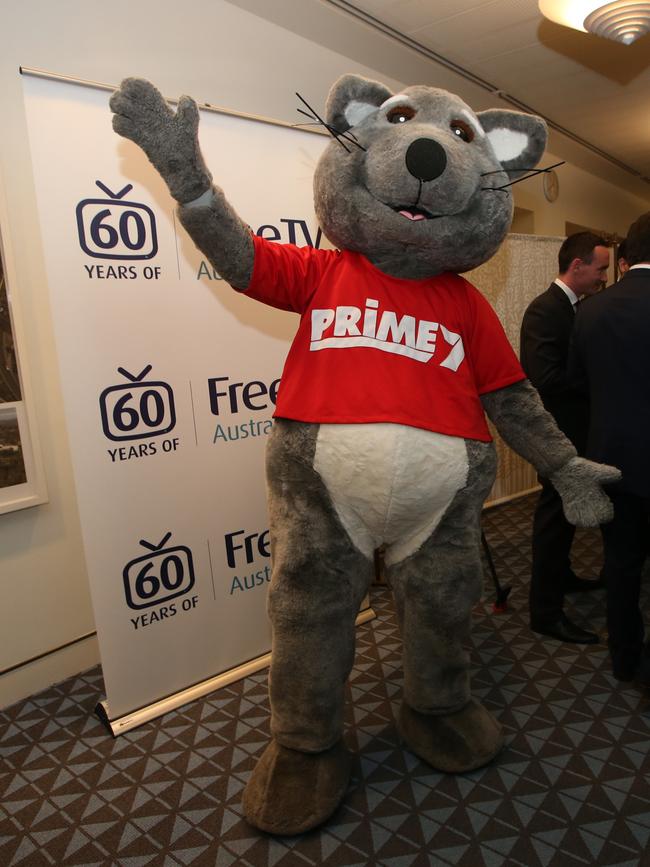

These days the on-air duties of the larger-than-life furry mascot of regional TV network Prime7 are mostly limited to telling any children left watching at night that it’s time to pack up and go to bed.

The curtains are also about to be drawn on Prime Possum’s owner Prime Media, the regional TV operator that has broadcast a staple of AFL, local news and Home And Away to more than 5.5 million people outside of Australia’s capital cities for decades.

It’s second time lucky for Prime’s long-time broadcast partner. The Kerry Stokes-backed Seven West Media last month returned with a $132m takeover, with shareholders earlier Thursday overwhelmingly endorsing the offer at a vote.

The latest bid comes after a failed $64m offer by Seven two years ago. The previous bid won the backing of the Prime board but critically not its big shareholders – including regional media mogul Antony Catalano with 23 per cent and Prime’s rival WIN TV owner Bruce Gordon (11.4 per cent). This time they were both very much onside.

Unlike the previous low-ball offer where the currency used was Seven shares, Prime’s shareholders this time backed the all-cash deal. Following Thursday’s vote where more than 94 per cent of Prime shareholders backed the deal, the acquisition will be finalised on December 31.

For viewers little will change under Seven. Indeed, some of Prime’s markets – such as Canberra – have the prospect of seeing a local news bulletin retuned.

“They do a great job in news,” Seven CEO James Warburton said of Prime’s local broadcasts. “We’ll be looking to expand this and getting more news resources in the regions.”

Seven is targeting savings from merging the two companies of between $5m and $10m – previously it was $11m under the old deal. Analysts expect the top end of this range to be easily reached mostly through back office and savings on affiliate fees.

For advertisers, Seven will become a one-stop shop for national advertisers looking to reach almost 23 million people in city and regional markets.

But the big play for Seven is the prospect of rolling out its 7plus free video streaming service to a new audience. Video-on-demand services is the new battleground for free-to-air broadcasters as they seek to protect their audiences from newer streaming players including Foxtel’s Kayo or Binge, Nine’s Stan or global giant Netflix.

Regional television is at the front end of the disruption taking place in broadcast media. Other sectors of the media such as newspapers were forced to diversify and find new revenue streams early last decade while the broadcast TV model continued. But with a smaller balance sheet and little content of their own they’ve not had the resources to pivot into digital platforms.

“Having a TV licence used to be the easy way to make money …. which meant businesses just got lazy,” one former executive said. In addition, Prime and Seven’s affiliate deal going back decades made it tougher for the smaller broadcaster to innovate.

The Prime deal is not structured like a normal takeover. Effectively, Seven is acquiring all of Prime’s assets and staff. Prime will then use the cash from the deal and $10m sitting in the bank to return this to shareholders in the form of dividends. All up it is worth 36c a share, compared to the 44c Prime closed at on Wednesday.

This structure makes the best use of Prime’s vast holding of franking credits valued at 11c a share. At the end of the sale Prime will remain a shell company with no revenue and no assets, with the shares to be delisted next year.

Seven returns

It is understood a renewed approach by Warburton in October led to a heated boardroom discussion between Catalano and then Prime chair Ian McGill over the valuation of the regional broadcaster. Catalano strongly opposed the previous Seven offer because he believed at the time all the value was going to Seven. For Warburton’s part the timing was critical, he knew from his own broadcast business just how quickly advertising markets were recovering from the Covid lockdowns and didn’t want the valuation to slip away.

The clash with Catalano, who had done his own sums on a deal, triggered the exit of McGill, a former go-to media lawyer and one-time partner with Allens, paving the way for Cass O’Connor to step in as chair. Known as a straight shooter as well as a tough negotiator, within 24 hours O’Conner signed an in-principle deal with Warburton and remarkably she had secured support of all Prime’s major shareholders.

Catalano, who owns the former Fairfax Australian Community News newspaper arm, had previous aspirations to merge his publishing business with Prime to create a mini-Nine Entertainment that combines publishing and a free-to-air broadcaster. But TV reach rules preventing the ownership of fewer than four independent media operators in regional areas would have forced him to sell assets in central Victoria and the Riverina, two of the most lucrative markets. It is understood Catalano plans to use some of the cash windfall on the Prime sale to boost his ACN business.

Gordon’s WIN had also eyed Prime mostly as a vehicle to share costs on news bulletins, but also ran up against broadcast rules.

The upending of media has hit bush broadcasters hard. With a smaller balance sheet and audience, they’ve not had the resources to pivot. For the most part regional broadcasters are big relay stations that don’t own their content, which has made it harder to defend the business.

The economics of the bush has been another factor. Prior to Covid, much of eastern Australia had been grappling with its own prolonged downturn due to a crippling drought.

TV advertising revenue is off 20 per cent over the past five years, compared to capital city revenue which is down on over 10 per cent over the same period. Prime has seen a sharp pick-up of revenue earnings in the September quarter but its board sees the longer-term outlook as a standalone business as “structurally challenged”.

Since the mid-80s, Prime has been busy trading media businesses across regional Australia and around the world – at one time Prime operated one of Argentina’s biggest free-to-air broadcasters, but was stung by the country’s economic collapse in the early 2000s. Prime, which was formed by late healthcare businessman Paul Ramsay, also has a long history with Seven including acquiring WA’s Golden West Network in the late 1990s from Stokes, now set to be retuned to Seven.

Today Prime reaches much of eastern Australia with its footprint across regional NSW, ACT, Victoria, Queensland’s Gold Coast region and regional WA. This gives it the biggest geographical footprint of the broadcasters and, crucially for affiliate Seven, a regional broadcast signal into the states where AFL dominates. This AFL reach is seen by those inside Prime as its key bargaining chip with Seven, although others argue it has not been used hard enough.

With a little over two years left on its five-year deal with Seven, Prime’s board was concerned that regional broadcast rival Southern Cross Media was planning an all-or-nothing play for the Seven broadcast signal. (Southern Cross is Ten’s partner in most markets).

With no programming Prime would have had nothing to put on the airwaves. But after winning the prime prize, Seven’s Warburton can keep the broadcast machine running while leaving Prime Possum free to keep sending the kids off to bed.

johnstone@theaustralian.com.au

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout