Treasury Wine strategy cheers analysts

Treasury Wine Estates has started to rebuild its battered image as the market warms to its strategy.

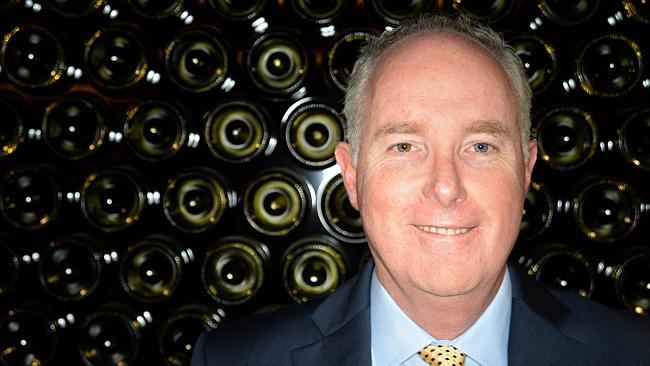

Treasury Wine Estates, which burned billions of dollars on poor acquisitions when owned by accident-prone brewer Foster’s, has started to rebuild its battered image and the market is warming to the strategy of boss Michael Clarke.

Mr Clarke, who took the reins of the world’s biggest listed winemaker 19 months ago, on Wednesday unveiled the company’s biggest purchase since it was spun out of Foster’s in 2011: the $754 million acquisition of Diageo’s US and British wine division.

The deal was also coupled with an event rare in the corporate history of Foster’s or Treasury Wine: a profit upgrade. Mr Clarke announced robust earnings in the first quarter of financial 2016 had enabled him to raise pre-tax guidance to between $270m and $290m, against the market consensus of $271m.

The acquisition will be paid for via a fully underwritten 2-for-15 renounceable entitlement offer priced at $5.60 a share to raise $486m, with the balance funded through debt. Shares in Treasury Wine were in a trading halt yesterday, and last traded at $6.57.

Merrill Lynch analyst David Errington, who labelled the US and Britain “graveyards” for previous Foster’s management when it came to the billions wasted on buying Beringer, said Mr Clarke’s proposal to buy Diageo’s luxury and mid-premium wines in the US looked “financially compelling”.

“On the numbers given, the company has paid $US600m ($819m) for a business that is currently generating $US76m EBITDA,” Mr Errington said of the Diageo deal, which will give Treasury Wine brands such as Beaulieu Vineyards, Sterling Vineyards, Acacia, Provenance and Hewitt, and an operation comprising four million cases of wine.

“Treasury Wine stated there are at least $US25m of cost synergies, and there are likely to be substantially more synergies, including the mixing of wine grapes into other brands (including Treasury Wine’s luxury brands), providing sizeable uplift to sales and margins opportunities.”

Mr Errington said Diageo admitted in its press release on the sale it would book a £150m ($317m) after-tax loss, which showed that Treasury Wine had paid an attractive price.

Deutsche Bank analyst Michael Simotas said the acquisition was paid for by “expensive scrip and cheap debt”, with the scale and premium fruit it provided in the US making strategic sense.

But Mr Simotas said he would have preferred that the deal didn’t come with commercial wine brand Blossom Hill, which Diageo has also offloaded to Treasury Wine.

“Most of the brands — even the premium ones — have been in decline, which adds execution risk, but management’s track record gives us some comfort.”

Credit Suisse analyst Larry Gandler lifted his recommendation to “neutral’’ from “underperform”.